Warner and Disney Shift Focus to Streaming, and Consumers Weigh In with Their Wallets

They were two days that shook the entertainment world.

After WarnerMedia announced on December 3 that each of its 2021 films would be made available on HBO Max the same day as in theaters, reactions were decidedly mixed. Some industry analysts praised the decision as a boon to the streaming service, while others worried about the broader impact on the industry, including theater chains. Craig Moffet summed up his take: “It is hard to find any winners here.”

Just one week later, on December 10, it was Disney’s turn to register on the entertainment Richter scale. Analysts were almost universally positive about the company’s aggressive streaming plans for 2021, and the stock market followed suit the very next day, with a 9% increase in Disney shares.

We’ve heard what the analysts said; how long will it be before we see the impact on subscriber numbers?

Not long at all, at least for HBO Max. Hub Entertainment Research’s ongoing TV Churn Tracker study measures the full range of TV services consumers subscribe to, add, and drop—and the reasons for doing each.

Our data showed impressive growth for HBO Max in December, thanks in large part to the Christmas day release of Wonder Woman 1984 (which, not coincidentally, was the most viewed content on any streaming platform that week by far, according to Nielsen).

- HBO Max’s share of new TV service subscribers nearly doubled in December. 13% of consumers who signed up for any TV subscription in December signed up for HBO Max. In November, that percentage was just 7%.

Although Disney+ didn’t see the same level of subscriber growth between the two months (new subscribers held steady), we’ll see in a moment that the reasons for adding Disney+ shifted dramatically in December, on the heels of Disney’s content announcement.

How much of these subscription additions can be attributed to each company’s new streaming-focused strategy?

Quite a bit of it, in fact.

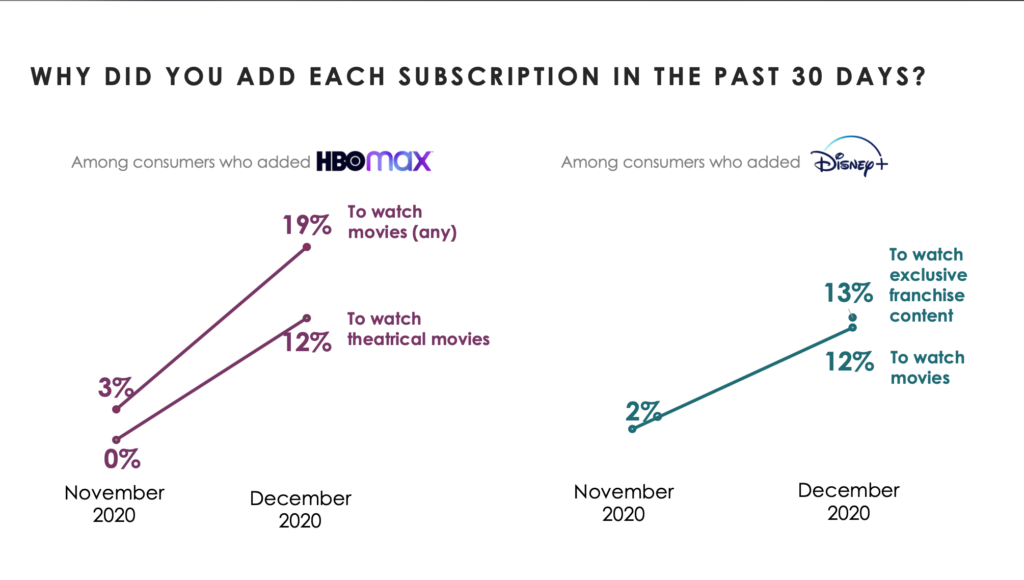

- Among those who added HBO Max in December, 19% said they added the service to watch movies—including 12% who signed up to watch “theatrical” movies . The total movie percentage in November was only 3%, meaning December saw a six-fold increase in movies as a reason for subscribing to HBO Max.

- Among those who added Disney+ in December, 12% said they signed up to watch movies; in November, the movie percentage was just 2%. And in a new question asked in December, 13% said they signed up to watch exclusive franchise content (from Star Wars, Pixar, and Marvel)—as frequently mentioned as “movies”.

It of course remains to be seen whether Warner’s or Disney’s December decisions are precursors of a permanent shift in how movie and franchise content is distributed, or whether theaters will once again reign supreme as the exclusive home for first-run films. But while industry analysts wait for that to play out, pandemic-fatigued Americans—spending more time than ever at home—are already happily endorsing this new streaming normal.