Streaming Insights: Viewer Experience, Preferred Content and More

As the streaming wars rage on, platforms face an increasingly competitive landscape when it comes to viewership and subscribers. And while in many ways Netflix keeps gaining the upper hand, as TVREV’s John Cassillo wrote about earlier this month, a new study from MX8 Labs reveals some nuanced variations in viewer behavior and perception.

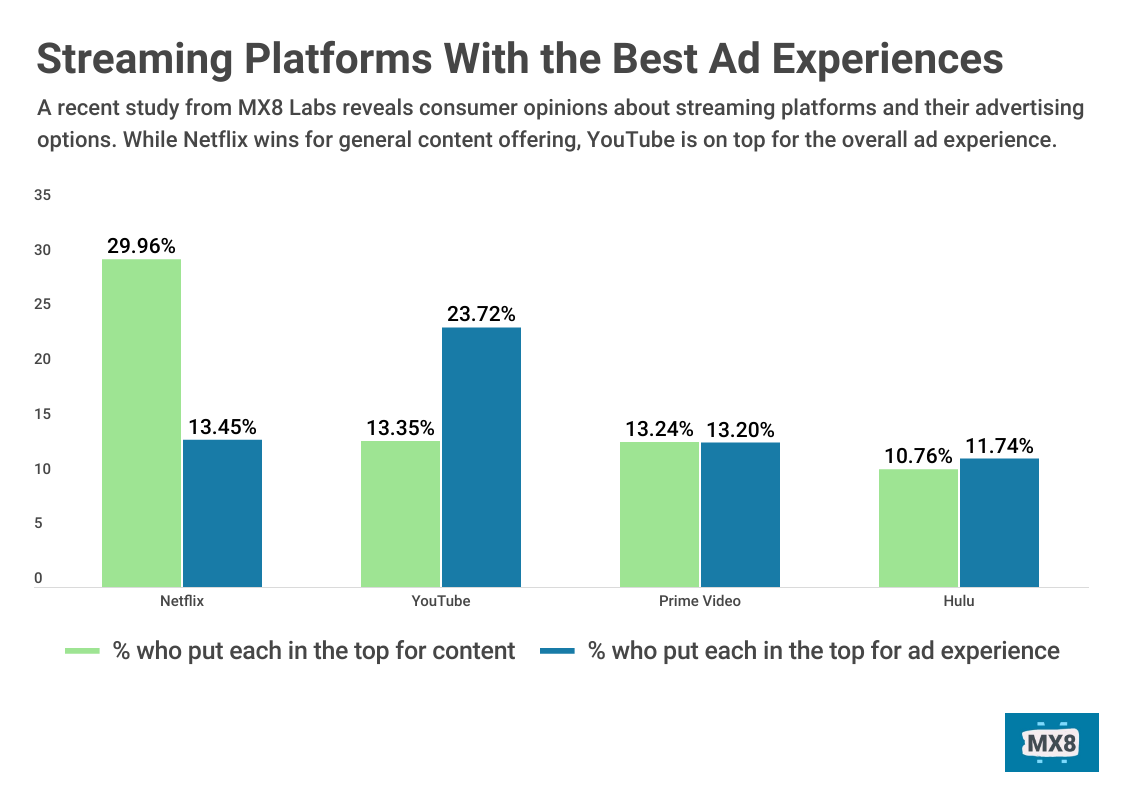

Among the realm of “well, yeah,” is the fact that Netflix is the No. 1 service watched overall — but it falls short in terms of ad experience; for that, YouTube is ranked highest (24% of all respondents). Get more insights about consumer perception of ads on streaming on The Measure.

Netflix also wins for user experience (ranked No. 1 by 42% of consumers) and content appeal, but a deeper demographic analysis reveals some areas for improvement: Netflix underperforms for content appeal among 18-24 year olds, and consumers living in the Southern U.S. and Midwest region. Meanwhile, although Disney+ beat Peacock for overall experience and content appeal, it performed slightly lower than Peacock in terms of the ad experience.

MX8 also asked viewers about their preferred content across subscription platforms that include an ad-supported tier. Notably, for network TV series, consumers actually ranked Netflix (37%) lower than Hulu (45%), Paramount+ (44%) and Peacock (43%). This is particularly interesting given that Netflix gained a lot of ground in the early days of streaming by licensing these types of shows, and has touted high viewership numbers more recently for things like the USA original Suits. Brandon Katz dive deeper into the streaming paradox around licensing in this TVREV piece, and MX8 shared more data here as well.

The above insights just scratch the surface — the MX8 survey revealed many other viewer trends, including around FASTs, variations among different demographics and more, that The Measure will share in upcoming weeks. So stay tuned!