Gen Z Rules Streaming, But Is The Industry Ignoring Everyone Else?

Is the television industry overlooking a significant audience segment? While shows targeting Millennials and Gen X continue to perform well, the data suggests a clear shift in viewer preference, particularly among younger demographics.

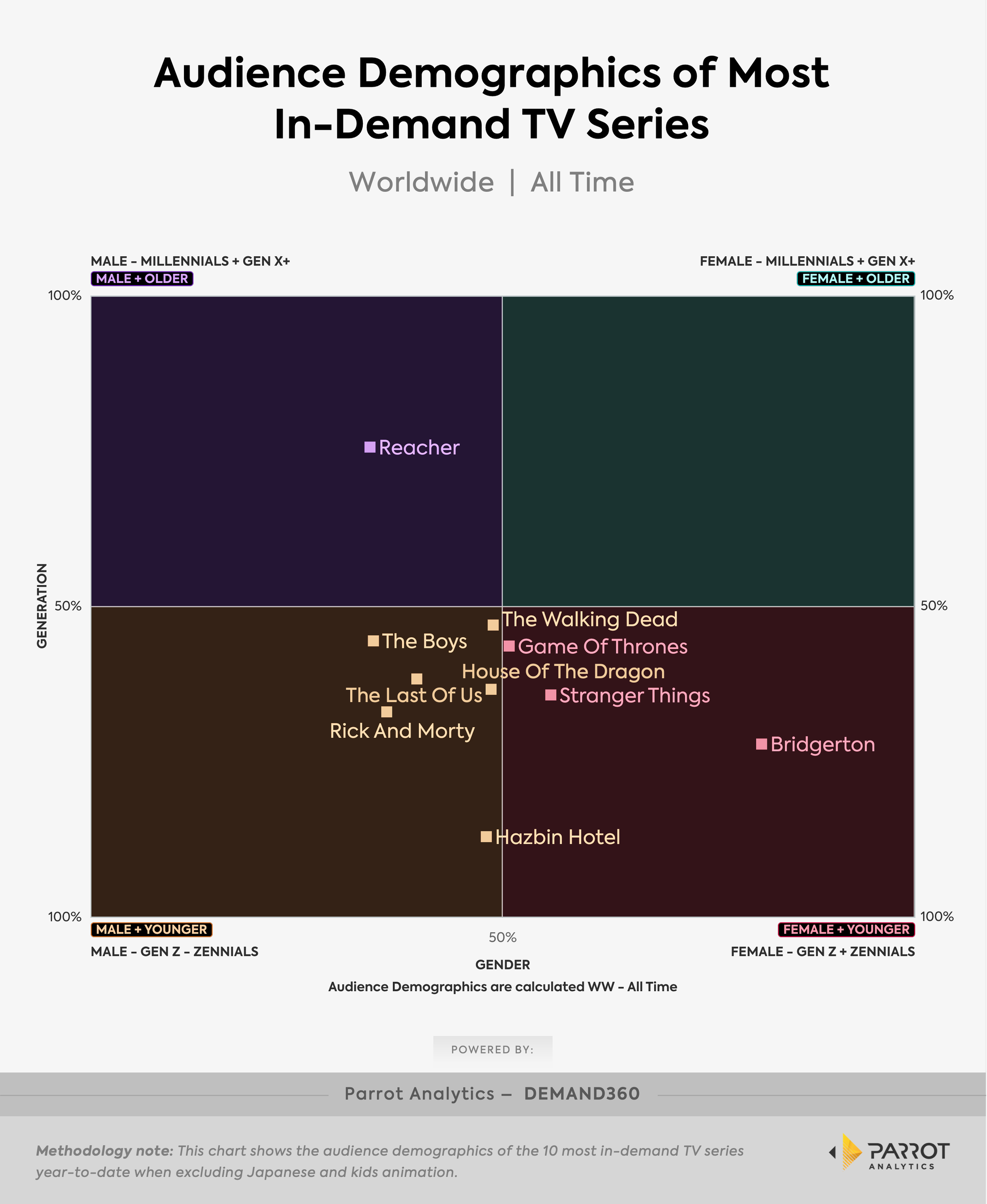

According to Parrot Analytics, nine of the ten most in-demand TV shows worldwide (excluding Japanese and kids animation) from January 1 to August 8 primarily appealed to Gen Z and Zennial audiences (15-31). The only top 10 series that resonated more with slightly older audiences in the Millennial and Gen X+ range (32-42+) was Amazon Prime Video’s Reacher. Within this top 10, seven series resonated most with male viewers with just three trending more female overall. Not a single Top 10 series over-indexed with Millennial/Gen X+ female viewers.

Yet older and more female-skewing shows such as Breaking Bad, The Big Bang Theory, Young Sheldon, The Simpsons, Family Guy, Succession, Yellowstone, Modern Family, Grey's Anatomy and others all appeared among the 40 most in-demand TV shows during this stretch. This indicates that there’s still substantial audience for other demographics. But if that is the case, why aren’t shows tailored to these viewers breaking into the top tier?

The 10 most in-demand series year-to-date helps to provide a brief glimpse into the worldwide general audience preference. What we see is a clear desire for genre series, or shows that can be classified as science-fiction (The Walking Dead, The Last Of Us, Rick and Morty, Stranger Things), fantasy (Hazbin Hotel, Game of Thrones, House of the Dragon), superhero (The Boys), and historical romance (Bridgerton). Reacher is the only show of the bunch without a splashy hook (though we understand the base appeal of “extremely large guy kicks a lot of ass”).

Historically, genre entertainment skews more male — and recently younger — though efforts such as Netflix’s original fantasy film Damsel and Apple TV+’s sci-fi series Silo suggest a potential for broadening the appeal of these formats. The former, which tilts far more female (56%), has become Netflix’s seventh most-watched English movie ever while the latter, which counts nearly 70% of its audience in the Millennial-Gen X+ age ranges, will debut a second season in November. (Overall, it’s clear that linear series are more effective at reaching older female viewers overall while streaming is naturally a bridge to younger audiences).

This general demographic imbalance has significant implications for both subscription and advertising streaming models. Streamers need to balance audience acquisition and retention while maximizing ad revenue. A more evenly distributed viewership would improve the efficiency of programming budgets and allow for more precise targeted advertising.

While Netflix's ad-supported tier struggles to gain traction, Amazon and Hulu have found more advertising success by offering a broader range of content appealing to a wider demographic.

The industry must carefully analyze viewership data to identify opportunities for growth. By understanding the evolving preferences of different age groups and genders, networks and streamers can develop programming strategies that resonate with a broader audience and drive long-term success.