ESPN Without Live Sports: Looking at Ad, Programming Changes

Live sports is a major part of TV audiences and ad budgets -- and there’s no network where that’s more true than ESPN, the country’s largest holder of live sports broadcast rights. ESPN and its family of networks have studio shows and documentaries, yes. But the majority of programming is the sporting events themselves, and the studio shows largely exist to talk about those results.

All of that was upended by March 12, when live sporting events in the U.S. were largely cancelled en masse amid coronavirus fears. And with that move, ESPN's programming -- and ad inventory against said programming -- was turned on its head.

Things are obviously not the same for ESPN since. Estimated TV ad spend is down about 32% for March 12-22 vs. March 1-11 according to iSpot.tv, and impressions have nearly been cut in half. Yet, attention scores (the percentage of an ad that plays across a TV device) have also stayed steady at about 92% across all ESPN programming.

Looking at ESPN on March 1-11, the top brands in terms of attention index (the attention for a specific brand or creative spot vs. the average) looked like this -- for brands with a minimum of 3 million impressions:

Yoplait (Attention index - 193; 93% less likely to be interrupted)

GF-9 (189; 89% less likely to be interrupted)

Atkins (176; 76% less likely to be interrupted)

Hilton Hotels Worldwide (173; 73% less likely to be interrupted)

EGO (171; 71% less likely to be interrupted)

And March 12-22:

Safelite Auto Glass (176; 76% less likely to be interrupted)

IFC TV (166; 66% less likely to be interrupted)

U.S. Army (164; 64% less likely to be interrupted)

Apartments.com (164; 64% less likely to be interrupted)

Aaron’s (162; 62% less likely to be interrupted)

For individual spots, attention is still holding up pretty similarly from the first time period (when there was sports) to the second (when there wasn’t, save one earlier tip-off on March 12 in a game that was eventually cancelled).

Top Spots by Attention Index, March 1-11 (min. 1 million impressions):

Yoplait - Taekwondo: Starburst Flavor (193; 93% less likely to be interrupted)

GF-9 - Reclaim Your Vitality (183; 83% less likely to be interrupted)

Jersey Mike’s - Day of Giving (179; 79% less likely to be interrupted)

Atkins - Frozen Meals: Time Well Spent (176: 76% less likely to be interrupted)

Whole Foods - More Than a Label (173; 73% less likely to be interrupted)

Top Spots by Attention Index, March 12-22 (min. 1 million impressions):

Jos. A Bank - Last Chance: Suits and Shirts (179; 79% less likely to be interrupted)

Safelite Auto Repair - Camping Trip Windshield Chip (176; 76% less likely to be interrupted)

OnStar - Helping Find You When Others Can’t (176; 76% less likely to be interrupted)

Daisy Cottage Cheese - Only Daisy Will Do (174; 74% less likely to be interrupted)

Lexus - Questions (171; 71% less likely to be interrupted)

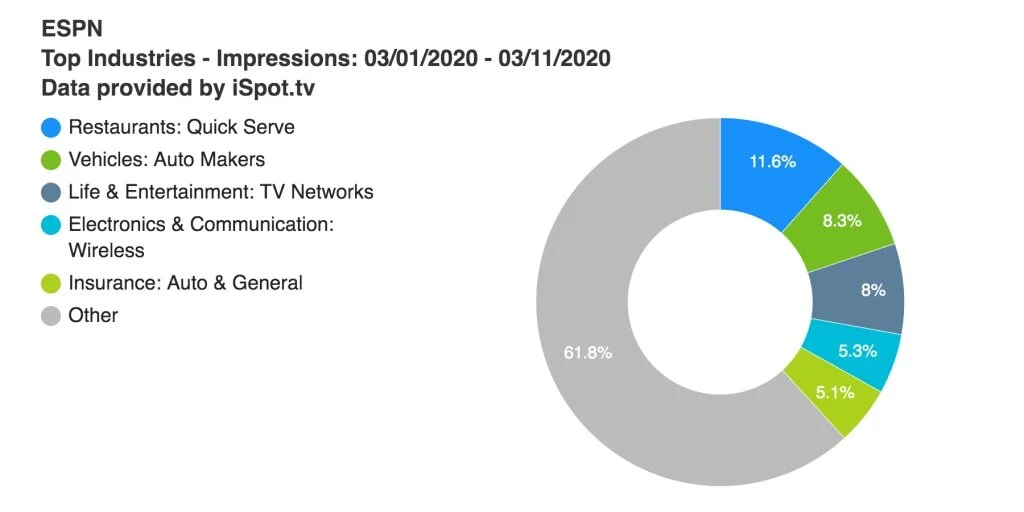

At least by impressions, top brand advertiser industries haven’t really changed much for ESPN in the first 11-day stretch vs. the second. Most notably, Quick serve restaurants have cut back a bit, while beer and streaming have increased.

So what are ESPN audiences watching without live sports? Well, it’s a lot of SportsCenter. The network’s flagship program already made up 27.9% of all impressions from March 1-11. From March 12-22, it’s 36.6%, and that’s before adding in Scott Van Pelt’s branded SportsCenter (10.3%) plus SportsCenter Special (7.3%). SportsCenter is still top 10 in terms of impressions (1.4 billion) during the time period, despite having no live sports results to discuss.

Even without the main topic the show reports on, SportsCenter impressions are still down just 23% from the earlier time period. Looking at iSpot Lift Ratings* from the past three months, advertising on ESPN is still poised to be beneficial for a few industries -- and could now offer new opportunities to air ads during SportsCenter when that door was potentially closed before:

Insurance (average lift rating of 45.61% in January 2020)

Food Delivery (average lift rating of 40.13% in January 2020)

Wireless Carriers (average lift rating of 36.51% in December 2019)

*iSpot Lift Rating measures the causal impact of TV advertising on key performance indicators (KPIs); put simply, it reflects new business driven by TV ad placements.