Streaming Services Must Bear Down To Win, Or At Least Stay In, This Race

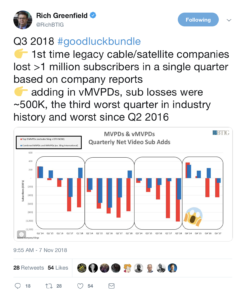

There's an old saw about two guys confronted by a bear. One starts running, and the other yells, "Where are you going? You can't outrun a bear." His erstwhile pal shouts back, "I don't have to outrun the bear. I just have to outrun you."That rather frosty joke came to mind when reading a Hollywood Reporter piece that suggests CBS doesn't need to beat Netflix to succeed with its All Access streaming service. All it needs to do is beat HBO.His ultimate point, one I've also been pondering for a while, is that with so many companies jumping into the online video-streaming business, our measures of success need to change. Victory in this race may be a relative thing for many of the companies taking part, especially with that huge Netflix lead.Who will "win?" How will we even define winning, with so many players, and customers likely to subscribe to, and churn through, multiple providers? Will we use market share? Subscribers? Revenues? Profits? I lean toward that latter one, but the reality is many companies in this race probably won't be showing profits any time soon.There's room for several subscription services on every person's devices of choice. But there's almost certainly not room for all of those services, especially with more coming next year from Disney(which finally said its new service will be called Disney+), WarnerMedia, Walmart and Apple.Right now, everyone in TV is trying to outrun the bear, which these days seems to be Netflix, once the place where networks extracted hefty licensing checks for their older shows.Netflix is a deficit-financed bear, to be sure, buying its way to preeminence with $10 billion in junk bonds. But it's probably safe to expect Netflix to continue to be the bear everyone else is running from. Its latest earnings announcement showed another 7 million new subscribers, mostly overseas, to 137 million total. To further that overseas growth, the company this week announced 17 new series and features from India and other parts of Asia, on top of nearly 100 existing programs from that region.Traditional pay-TV, meanwhile, keeps shrinking, despite predictions by some that cord cutting had slowed. In the last quarter, according to a new study by MoffettNathanson, MVPDs together lost 1.1 million subscribers, the most ever.Worse, said MoffettNathanson, the nation is adding about 200,000 households a quarter, and new pay-TV subscribers aren't coming close to keeping up. BTIG analyst Rich Greenfield found similar math in his own work, and called it "the third-worst quarter in industry history and worst since Q2 2016." And it all comes after a bad 2017 too.Barely three-fourths of the U.S., about 78 percent of TV households, still subscribe to some pay-TV service, according to Leichtman Research Group. That's down 8 percentage points since 2013.Virtual MVPDs, the skinny and mesomorph bundles of IP-delivered digital channels, meanwhile, added about half a million subscribers.That would seem to be a bright spot for pay-TV providers, but as my esteemed colleague Alan Wolk likes to point out, those skinny bundles of TV networks are not well fed. Most, if not all, are losing money as they try to build market share. Now, many of the vMVPDs are raising prices as growth stalls, trying to get to a stable place.Even Hulu, one of the biggest streamers and possessed of its own vMVPD offering, is probably losing money, enough that Disney (a definitely bear-like creature) is talking about raising prices when it gains majority control after the Fox deal closes.For its part, HBO faces much higher expectations as part of another mega-merger involving yet another would-be bear, AT&T.New AT&T boss John Stankey suggested in June that HBO's competitors now include the YouTubes of the world, not just the Showtimes. To compete, HBO will need to push out a lot more content, Stankey said, while remaining captivating.Whether HBO can still be the award-scooping, profit-driving beast of the past couple of decades is another question. That'll be a different kind of bear, and one of HBO's own making. Among other challenges, HBO faces competition not only from outside AT&T, but from inside too, with OTT offerings from WarnerMedia and DC Universe, and specialty providers such as Crunchyroll (which already has more than 2 million subscribers), Rooster Teeth and the VRV mini-skinny bundle.For CBS All Access, the challenge is different, the bears belonging to someone else. The company's interim CEO Joe Iannello said in this week's earnings call that All Access and Showtime's OTT service together are ahead of schedule to reach a 2019 goal of 8 million subscribers.He credited their growth with driving CBS' overall great quarter, despite the corporate mayhem and machinations that led to the August departure of Iannello's long-time boss, Les Moonves.Both CBS All Access and Disney+ will double down on fan-fave franchises that will appeal to hard-core fan boys (and girls). All Access plans another season of its launch title, Star Trek Discovery, a new Star Trek series featuring franchise stalwart Patrick Stewart, and an adult-focused animated show set in the universe. In short, All Access is going where many men and women have gone a lot before.Disney+ also is doubling down on that which its fans already know and love, producing scads of spinoff shows from the Marvel and Star Wars universes to flesh out its offering.When Disney+ finally arrives a year from now, it's possible that the service will become the bear everyone else runs from. But it's also possible that, like so many others in this crowded field, Disney+ may be left just trying to outrun enough of the others to beat the real bear chasing them all.

BTIG analyst Rich Greenfield found similar math in his own work, and called it "the third-worst quarter in industry history and worst since Q2 2016." And it all comes after a bad 2017 too.Barely three-fourths of the U.S., about 78 percent of TV households, still subscribe to some pay-TV service, according to Leichtman Research Group. That's down 8 percentage points since 2013.Virtual MVPDs, the skinny and mesomorph bundles of IP-delivered digital channels, meanwhile, added about half a million subscribers.That would seem to be a bright spot for pay-TV providers, but as my esteemed colleague Alan Wolk likes to point out, those skinny bundles of TV networks are not well fed. Most, if not all, are losing money as they try to build market share. Now, many of the vMVPDs are raising prices as growth stalls, trying to get to a stable place.Even Hulu, one of the biggest streamers and possessed of its own vMVPD offering, is probably losing money, enough that Disney (a definitely bear-like creature) is talking about raising prices when it gains majority control after the Fox deal closes.For its part, HBO faces much higher expectations as part of another mega-merger involving yet another would-be bear, AT&T.New AT&T boss John Stankey suggested in June that HBO's competitors now include the YouTubes of the world, not just the Showtimes. To compete, HBO will need to push out a lot more content, Stankey said, while remaining captivating.Whether HBO can still be the award-scooping, profit-driving beast of the past couple of decades is another question. That'll be a different kind of bear, and one of HBO's own making. Among other challenges, HBO faces competition not only from outside AT&T, but from inside too, with OTT offerings from WarnerMedia and DC Universe, and specialty providers such as Crunchyroll (which already has more than 2 million subscribers), Rooster Teeth and the VRV mini-skinny bundle.For CBS All Access, the challenge is different, the bears belonging to someone else. The company's interim CEO Joe Iannello said in this week's earnings call that All Access and Showtime's OTT service together are ahead of schedule to reach a 2019 goal of 8 million subscribers.He credited their growth with driving CBS' overall great quarter, despite the corporate mayhem and machinations that led to the August departure of Iannello's long-time boss, Les Moonves.Both CBS All Access and Disney+ will double down on fan-fave franchises that will appeal to hard-core fan boys (and girls). All Access plans another season of its launch title, Star Trek Discovery, a new Star Trek series featuring franchise stalwart Patrick Stewart, and an adult-focused animated show set in the universe. In short, All Access is going where many men and women have gone a lot before.Disney+ also is doubling down on that which its fans already know and love, producing scads of spinoff shows from the Marvel and Star Wars universes to flesh out its offering.When Disney+ finally arrives a year from now, it's possible that the service will become the bear everyone else runs from. But it's also possible that, like so many others in this crowded field, Disney+ may be left just trying to outrun enough of the others to beat the real bear chasing them all.