Getting Past The Urge To Merge: Can Yango Play Show Hollyood The Way?

Hollywood, much like professional sports, is a copycat business. At the mere sight of modest success, strategies will rapidly be imitated and recreated industry wide. But the issue with creating such a feedback loop by incessantly borrowing from one another is that it dulls creative problem solving.

In this moment of entertainment media contraction, consolidation has become the popular countermeasure to face the compounding challenges of today. Paramount Global, in particular, appears to be the most significant company readily available on the open market. On paper, the oft-rumored combination of Paramount and Comcast’s NBCUniversal would seemingly create a Hollywood heavyweight capable of domination. But perhaps the industry needs to stop thinking in terms of size and start thinking in terms of agility.

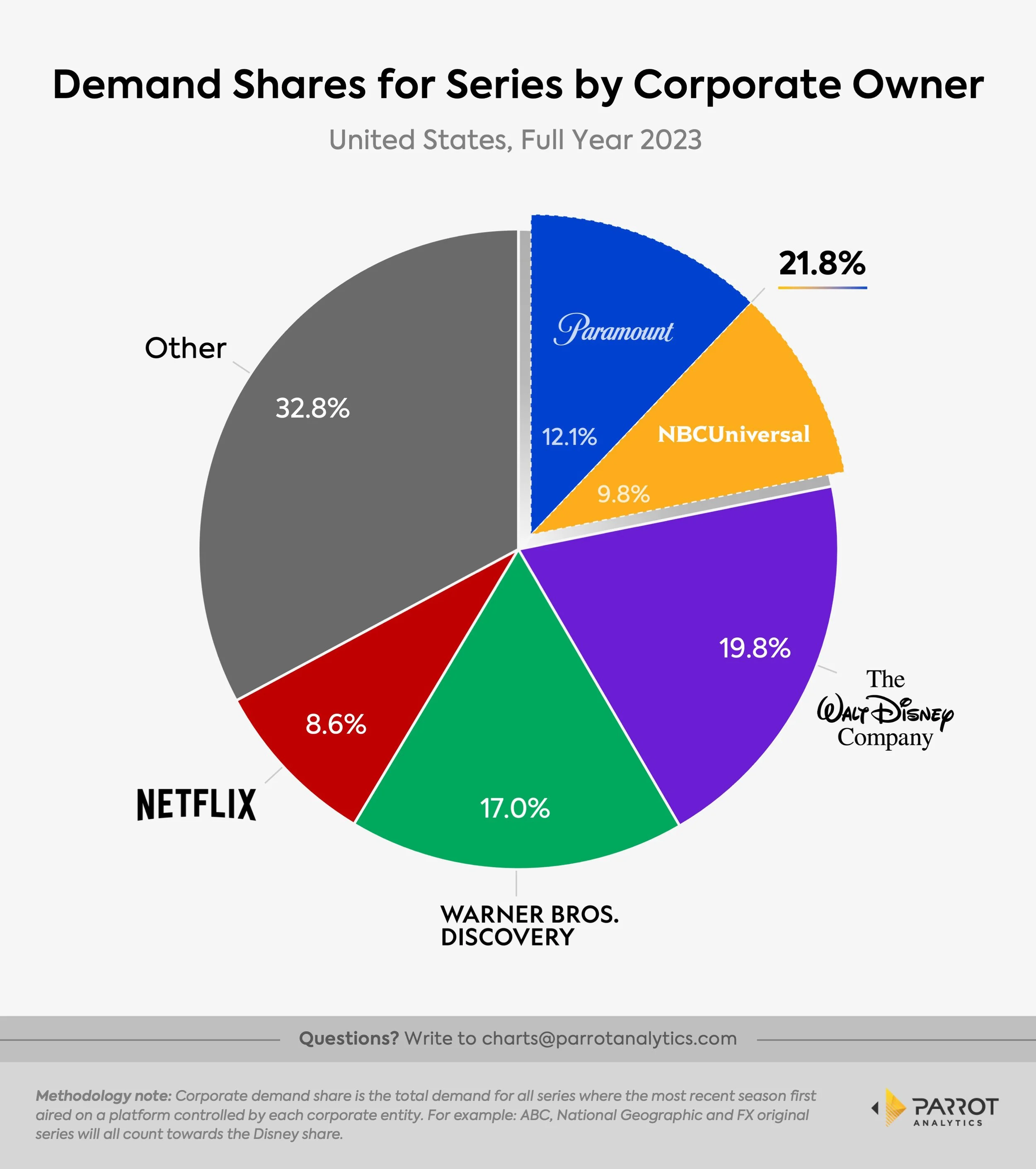

Corporate demand share assesses the long-term viability of the top media companies as they look to consolidate their original content’s availability exclusively onto their platforms, and can effectively help value a conglomerate’s legacy and library content in aggregate as the licensing market is re-opened after years of in-house consolidation.

A Paramount-NBCU merger would position the combined entity as the leader in the U.S. market's corporate demand share with a 21.8% share, surpassing Disney in 2023. This formidable library would merge Paramount’s beloved franchises, such as Star Trek and Yellowstone’s creator Taylor Sheridan’s prolific roster with NBCU’s highly sought-after sitcoms and procedural dramas, including The Office and Law and Order. There is no doubt an attractive collection of assets and strategic synergies to be had.

And yet, raw scale for the sake of scale has not solved many problems in recent years.

AT&T punted on Time Warner after just a few years (and at a significant loss). The combination of Discovery+ and HBO Max, on top of aggressive cost-cutting, has helped turn a modest direct-to-consumer profit but has not reignited subscriber growth or tackled the combined company’s debt issues. WBD is expected to make yet another M&A move to help its cause. Disney wound up overpaying for 20th Century Fox and has been hampered ever since. Now, the Mouse House is hoping a combo of Disney+ and Hulu can help ameliorate growing issues elsewhere. Comcast’s acquisition of Sky, made after missing out on Fox, has not amounted to much.

As such macro transactions continue to take center stage, I continue to be intrigued by smaller moves that could potentially serve as a template for future strategy. Recently, Yango Play launched in the MENA region with an ambitious collection of media experiences: a mix of both Hollywood and local market TV shows and films, music streams, curated music lists, mobile games, etc. Perhaps most compelling is the gamefied app function Yango City that rewards users for activity and usage across its verticals.

Yango Play is an attempt to consolidate multiple consumer media needs and provide incentive to varied usage, ultimately solving for a collection of audience pain points. This creates a socialized community with friendly competition and exchange, pushing media consumption from a passive medium to a more active one by providing subscribers with a sense of direct control and ownership. In doing so, it also trains subscribers to engage with the platform more frequently.

Should Yango Play succeed, there’s an argument to be made that global media consolidation should focus less on the combination of costly premium entertainment libraries (which did not prevent rising churn in 2023) and more on the strategic coupling of unique but complementary media activities and services.

It’s not that audiences always want more, it’s that consumers are much more satisfied with better.