How Netflix Rules Main Street As Well As Wall Street

Wall Street loves Netflix. Netflix shares shot up last week after it showed unexpectedly strong subscription, revenue and earnings growth in the fourth quarter.

Viewers are also big Netflix fans. In a new study, research company MX8 Labs found Netflix was not only the most-watched among the streaming platforms, but it also ranked highest for overall experience, content appeals and ad experience.

That begs the chicken and egg question. Which came first: Netflix’s appeal to consumers? Or a high valuation for Netflix stock, which allowed the company to invest in programming and technology? At this point it doesn’t matter because either way Netflix has been heralded as the winner of the streaming wars.

According to MX8’s data, Netflix is watched by 72% of the respondents in its survey of people 18 years and up, and by 82% of 18- to 24-year-olds.

Netflix ranked No. 1 for overall content appeal by 40% of the respondents and No. 2 by another 25%. Movies were the most favored type of content on Netflix and its original series were more popular than the off-network shows on the platform. Even though it is just starting to dip its toes into the sports world, 12% of viewers said sports was their favorite content on Netflix.

In terms of advertising, Netflix has been off to a slow start. Among those surveyed, only 37% of subscribers are on the ad-supported tier, lowest of any streamer other than Disney+. The positive news for Netflix is ad-tier subscribers ranked Netflix highest for its ad experience.

Also important: viewers have above average recall of brands that advertise on Netflix with 27% able to cite specific brands mentioned in commercials.

Following Netflix, the most popular streaming services with viewers were YouTube (watched by 63% of those surveyed), Amazon Prime Video (63%), Hulu (56%), Disney+ (45%), Peacock (36%), Paramount+ (34%), Tubi (30%), Max (30%), The Roku Channel (25%), Apple TV+ (22%), Pluto TV (20%), Discovery+ (13%), Samsung TV+ (8%), Crackle (6%), Vudu (5%), Vizio Watchfree+ (4%), and Plex (4%).

Not so long ago, being commercial free was a big benefit of subscription streaming services. Now most streaming services are either ad supported or offer an ad-supported tier. Viewers seem to like it because the ad-supported tiers cost less.

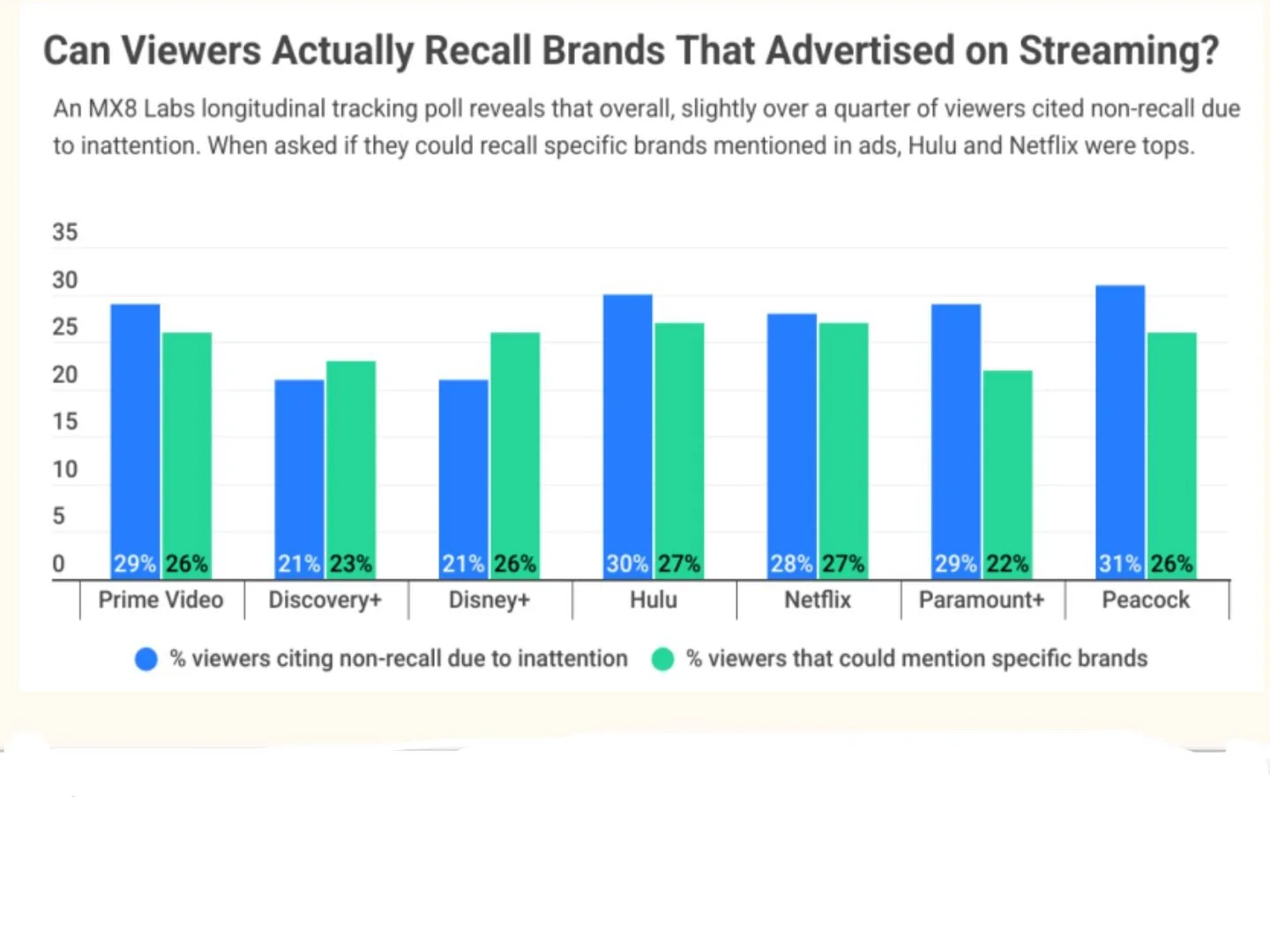

For advertisers, the study found that about one-quarter of viewers said they weren’t able to recall ads because of inattention. Disney+ was tops among the subscription services, with only 21% of its viewers saying they couldn’t remember which brands advertised while they watched.

On the other hand, when viewers were asked to recall specific brands that streamed commercials, Hulu and Netflix scored highest with 27% able to name brands. Among young viewers (18 to 24) brand recall was 37%, compared to a 22% average overall for subscriber streaming services.

MX8 also looked at the free ad-supported streaming television (FAST) services. It found that Tubi was the most watched with 30% of viewers saying the’ve streamed something on Tubi. Following Tubi with the most viewing were The Roku Channel and Pluto TV.

Commercials are part of the DNA of FAST services, but according to the survey, viewers say ad breaks are more annoying than entertainment in the way commercials are handled on some of the services. Viewers are also irritated by the ad experience provided by others.

For example, 36% of Pluto TV viewers said its ad breaks were annoying, compared with 13% who said they were entertaining. For The Roku Channel, 35% found the ad breaks annoying and 18% found them entertaining. Tubi’s ad breaks annoyed 32% of viewers, with 14% saying those interruptions were entertaining.

Apparently, some services offer a better commercial environment than others. When asked about Samsung TV+, 60% of viewers surveyed said they think the ad frequency is “just right.” Vizio Watchfree+ got a similar score, with 58% of Watchfree+ users calling its ad frequency “just right.”

In conclusion, the report found that “in today’s crowded landscape, streaming platforms need to be equipped with deep audience insights in order to stay competitive and craft forward-thinking strategies Going beyond simple total audience share is imperative, especially since different demographic segments are demonstrating varied preferences and behavior, as revealed by the insights in this whitepaper. And it’s not just the streaming services that can benefit from this type of intelligence — as brands continue to iterate on their streaming ad strategy, understanding current trends in audience attention to advertising, as well as the preferred content across different cohorts of viewers, will be key to success.”

The study is based on a longitudinal tracking poll of more than 7,000 U.S. consumers over the age of 18.

Source: MX8 Labs