Does Big 12 Expansion Move TV/Fan Needle Enough For Conference?

It’s been an eventful 13 years for the Big 12 Conference.

Back in 2010-12, the conference was seemingly “gutted” by a TV-fueled conference realignment flurry that sent saw members like Nebraska leave for the Big Ten, Colorado head to the Pac-12, and Missouri and Texas A&M depart for the SEC. The Big 12 backfilled with TCU and West Virginia, but was never really at ease, so to speak. As the lone 10-team conference in college football’s “Power Five,” it always seemed like the other shoe was about to drop — so much so that the whole thing nearly came tumbling down a year later when Oklahoma and Texas appeared ready to leave for the Pac-12 (along with in-state brethren Texas Tech and Oklahoma State).

Oklahoma and Texas eventually opted to jump to the SEC for more TV revenue a decade later — in a move that once again seemed to put the Big 12 on death’s door. Instead, the Big 12 quickly added new members BYU, Cincinnati, Houston and UCF. And after courting numerous disgruntled Pac-12 members in the wake of UCLA and USC’s impending departure to the Big Ten, the Big 12 finally picked off Colorado last week.

The Big 12 isn’t done yet either, as it tries to take advantage of the Pac-12’s perceived weakness in the marketplace and drive up its own TV value as a result. Arizona, Arizona State and Utah could all join Colorado in the league soon, or the Big 12 may look elsewhere if those three decide to remain in the Pac-12.

Remaining in the Pac-12 seems increasingly less likely for those three schools or any member, though, given the Pac-12’s struggles to secure its future media rights (which was part of what drove USC, UCLA and Colorado all out the door). News mid-way through Tuesday (via Action Network’s Brett McMurphy) that the league still didn’t have a rights deal certainly emboldens the idea that the Big 12’s about to grow again.

So the Big 12 could be a 16-team league by 2024, and could conceivably be No. 3 in terms of power conference value (for TV deals and overall fan interest) behind the SEC and Big Ten. However, just continually adding teams doesn’t necessarily make for a “better” conference in terms of what it means to media partners like Fox and ESPN.

The Bergen Record’s Zach Miller shared data on the most-watched college football programs by average number of viewers during the 2022 regular season. Here’s the average ranking for the top four conferences, reflecting 2024 membership (including a hypothetical Arizona, Arizona State and Utah in the Big 12). I wouldn’t call this methodology perfect, but it’s at least a baseline for the conversation around TV audience.

Big Ten:25

SEC: 23

ACC: 55

Big 12: 48

For further reference, the Big 12’s average ranking would be 44 without Arizona, Arizona State, Colorado and Utah (Utah’s No. 33, while the rest are all above 60).

There are additional caveats on the rankings method above, including that it’s just one season and that can create temporary dips. But realistically, it’s hard to see how this does much more for the conference in terms of increasing per-team value for media rights. Moreso, this just pushes the overall payout higher via more inventory and the potential addition of a bigger draw in Utah. The distance between the Big 12 and Big Ten/SEC remains quite large.

What will also be interesting for the Big 12 is what happens to those figures without the larger TV draws like Texas (No. 8) and Oklahoma (No. 23). They’re not the only factors propping up those rankings, but obviously since both draw a lot of viewers, that counts for opponents as well. You could see a scenario where the average Big 12 audience is more in line with the ACC’s starting in 2024.

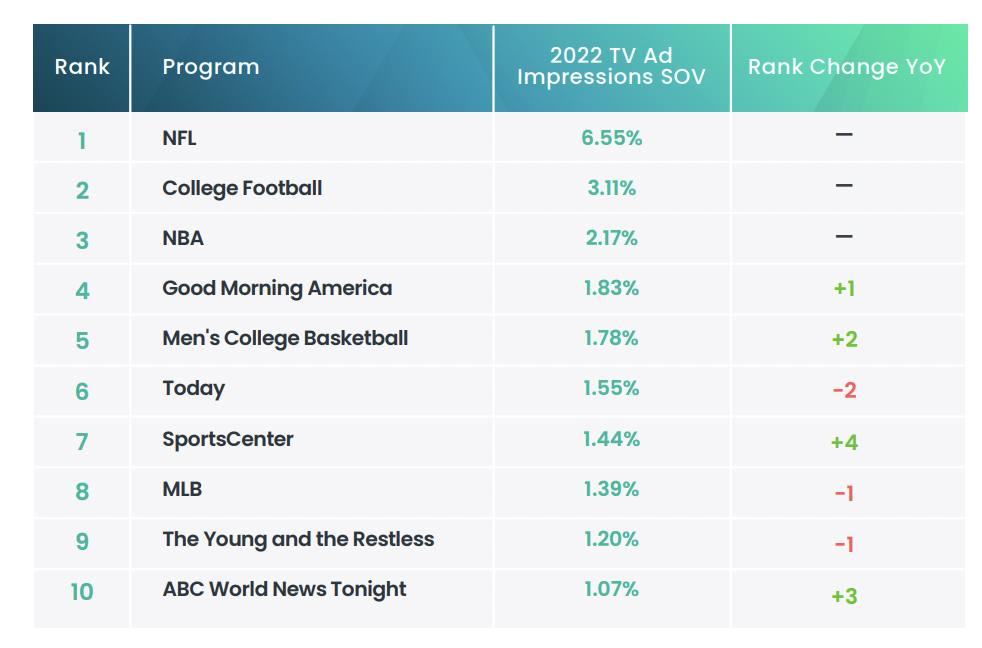

That’s not a knock on the Big 12, though. Any expansion move from a non-Big Ten or SEC league was never going to close the media revenue gap (Big Ten and SEC members are basically making double what the Big 12 and ACC are, respectively, each year). Every conference remains part of a college football television product that’s the No. 2 program on TV each year according to ad impressions data from iSpot.

The question going forward, though, could be how much of that national linear TV space is reserved for non-Big Ten and SEC games. Big 12 and ACC (and other conferences) still have slots all their own with network partners like ESPN and Fox. But the more teams join the Big Ten and SEC, and the more those conferences position themselves as the 1A and 1B options for college football programming, the less valuable the other leagues look in the long-term.

That won’t impact the current deals the ACC and Big 12 have in place, as both are locked in with partners for at least another seven years (another 13 for the ACC). It’s already having an impact on the Pac-12, however, and there’s a trickle-down that will no doubt seep into smaller conference negotiations in the coming years as well.

As a college football fan myself, I don’t see how this benefits the overall health of the sport, the fans, or even the networks. With a dwindling number of supposedly valuable games available, the interest in the product could diminish save for those featuring “top” programs like Alabama, Ohio State, Michigan, Georgia, etc. It seems unlikely that networks will be thrilled with that idea, since those teams don’t play in all of the games. But they’re also the ones pushing this future forward.