Hooked On Netflix: Analyzing The Streaming Giant’s Low Churn Rates

Churn - it’s the constant thorn in the side of the streaming industry and the primary reason why the business may never match the financial highs of the pay-TV model. From the company perspective, cancelling a subscription is simply too easy. Industry research suggests that streamers generally need to keep a paying customer for up to 15 months in order to turn a profit. That’s a long time for a model that is vulnerable to a single click. While we consumers love the freedom and control we have over our own TV destinies, there’s no doubt that the volatility of that monthly recurring revenue keeps the cost of customer acquisition high for streamers.

So how do streaming companies keep churn rates low?

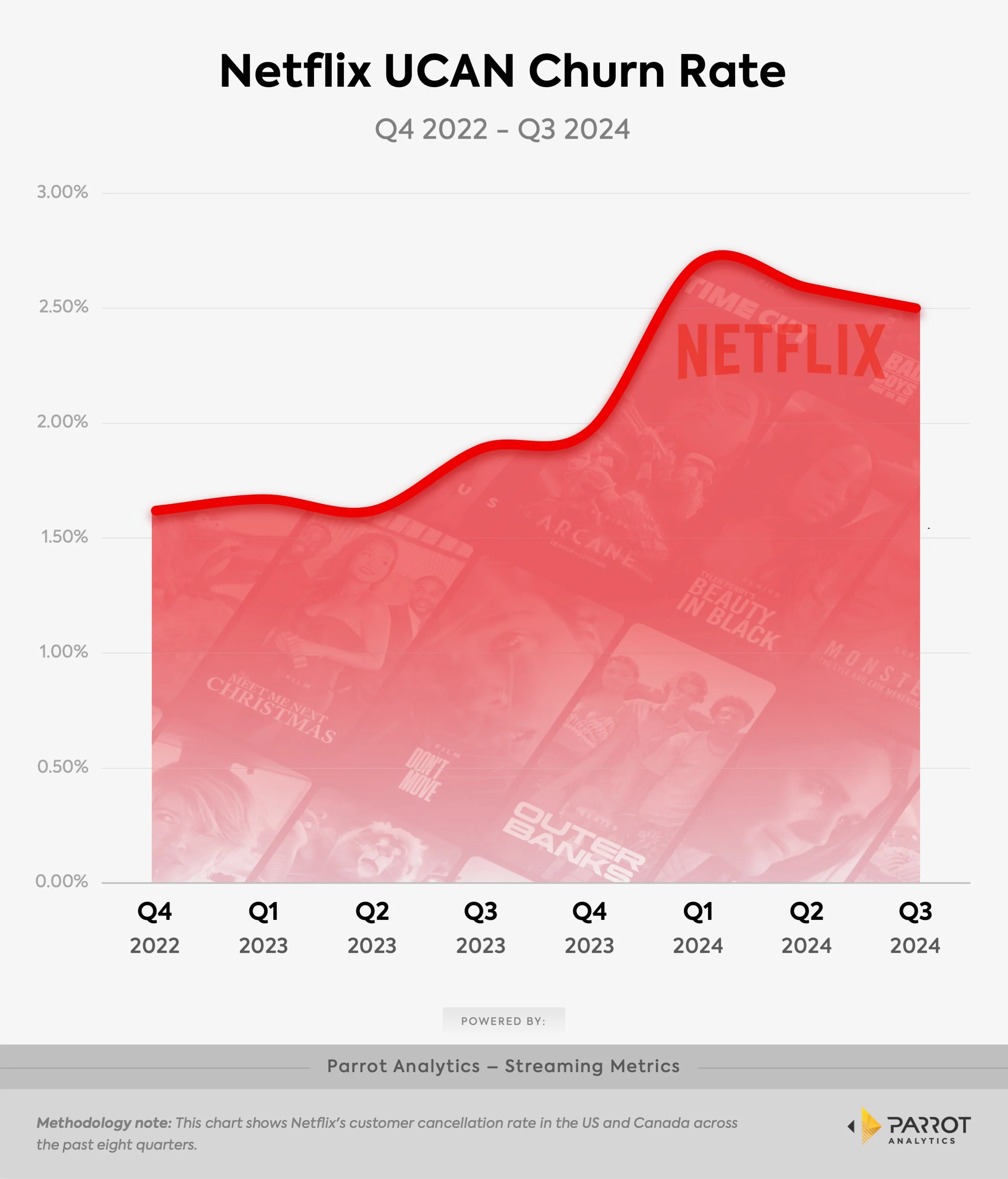

Netflix boasts the best monthly UCAN churn rate of the eight premium SVOD services by a wide margin, hovering between 1-3% in the last two years, according to Parrot Analytics’ Streaming Metrics. This is well below the industry average around 5%. While the streamer saw increased churn earlier this year as a result of ending its iTunes billing, the rate has steadily decreased over the past two quarters. This decline, and Netflix’s overall industry-best churn rates, come despite a rash of price increases in recent years.

There’s little doubt that Netflix benefits from a first-mover advantage. As the earliest major streaming service and one of the first to deliver original programming, Netflix customers have developed habitual usage patterns over the last 15 years. Netflix unsurprisingly ranks first in total US on-platform demand share (18.4%), which accounts for all original and licensed TV shows and films and serves as a proxy for which service customers consider their default streamers. To paraphrase a great line from The Wire, getting there early does matter.

Library size also plays a role. Netflix boasts the second-largest supply of TV series and films in the US among the premium SVOD services behind only Amazon, per Parrot Analytics’ Content Panorama. Importantly, Netflix releases more originals than any other service, even as its supply share of all streaming original premieres ticked down slightly in Q3 2024.

As recently as Q3 2021, Netflix accounted for 30.2% of all new streaming original titles released globally. Fast forward to Q3 2023, and Netflix’s share of new streaming originals worldwide was down to 14.7%. However, Netflix reversed this trend starting in Q4 2023, and has accounted for over 20% of all new streaming original releases in three of the past four quarters. This coincided with Netflix’s first increase in original demand share since before 2020.

Yes, Netflix’s voluminous spending on originals results in a surprisingly large number of titles that barely register with its subscriber base. That’s not great from an ROI perspective. But the steady flow, in addition to strategic licensing, has allowed the service to constantly engage its customers, which has improved retention.

One overlooked element of Netflix’s success in keeping churn low is a high quality user experience and interface. The company invested immense resources into its technology (Jake Paul vs Mike Tyson buffering issues notwithstanding) and it shows. This is particularly true on a macro scale in which Netflix has always emphasized being platform agnostic, i.e. compatible with all devices.

On the more micro user scale, the company leverages user data in a number of effective ways. Netflix’s in-app promotional efforts, search functions and recommendation algorithm are leaps and bounds better than the competition. While the large library may lead to endless scrolling on occasion, it’s a far more seamless experience compared to a few other apps that shall remain nameless at this time (but you can guess). Auto-play trailers, changing title cards, curated collections of related content, even the failed Netflix shuffle feature that was discontinued in 2023, all underscore the streamer’s attempts to make life easier for its customers.

Other contributing factors to low churn and high retention rates across the industry include flexible pricing options, strategic promotional campaigns and quality customer service. Netflix is far from perfect, but has created a sustainably sticky offering by refusing to become complacent and constantly seeking out improvements. First-mover advantage, compelling content and good technology have helped it achieve an industry-leading churn rate and build a highly profitable model. Who knows if that’ll be enough five years from now. But in the present, there’s a reason why Netflix is the king of streaming.