Over Half Of College Football’s Audience Is Controlled By Two Conferences

College football has always been a sport of “haves” and “have-nots,” but that dynamic has become even more extreme over time — especially as the on-field battles have expanded into struggles to maximize TV viewership and revenues.

This season may also serve as the sport’s tipping-point into a new and more centralized era that primarily revolves less around the sport’s regional nature and small cities, and more on the wider draw of its two national products: The Big Ten and SEC.

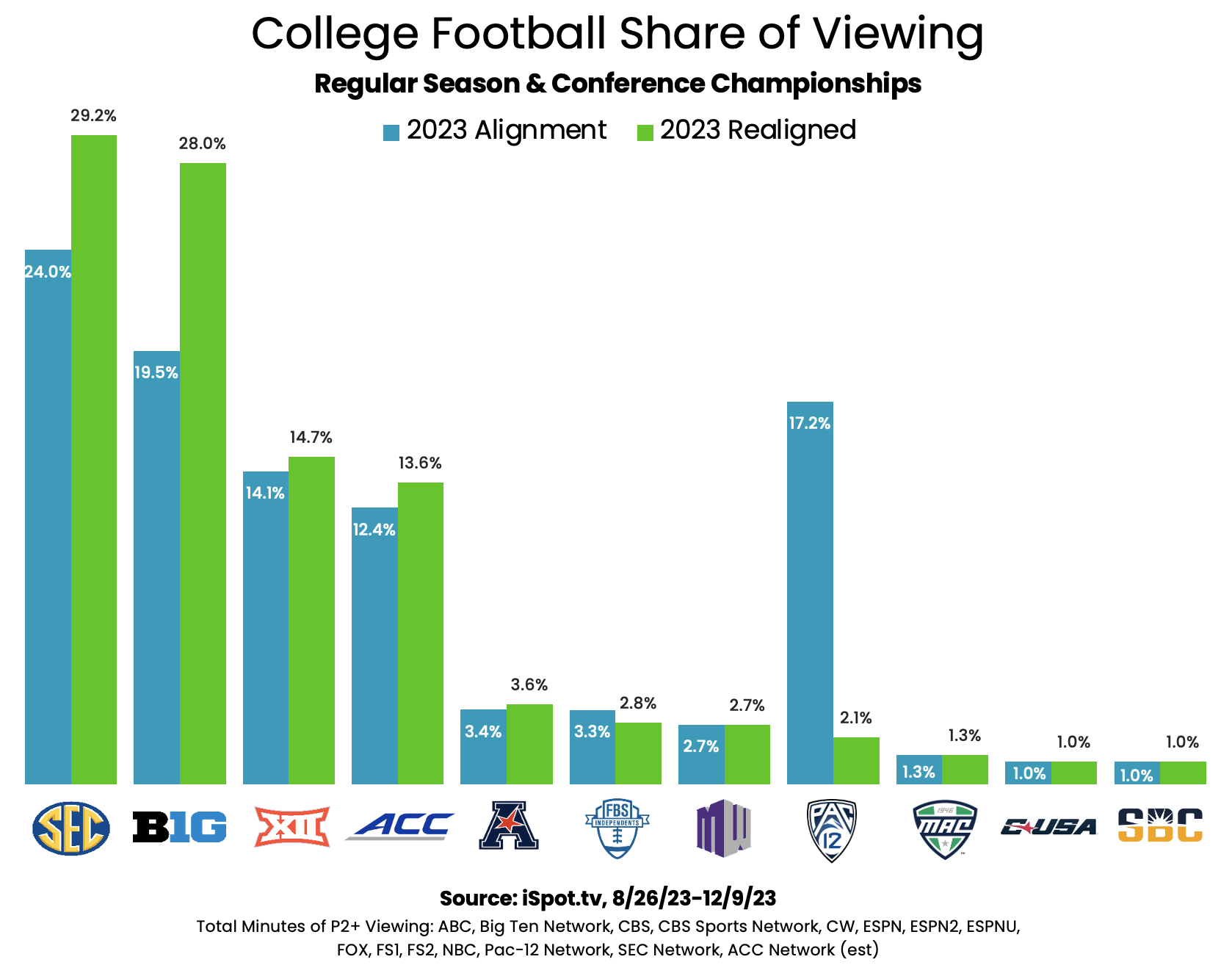

Research from iSpot shows what conference viewership share would’ve looked like last season with this year’s (realigned) membership, and… the Big Ten and SEC now own well over 50% of TV viewership for college football.

Using last year’s data, the SEC’s additions of Texas and Oklahoma upgrade it from 24.0% of college football viewing, to 29.2%. The Big Ten getting Oregon, UCLA, USC and Washington upgrade the league from 19.6% of viewership to 28.0%. The NCAA’s two richest conferences — and the faces of Fox and ESPN’s college sports rights war — would’ve controlled 57% of the TV audience last year. And you could argue it’s likely to be more this year with some of those big-name schools now moving on to greener pastures (so they’re not on the schedules of the lesser teams in the Big 12 or former Pac-12 anymore.

Given the gap in attention (along with TV revenues), the Big 12 and ACC’s own, lesser additions made perfect sense to just try and keep pace with where they were in 2023. The Big 12 backfilled for Texas and Oklahoma with Arizona, Arizona State, Colorado and Utah, and was able to net a 0.6% larger share of viewing. The ACC threw a liferaft to California and Stanford (and were willing to let SMU in as long as they aren’t paid TV revenues for nearly a decade) for a modest boost from 12.4% to 13.6% of viewing.

Those percentages do matter, I’ll say. I don’t want to minimize those games in the ACC or Big 12 (or other conferences). They still account for 43% of the sport’s viewing. But the more the SEC and Big Ten get premium treatment, constant big-name matchups and (starting this year) more playoff spots, the more that lead is likely to grow.

It’s why it’s understandable why members of the ACC are eyeing the exits, or at least a way to try and shrink the gap between the Big Ten and SEC and the rest. Florida State and Clemson are in for an extended legal battle with the ACC (where they’re currently still members), and appear desperate to find a path into one of those bigger-revenue leagues. The two programs have competed at the top of the conference for years, but feel they’re falling behind in an escalating arms race. Those conversations are happening on other campuses around the country too, even if less publicly, as schools don’t want to be caught flat-footed in this new era and shifting membership landscape.

Is all of this good for the sport, though? As a long-time fan (of Syracuse, but hear me out), I’m not so sure.

If nearly every “power” program (and plenty of non-powers, too) are confined to two huge leagues, it gets harder to keep up the illusion that others outside of that group can win something important during a given season. To FSU and Clemson’s arms race idea, the richer the 34 schools in the Big Ten and SEC get, the more they’ll get even better players than the other leagues, the more the other leagues fall behind, and the more those premium TV spots become self-fulfilling prophecies. Suddenly, that 57% of viewing sounds quaint. And you could see it climbing well past 60% or more.

At that point, how do networks and streaming services justify paying escalating rights fees when they’re only getting a fraction of what they used to when paying for non-Big Ten/SEC conferences?

This season should be informative toward what happens next… for better or worse.