Among Subscription Streamers, Disney+ Stands Out for Viewer Ad Recall

While the term “streaming wars” often summons thoughts of platforms competing for viewership, another battle is being fought on the advertising side of things. Over the last couple of years, all of the major subscription streamers have rolled out ad-supported tiers and begun to woo brands. But the road has been rocky this year, with advertisers clamoring for “rollbacks” amidst what many consider too-high CPMs. All of this begs the question: How impactful are ads on streaming, and do people even pay attention to them?

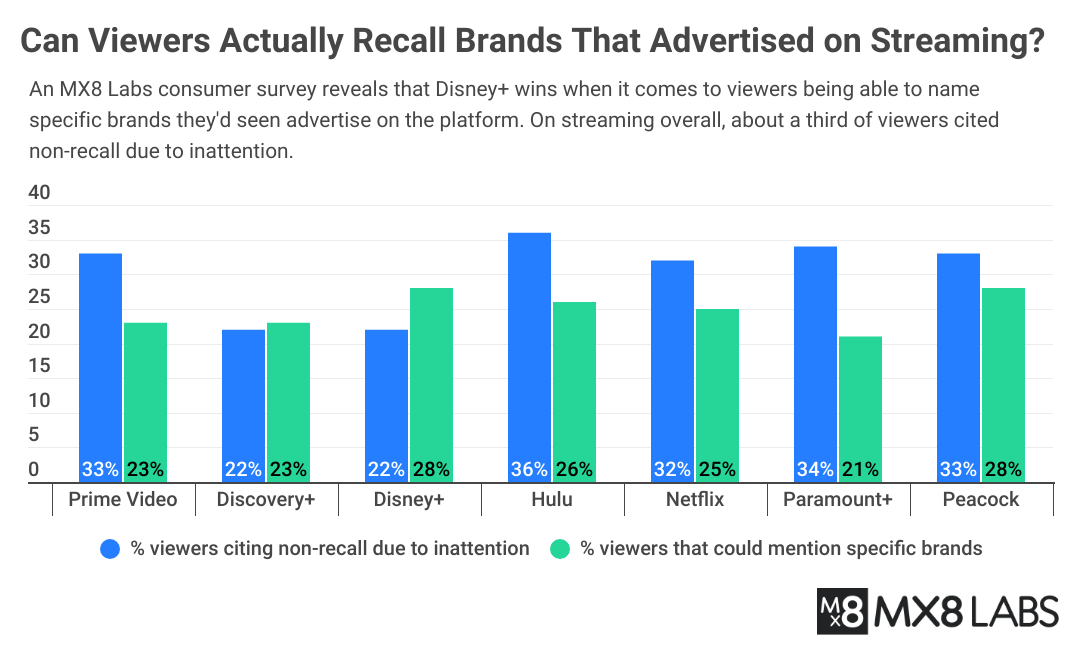

As part of its study on streaming platforms, MX8 Labs surveyed viewers about brand recall, attention and if ads have actually influenced them to make a purchase. Disney+ emerged as a leader in a few areas. Quick note: FASTs and YouTube are not covered below — MX8 has data on those as well, which we’ll feature in an upcoming article.

For the bulk of the top subscription services, roughly one third of viewers said they couldn’t remember ads due to inattention. But for Disney+, that share was measurably lower, at 22% — while notably, Disney-owned Hulu had the highest non-recall among the top services, at 36%.

That being said, looking at specific demographics, Hulu performed better across younger audiences, with non-recall below average for 18-44 year olds. Netflix and Peacock also seem to be holding the attention of the youngest viewers, with only 19% and 18%, respectively, of 18-24 year olds citing non-recall due to inattention.

When asked to remember specific brands that had been seen, Disney+ and Peacock led the pack, both with 28% of people able to name names. Netflix had the smallest share of overall viewers that could cite a specific brand (20%) — but for people watching on a laptop or PC, that share jumped to 35%.

Attention and recall aside, how much do ads on streaming actually impact purchase decisions? Across all demographics, Discovery+ and Disney+ were ranked highest by viewers for purchase influence, while Hulu, Prime Video, Paramount+ and Peacock performed below average. Netflix was squarely in the middle.

Drilling into specific demographics yields some other interesting findings. For example, Discovery+ viewers were likely to cite above-average purchase influence for ads they saw on Netflix, but below-average influence for ads on Prime Video, Hulu and — notably — Discovery+ itself. There were also variations by age: People 35-44 years old cited ads on Prime Video and Netflix as having above-average influence on purchase decisions, while 55-64 year olds said Peacock ads have greater influence. For people in the Midwest, only Hulu and Peacock had above-average influence.

It would seem that insights like these are exactly what advertisers need to make the most of the robust targeting capabilities available on streaming…and maybe help justify the cost.