iSpot Upfronts Report Reveals a Measure of Advertiser Optimism

In 1962, ABC set out to discover how advertisers felt about its new shows. That presentation gave birth to what would become the TV upfronts, the annual festivity where networks tout their latest and greatest in an attempt to woo advertiser dollars. A lot has happened in the 62 years since, and even in today’s streaming age, this yearly event remains critical for TV media buying and planning.

Ahead of the 2024 upfronts, iSpot.tv has released a new study revealing insights about how advertisers are planning for the year ahead. Below are a few key points, and you can download the full report here.

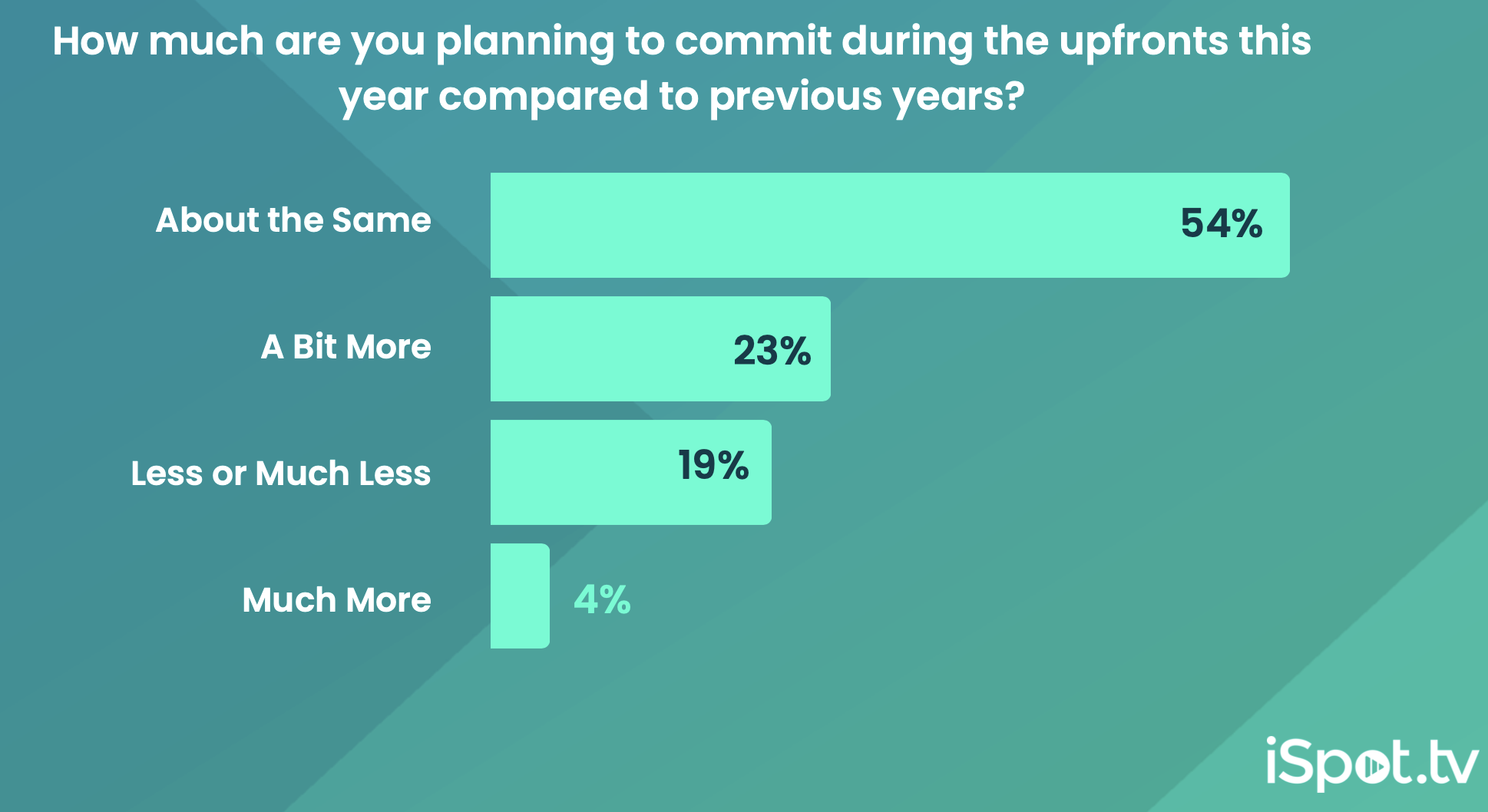

Only 19% Indicate Smaller Upfront Budgets

iSpot’s survey of senior marketing executives from both brands and agencies reveals that a whopping 81% are planning to allocate at least as much, if not more, to upfront budgets this year compared to last.

That being said, iSpot notes differences in perspective between agencies and brands, with the former feeling a bit more bullish: 85% of agency respondents believe upfront budgets will grow or remain the same, vs. 74% of brand respondents. One reason for the disparity? “Agencies have a broader perspective of the ad marketplace whereas brands may be more focused on their specific industry performance and objectives.”

A Steadiness With Streaming

Although audience migration toward streaming has risen dramatically in the last few years — and with it, the development of more ad-supported services — upfront allocation has steadied. When asked what percentage of their upfront budget is allocated to digital streaming platforms, 30% of respondents said more than one-fifth, the same amount as last year. Meanwhile, 48% of advertisers are spending 15% or less on those platforms. In other words, old school television is still the (main) name of the game, at least for now.

When it comes to specific platforms, 75% of respondents plan to allocate upfront spend to Hulu, and 51% will invest in Peacock. Paramount+ and YouTube TV are two other favorites, with 47% of surveyed execs citing investment in those platforms.

Interest Around New Currencies

A key challenge facing advertisers today is how to measure cross-platform viewing and the resulting highly-fragmented audiences. Indeed, fragmentation was ranked as either the biggest or second biggest challenge for streaming measurement by 53.6% of survey respondents. Given this, it’s not surprising that there’s significant interest in new currencies — but just how much interest depends on, well, the money.

Put simply, the more an advertiser spends, the more appetite there is for new currencies. While 70% of advertisers with lower budgets (under $15 million annually) signaled interest in alternative currencies, that jumps to 87% for advertisers with budgets of $250 million or more.

The Bottom Line

The shifting landscape has fundamentally changed how TV is bought, counted and optimized, but the upfronts continue to play a pivotal role. With new challenges have come new opportunities, and advertisers are keen to adjust — with a measured approach — how they allocate budgets and reach cross-platform audiences. And despite the economic uncertainty and world events of recent years, many are optimistic about what the future holds.