Digital Giant Amazon Elbows Deeper Into TV’s Upfront, Signaling Market Remains Vital

Every year there seems to be a debate about the value of TV’s annual upfront extravaganza as advertising becomes more data-driven and programmatically purchased.

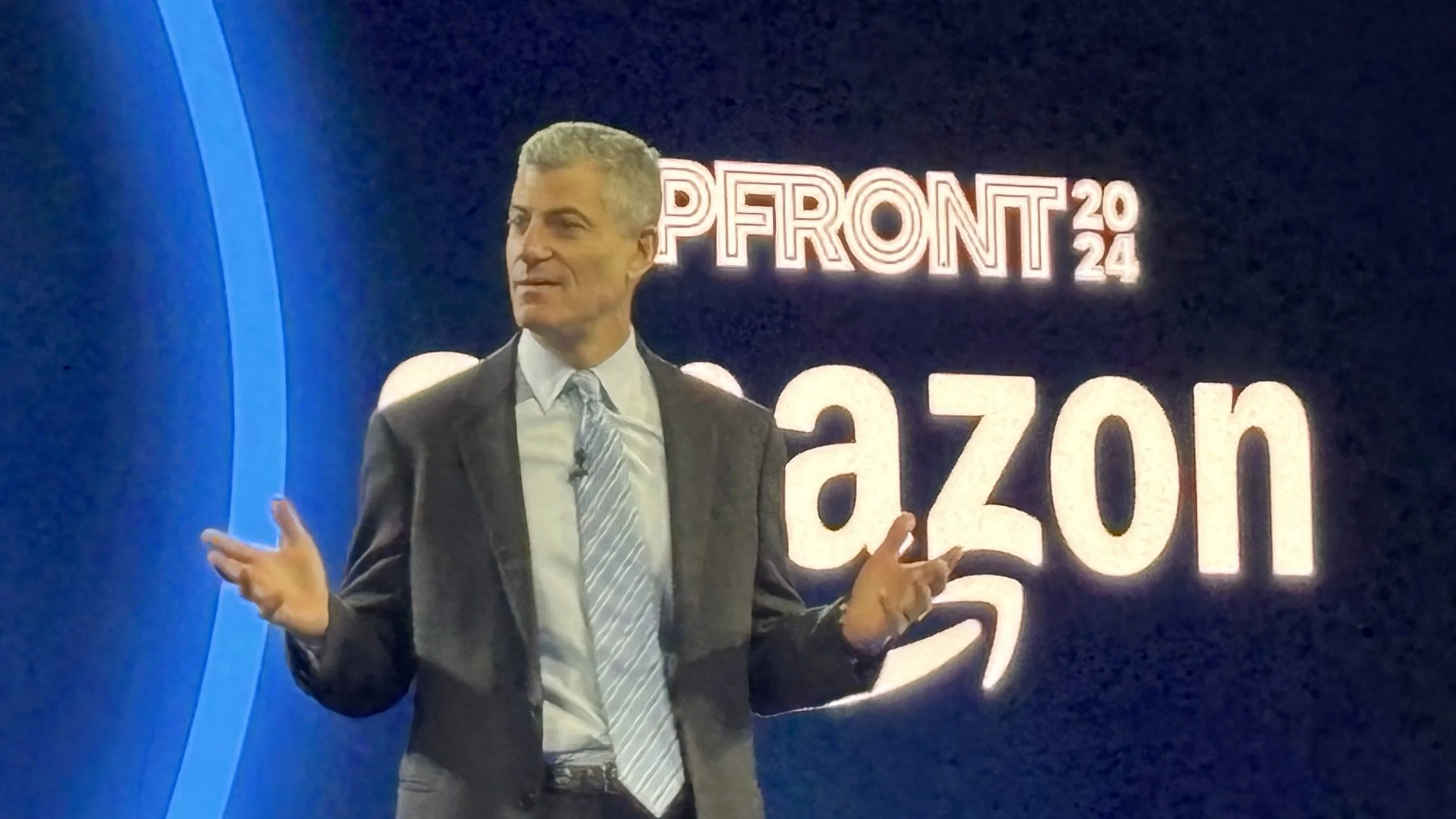

Last year’s Amazon upfront (JL photo)

Amazon last year disrupted prices in the connected TV market by serving ads to nearly all of its Prime Video subscribers, flooding the market with additional inventory. This year it is planting its flag firmly in broadcast upfront week, announcing it would be holding a presentation on Monday, May 12 at 6:30 p.m. at the Beacon Theater in New York.

A couple of years ago, Paramount Global decided to stop spending millions on CBS’s annual production at Carnegie Hall on Wednesday of upfront week, opting instead for a more intimate meeting with top buyers and advertisers. Netflix – a newcomer to the ad business – quickly swooped in, claiming the time slot.

Amazon’s event will put a squeeze on Fox’s Monday afternoon event, as well as Telemundo’s annual musical performance Monday night. That will make logistics for buyers and advertisers a bit trickier, but that’s not the big story.

The big story is that no company has better data about what consumers are buying or more advanced ad tech than Amazon. Despite that edge in advanced advertising, the company has decided that to get TV’s big bucks, the upfront market is still the place to be.

Amazon held an upfront event last year on Tuesday morning at out-of-the-way Pier 36 in lower Manhattan. The event was star studded, with Alicia Keys, Reese Witherspoon, Will Ferrell and Jake Gyllenhaal appearing on stage. There was also a celebration of football, with Amazon’s Thursday Night Football and a second Black Friday NFL game on the schedule.

It must have worked, because Amazon is back for more upfront action.

“We’ve received positive feedback from agencies and brands leading to strong demand following our first upfront with Prime Video ads,” said Alan Moss, VP of Global Ad Sales at Amazon, in a statement. “Advertisers are leaning into our comprehensive offering of full-funnel advertising solutions. We’re connecting campaign tactics across awareness, consideration, and conversion into a cohesive strategy to directly measure the contribution of each tactic and enable on-going business growth.”

Amazon’s move is the latest milestone as digital companies try to entice traditional advertisers. Both Amazon and Netflix have gotten into the sports business, the heart of the traditional advertising business. Meanwhile, legacy media companies tout technology to keep revenues from receding.

As Amazon and Netflix dive into audience grabbing live events, NBCUniversal – which is spinning off its cable networks – announced that its streaming service Peacock also has live events and is launching a “Live in Browse” feature that is intended to highlight that programming on its home page and give marketers another place to highlight sponsorships.

Getting set to celebrate its 100th year, NBCU also announced that Pause Ads will be available in live events (NBCU says Pause Ads on Peacock boost in-site visitation for brands by 43% and generate 43% higher memorability than standard spots). It is also updating its Super Bowl ad model (NBC has next year’s game), enabling advertisers to leverage three times more data points than in 2018.

“NBCUniversal has long been a leader in innovative storytelling and advertising technology. Our One Platform ecosystem has maximized our marketers’ reach and scale over the past five years to prove TV is a performance vehicle in a way no other product in the marketplace has,” said Mark Marshall, chairman, global advertising & partnerships at NBCU. “Now, as we head into our next century, we are kicking off a slate of unrivaled content combined with cutting-edge technology and exceptional end-to-end advertising solutions that will drive demand in new ways and provide long-term viability for our clients.”

The war for the future of advertising will continue to be waged between the traditional media companies and the digital giants. And the upfront will remain a key battleground.