Niche Streamers Seeing Double The Growth Of The Bigs As Netflix, Hulu Market Share Drops

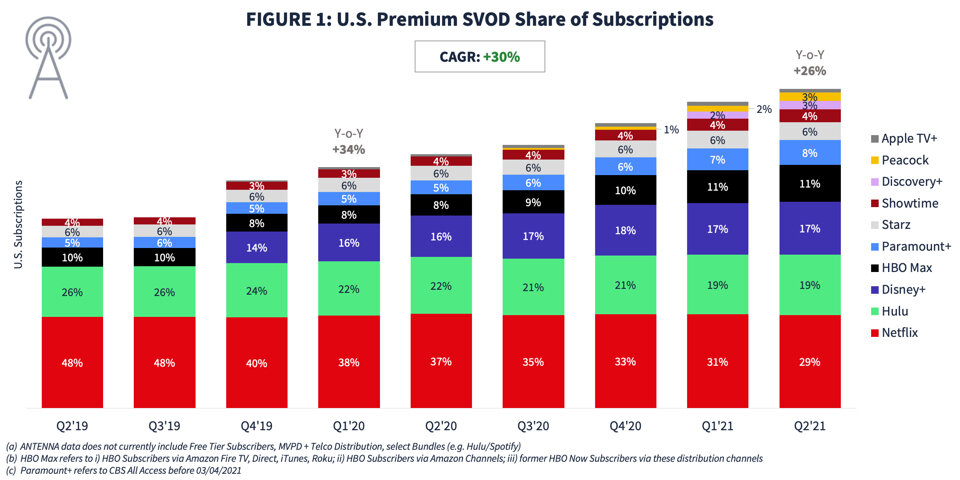

Between the pandemic and an influx of major new services, the number of U.S. subscription accounts has boomed, up 30 percent annually over the past two years, but niche subscription video services have done even better, more than doubling that estimable track record, according to a research note from analytics consultancy Antenna Inc..

The research note also detailed the shrinking market share for long-time leaders Netflix and Hulu as a phalanx of shiny new competitors hit the market beginning in November 2019. For the first time this last quarter, the two streaming pioneers have less than 50 percent of market share, though at least Hulu owner Disney can console itself with the 17 percent market share that Disney Plus has scooped up since it launched.

Disney Plus and other new services have grabbed a significant share of new subscribers even as the market continues to boom overall. (GRAPHIC COURTESY OF ANTENNA INC.)

“…A lot has changed in the last two years in this Premium category,” wrote Jonathan Carson, Antenna’s co-founder and chairman. “Netflix and Hulu now make up just 48 percent of category subscriptions, and have accounted for only 9 percent of category growth in the past two years.”

Actually, all the market leaders’ growth in U.S. subscribers, the study’s focus, came from Hulu. Netflix’s last quarterly earnings report showed Big Red actually declined by 400,000 subscribers in its home market, though it continued to expand internationally. It now has more than 209 million subs and is finally rounding into free cash flow positive on a regular basis after years of deficit-financing its programming. That’s good news given that it appears to have topped out in the U.S. at least for now.

Overall, the 10 largest streaming services have seen subscriber levels grow at a compounded annual rate of 30 percent over the past two years. Disney Plus now has the market’s third-largest share, 17 percent, and. WarnerMedia’s HBO Max has 11 percent, the only other big streamer with a double-digit market share.

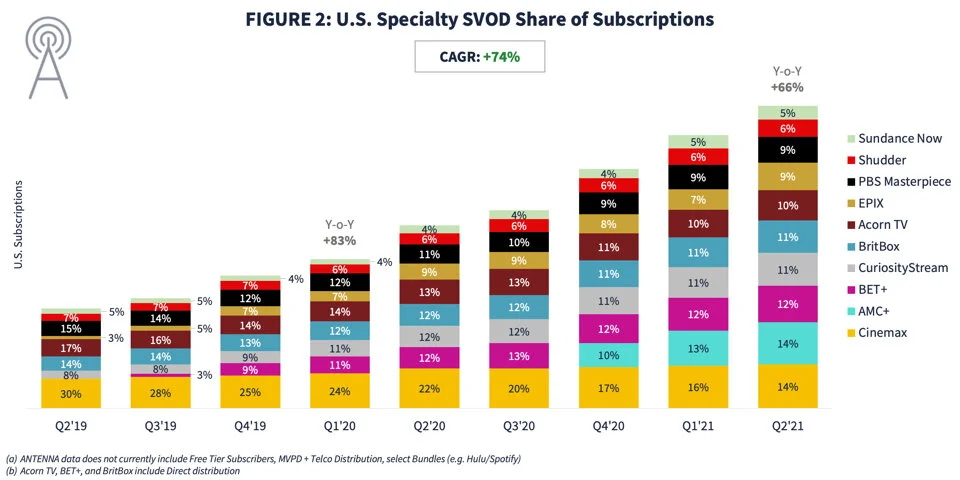

Subscriber additions for niche services have grown at a far higher rate than the major streamers, according to consulting firm Antenna.(GRAPHIC BY ANTENNA INC.)

For all the growth among the big services, niche streamers are growing even faster, up 74 percent on a compounded annual basis, including 66 percent growth this past year. The study looked at market share and subscriber growth for 10 “niche” services that focus on typically one type of programming such as movies or horror, or a specific demographic or content source.

Cinemax, AMC Plus, BET Plus, CuriosityStream, BritBox, and Epix have between 10 and 14 percent each of the market among those in what we’ll call the Little Big 10.

Two of the 10 – AMC Plus and ViacomCBS-owned BET Plus – launched in the past two years, and now have two of the three largest shares of the market among the 10 niche channels. As with the Big Ten, the long-time leader, in this case Cinemax, has seen a significant erosion of its position. Two years ago, Cinemax had 30 percent of the subscribers among the smaller services; now it’s tied with AMC Plus, which just launched late last year, at 14 percent.

It’s perhaps little surprise that Cinemax is seeing that erosion, though it has grown modestly over the past two years, according to Antenna.

But parent company WarnerMedia has been shifting some of Cinemax’s long-running franchises onto HBO Max, and positioning new series for its flagship service rather than Cinemax. Starving Cinemax of new shows, while maintaining its foothold in tens of millions of cable boxes, may make lots of sense on the corporate end as WarnerMedia tries to maximize HBO Max. But it’s hard to believe Cinemax will be even at this level of market size when Antenna writes a similar report a couple of years from now.