Fewer Ads For More Money? Don't Count On It

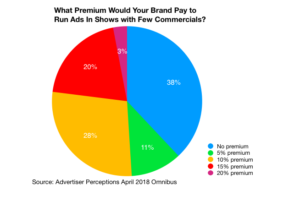

This year's big rush to cut the ad load on traditional TV networks is predicated on a simple premise: fewer ads should get watched more, with fewer distractions and tune-out, and therefore be worth more. Except, if this April survey of brands from Advertiser Perceptions is any guide, most advertisers aren't exactly excited about paying a lot more for the privilege of being only one of, say, two or four brands on display in an hour-long show.Almost two in five (38 percent) said they wouldn't be willing to pay any premium to run their ads in shows with fewer commercials. Another 11 percent would pay only as much 5 percent more for the privilege of less competition for viewer attention.Throw in the 28 percent who'd cap a premium at a 10 percent bump and you have more than three-fourths of the survey participants saying less competition isn't a big value add for them.Faced with ad-skipping on DVRs and some VOD offerings, ad-free competition from Netflix, and ad-light options on Hulu, the big broadcasters have had to adjust. Younger audiences in particular have grown used to watching shows on demand with few or no ads.They're showing less patience for interruptions of the sort built into the traditional network schedule, where as many as 16 minutes in an hour may be devoted to ads and promotions (i.e., in-house ads).NBC, Fox and others have noisily proclaimed that they will significantly reduce the ad loads on top shows such as Saturday Night Live and Family Guy. In one Family Guy episode this spring, the show ran uninterrupted, with 60-second Sony PlayStation ads for the new God of War game at each end.Such options may make network shows more palatable for younger audiences. And any general survey question like this one from Advertiser Perceptions could easily be left behind when the brass-tack realities of deal-making during and after Upfronts is finally concluded for the networks.But the survey does suggest that most brands find no more than modest value in a lighter ad load. If they won't pony up significantly more money for those reduced inventories, the networks will need to figure out more strategies to compete and still thrive in the current transition.Networks already have been touting their premium programming, brand safety – a pointed reminder of the many problems with advertising on YouTube and Facebook the past couple of years – and their increasing ability to do multi-platform sales. Perhaps those pitches will be enough to move the year's ad bounty upward again.

Except, if this April survey of brands from Advertiser Perceptions is any guide, most advertisers aren't exactly excited about paying a lot more for the privilege of being only one of, say, two or four brands on display in an hour-long show.Almost two in five (38 percent) said they wouldn't be willing to pay any premium to run their ads in shows with fewer commercials. Another 11 percent would pay only as much 5 percent more for the privilege of less competition for viewer attention.Throw in the 28 percent who'd cap a premium at a 10 percent bump and you have more than three-fourths of the survey participants saying less competition isn't a big value add for them.Faced with ad-skipping on DVRs and some VOD offerings, ad-free competition from Netflix, and ad-light options on Hulu, the big broadcasters have had to adjust. Younger audiences in particular have grown used to watching shows on demand with few or no ads.They're showing less patience for interruptions of the sort built into the traditional network schedule, where as many as 16 minutes in an hour may be devoted to ads and promotions (i.e., in-house ads).NBC, Fox and others have noisily proclaimed that they will significantly reduce the ad loads on top shows such as Saturday Night Live and Family Guy. In one Family Guy episode this spring, the show ran uninterrupted, with 60-second Sony PlayStation ads for the new God of War game at each end.Such options may make network shows more palatable for younger audiences. And any general survey question like this one from Advertiser Perceptions could easily be left behind when the brass-tack realities of deal-making during and after Upfronts is finally concluded for the networks.But the survey does suggest that most brands find no more than modest value in a lighter ad load. If they won't pony up significantly more money for those reduced inventories, the networks will need to figure out more strategies to compete and still thrive in the current transition.Networks already have been touting their premium programming, brand safety – a pointed reminder of the many problems with advertising on YouTube and Facebook the past couple of years – and their increasing ability to do multi-platform sales. Perhaps those pitches will be enough to move the year's ad bounty upward again.