Data: Netflix Beats Other Streamers for Content Appeal

Subscription streamers looking to dethrone Netflix have their work cut out for them, as revealed by an MX8 Labs longitudinal tracking poll of more than 4,800 U.S. adults over the age of 18. Unlike most surveys that pinpoint results as a moment in time, MX8 Labs longitudinal surveys are designed specifically to help the market understand consumer sentiment over a longer period of time, providing customers an understanding of trends across weeks, months and even years.

MX8 Labs found that Netflix was the most-watched service (72% of respondents), with an even higher share among 18-24 year olds (80%). And not only did viewers rank the red giant highest for overall experience, it also came out on top in terms of content appeal and ad experience. Below, we highlight a few deeper insights from the study. Note: YouTube and FASTs are excluded from comparisons.

Netflix was ranked No. 1 for overall content appeal by 40% of all respondents, with another 26% ranking it second. When it comes to the types of content viewers favored, movies overall ranked highest at 64% — and jumped to 76% for older viewers 55-64 years old — but Netflix original movies were slightly lower (50%). On the flip side, Netflix original series beat network TV series (55% to 40%, respectively).

Although Netflix has been making forays into the world of sports, it clearly has some work to do: Only 12% of viewers cited sports as their preferred content on the platform, making Netflix the second-lowest in that arena (Disney+ was behind, at 8%). Time will tell if special events, such as Netflix’s upcoming live stream of the Jake Paul vs Mike Tyson fight on Friday, will help move the needle in that respect.

On the advertising front, a majority of Netflix viewers report going ad-free — in fact, Netflix ranks second-lowest for share of viewers who report subscribing to an ad-supported tier (38%), just behind Disney+ (37%).

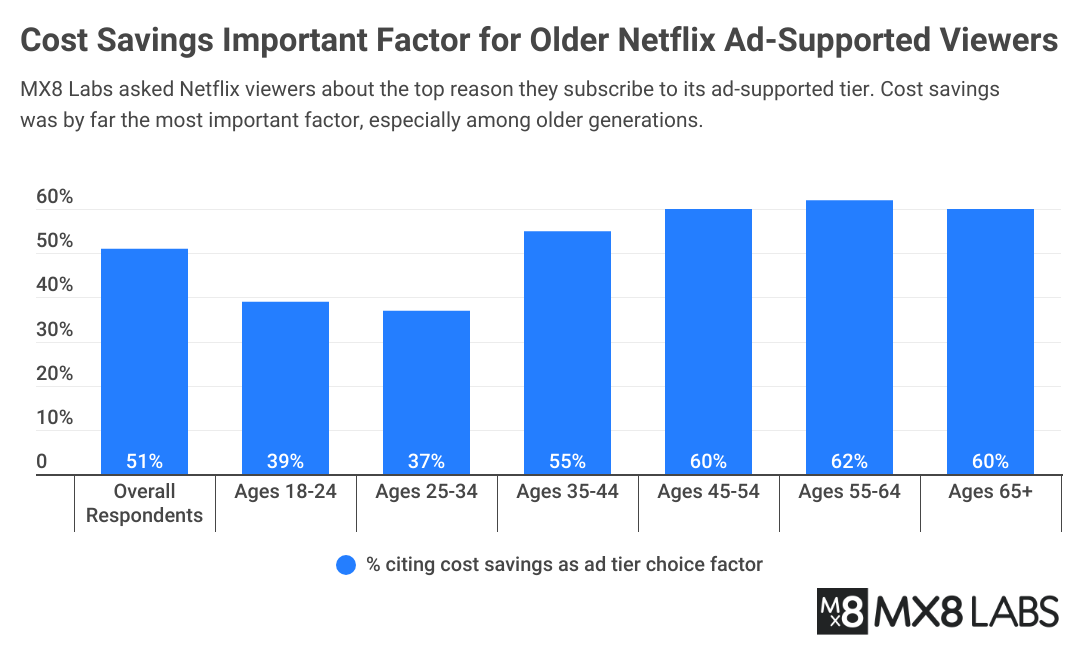

For viewers that are opting for the ad-supported subscription, cost was the more important factor, reported by 51% of respondents. Certain specific demographics were even more attuned to price: Older viewers cited cost in larger shares (60% of people ages 45-54, and 62% of 55-64 year olds). Additionally, 61% of people with household incomes between $35K-$49K and 59% of females said cost savings is why they subscribe to the ad-tier.

Across all the major subscription streaming services, Netflix ranked highest for ad experience. When asked the reason for why it has the best ad experience, 20% of respondents cited “few ads,” an above average share vs. other streamers with ad tiers. So bravo, Netflix, for balancing those ad loads well (enough).

There’s also some good news for brands that are advertising on Netflix: These viewers have above-average ad recall, with 27% able to cite specific brands mentioned in ads. Only Disney+ had higher recall — and it was a mere one point at that (28%).