Endeavor Wants The Sports Entertainment Content Title Belt

In an environment full of sports entertainment behemoths, you would’ve been forgiven for forgetting about Endeavor – until this week, of course.

The company will merge the Ultimate Fighting Championship (UFC) and World Wrestling Entertainment (WWE) into a new sports entertainment company. And with that, Endeavor basically has a stranglehold on fighting content in the U.S. and abroad. Sure, there are competitors. But none have the brand recognition or the history or tradition of the UFC and WWE. And as shown below, few sports properties are able to hold a candle to this combined venture.

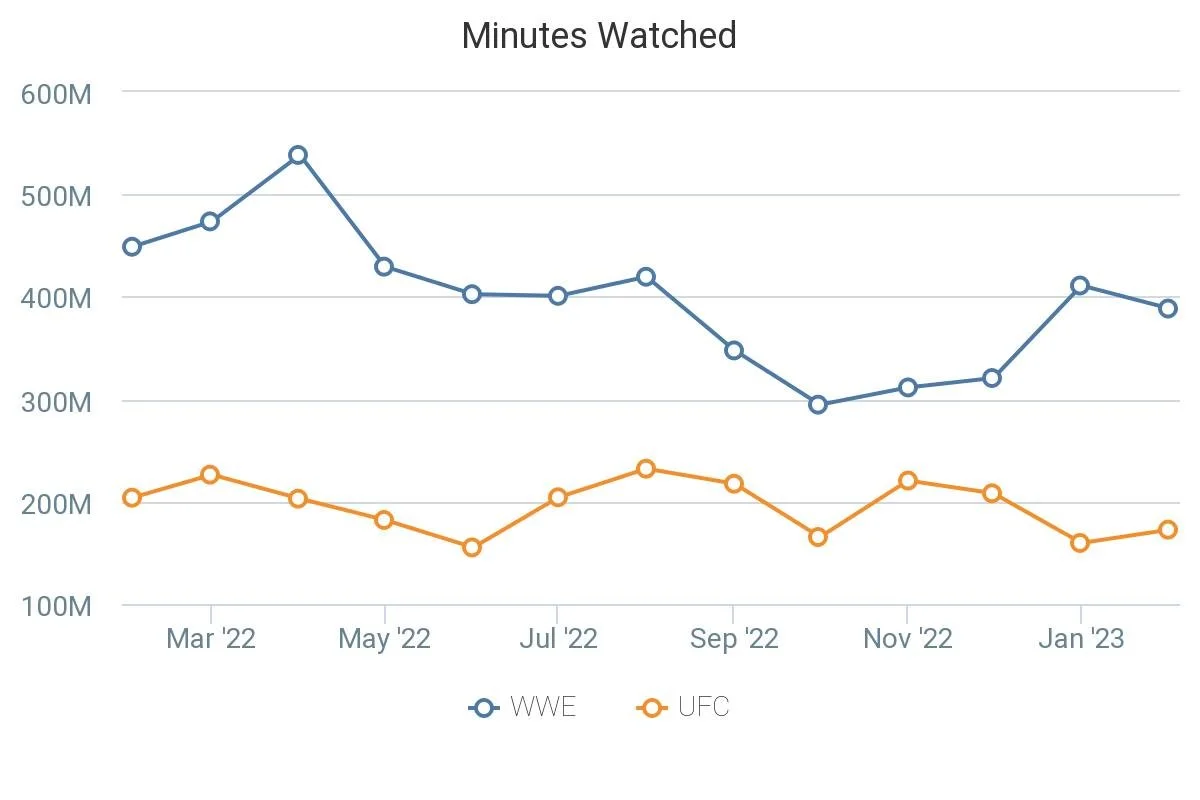

Data from Tubular Labs shows both entities were among the top 10 sports media creators (sports-related accounts owned by media companies) with U.S. audiences in February. WWE was No. 3 with 399 million minutes watched across YouTube and Facebook, while UFC was No. 7 at 173 million. The high marks are nothing new either, as the last year of data reveals:

(via Tubular)

WWE and UFC social video content also reaches large portions of U.S. audiences – not just superfans watching hours and hours of highlights. In February, WWE was No. 6 among sports media creators by share of U.S. population reached (4.8%) and UFC was No. 11 (3.4%).

The idea with the merger is to grow both properties, of course, and there’s ample opportunity to do so when considering how well they stack up against more “traditional” sports entities . For instance, both the WWE and UFC are watched for more minutes each month on social video than the NHL and MLB, and those leagues have recently scored big TV contract wins across both linear and streaming.

UFC and WWE seem poised to do the same, and could even pursue a joint streaming deal (according to reports) to maximize what they can make together on the open market. WWE’s current deals with Fox and NBCUniversal expire in 2024, while its Peacock contract extends through 2026. UFC is currently enjoying a lucrative arrangement with ESPN, although that deal ends in 2025.

So how much could this combined entity command? Wrestling economics expert Brandon Thurston predicted WWE alone could get a raise from $470 million per year in rights to over $700 million per year in a new deal.

Were it to happen, that would mean more money per year than the NHL’s current deal pays, but over $100 million less than NASCAR (another property with wider audience appeal beyond just major markets) is getting. But the environment’s also changed considerably since that projection last August:

Thruston’s analysis doesn’t include UFC in a package deal

NASCAR’s audience is declining relative to WWE, UFC and auto racing competitor F1, so the WWE continues to look more appealing for networks/advertisers interested in reaching similar audiences to NASCAR (whose rights are also coming up soon)

Continued audience shifts to streaming mean any TV deal will be more heavy on streaming – especially for the WWE, which skews young as it is (more on that later)

And while live sports and entertainment continue to be the only big draw left for TV, media companies are also in cost-cutting mode while rights elsewhere are soaring (see: the Big Ten’s astronomical deal as just one example)

So that’s a long-winded way of setting the stage for a joint WWE/UFC TV deal that will probably be nearing the $1 billion/year mark (including streaming) which would put it in the neighborhood of the Big Ten’s new three-network rights deal and what Paramount and Warner Bros. Discovery pay annually for the NCAA Men’s Basketball.

The fact that mixed martial arts and a scripted wrestling league could fetch that much is staggering, and the main motivation for Endeavor here. That both also have strong audiences on social video also signal to TV’s powers-that-be that UFC/WWE is playing a completely different game than most other sports entertainment properties – which are progressively getting older and struggling to gain as much traction with younger viewers.

According to Tubular, the WWE reached 14.0% of U.S. men 13-to-34 in February (No. 3 among sports media creators). UFC hit 8.2% (No. 13).

For reference: The NFL and House of Highlights were the only sports media creators to reach more than 20% of that group in February. And WWE is also likely to see a jump in the coming months here as a result of this weekend’s WrestleMania.

So yes, Endeavor knows exactly what it’s doing here, and is unlikely to be out-negotiated by networks largely starving for the younger audience it delivers. These networks ignored wrestling and MMA’s massive audiences until recently because of faulty perceptions as a down-scale product within the circles TV execs typically travel in.

Meanwhile, the event just drew a record 161K+ at SoFi Stadium… home of the Los Angeles Rams.

When the UFC/WWE cashes in on a new TV deal – or likely, various deals – you can bet it will be one of the U.S.’s most lucrative video properties, sports or otherwise.