FAST Forward: How Regional Focus Could Change Sports Media

Premium SVODs are focused first and foremost on national and global consumer interests. Streamers such as Netflix and Amazon Prime Video want to attract the largest possible customer base with programming that resonates worldwide. Yet, in stark contrast, FAST boasts a growing focus on regionality. It is this divergence that positions FAST to potentially play a small but important role in the future of sports distribution.

First, let’s underscore FAST’s increasing eye towards local programming, which ties directly into regional sports fandom in the US.

As of July 2022, there are nearly 200 local news TV stations with FAST channels, per Variety. Some major examples include the Byron Allen-owned Local Now, which focuses on localized news, weather, sports, traffic and entertainment in more than 225 markets across the US. Local Now has signed deals with PBS for live feeds of PBS member stations in more than 300 markets in addition to 27 local news channels from Hearst Television’s Very Local. In 2022, Roku signed a deal to bring NBC local news channels via The Roku Channel across several US markets.

Srinivasan KA, co-founder and CRO of FAST tech vendor Amagi, has even said in recent years that “We’reseeing almost a third of viewership on FAST come from news in general, and local news is a big part of that.” In this way, FAST is more similar to linear television, especially for major American markets such as New York, Boston, Atlanta, etc. As major sports broadcast rights continue to migrate to major SVOD platforms, fan development may be impacted as the focus is not on serving a hyper local audience but populating the top performing content. How will that help small market teams in the future?

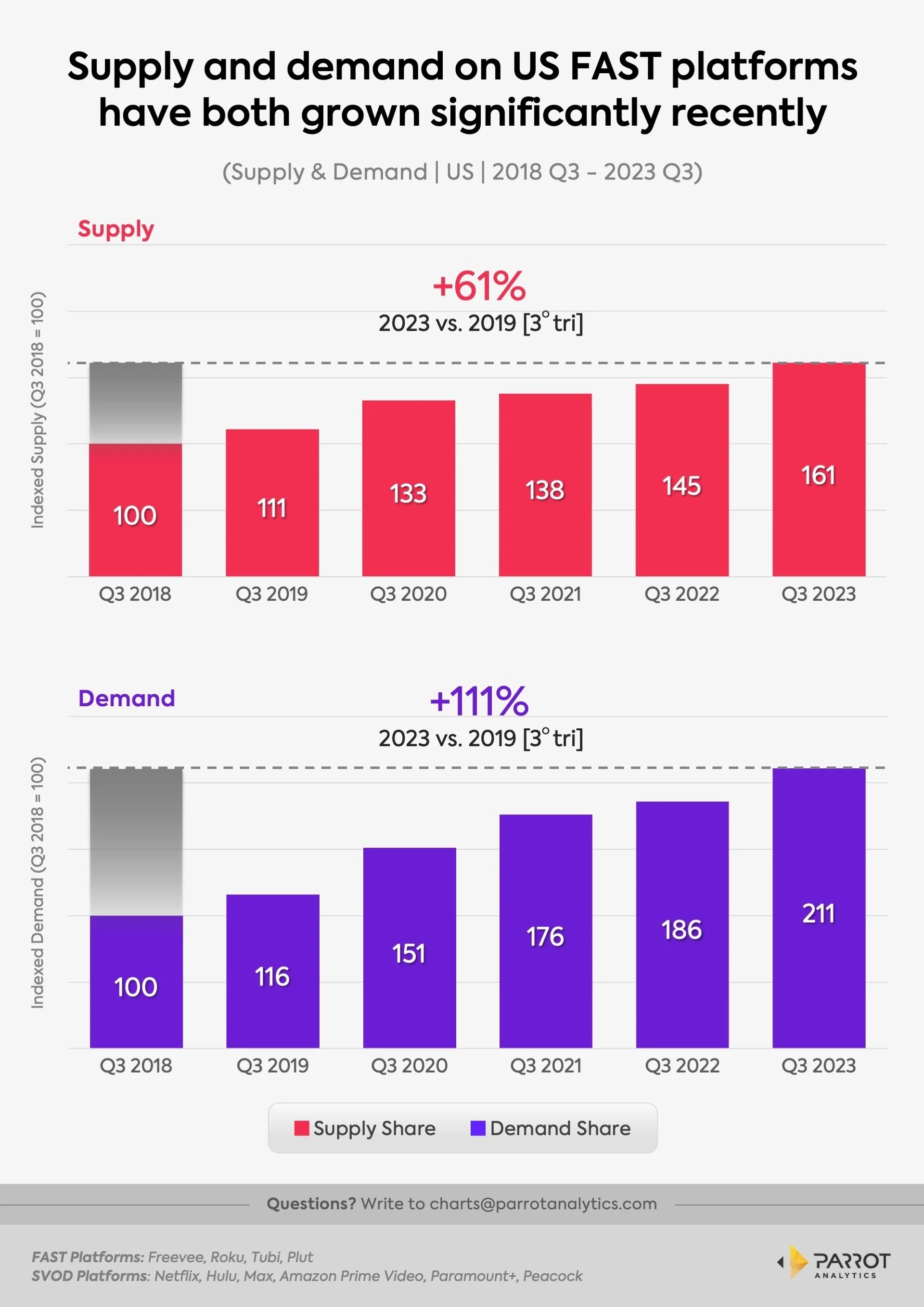

As we all know, FAST is growing quickly. Both the supply (+ 61%) and demand (+ 111%) for content available on FAST platforms in the US have experienced significant growth from Q3 2018 to Q3 2023, according to Parrot Analytics. The Big Four services — Pluto TV (78.5 million), Roku (73.5 million), Freevee (65 million) and Tubi (64 million) — all boast impressive monthly active user bases.

Yet despite this growth, mainstream sports seem reluctant to embrace the medium. Sports accounted for just 117 distinct FAST channels as of July 2022, per Variety. At the time, there were still no NHL, NBA or NASCAR channels available on FAST. There has not been a major FAST expansion for leagues such as MLB, NFL, PGA Tour, WWE, UFC, MLS, EPL and the top four FAST platforms are not among the top six FAST platforms in terms of dedicated sports channels by volume. While some of this is due to contractual limitations, this seems like a glaring missed opportunity to generate supplemental interest.

Historically, free-to-air sports broadcasts have been key to growing overall awareness of sports and attracting and developing new fans. Niche sports channels don’t require expensive media rights and can reach profitability faster with a smaller audience, creating a clear value bridge with FAST. Mainstream sports won’t abandon the broad reach of linear or major SVODs, yet can increasingly insist on simulcasting or re-run strategies that cast wide nets. Plus, Reality and Documentary are among the most in-demand genres on FAST, per Parrot, which can be used to further highlight sports-adjacent programming that promotes various leagues and players.

All leagues, whether firmly established or new sports, want to target young and diverse audiences, which is partially what FAST provides in addition to serving as a natural transition point for Gen X+ viewers leaving linear. To wit, 36% of Tubi’s viewers are in the key younger demo of 18-34. Additionally, the service reaches an increasingly multicultural audience with more than 50% growth year-over-year in African American and LGBTQ+ audiences, and 25% in the Hispanic audience, as of 2023. Chicken Soup’s TV viewing is 30% African American while Hispanic audiences comprise a significant portion as well, per the company.

FAST is too small to ever disrupt sports’ transition from linear to SVOD streaming. As of 2021, traditional pay TV services earned $69.9B through advertising and another $85B through subscription revenue. Compare that with the $2.6 billion in estimated ad revenue generated by all FAST services in the US in 2021 and it’s clear that the medium cannot outright replace the lost revenue from sports that rely on RSNs. Even some longer term estimates peg FAST revenue at “only” $12 billion by 2027.

Yet the longevity of sports leagues both big and small depends on the cultivation of new fans, which can be made more difficult in a world in which the bottom has fallen out of linear TV and the largest streamers only care about content that attracts the largest possible audience. FAST’s focus on local programming is crucial to addressing this issue. Throw in the lack of notable sports penetration within the medium, genre preferences and audience demographic profiles and it’s a natural fit to provide additive value to sports distribution on top of existing strategies.