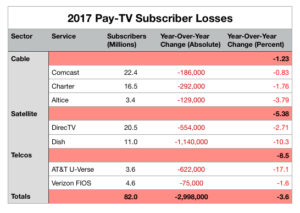

Cord Cutting Made 2017 Pay TV's "Worst-Ever" Year Amid 3.65-Percent Drop

Traditional Pay-TV providers lost an estimated 3.5 million subscribers in 2017, according to analysts nScreenMedia. The analysts called it the worst year of cord cutting ever for the industry.2018 is likely to be even "worse", amid aggressive pricing from digital competitors and the arrival of new distribution platforms. In all, the seven largest traditional providers – Comcast, Charter, Altice, DirecTV, Dish, AT&T U-Verse and Verizon FIOS – lost a combined 2 million subscribers, or 3.65 percent of their customers, in 2017, nScreen said. Projecting that across the entire industry – the big seven represent about 85 percent of the market – works out to about 3.5 million cord cutters last year.The declines were biggest with Dish Network and AT&T's U-Verse service, which both had double-digit drops in their subscriber bases.The U-Verse decline is partly because AT&T is trying to move its subscribers onto either its DirecTV satellite service or its virtual MVPD, DirecTV Now.Dish has a bigger problem. It was always the bargain-basement alternative in the Pay TV world. Now, its own cut-rate vMVPD, Sling TV, leads the pack of online "skinny bundles" in price disruption and its price-sensitive satellite customers are bargain hunting for alternatives.Sling saw its subscriber base rise by 700,000, nScreen said, but that can't be much comfort to even Dish, given that all the vMVPDs are operating at break-even or less pricing to build market share. In fact, it's possible Dish loses more money each time someone switches to Sling.It's no surprise, amid all the cord cutting and bargain hunting, that maverick Chairman Charlie Ergen, who just stepped down as CEO after Dish stock lost 13 percent of its value last year, reportedly is considering other options for the satellite provider's prodigious bandwidth.nScreen predicted cord cutting may be even worse in 2018, as vMVPDs continue their aggressive pricing to grab for vMVPDs. That market pressure could lead to another decline of as much as 5 percent in 2018.Further adding to the challenges, new delivery platforms are rolling out this year that could provide aggressive new competition and further add to the declines.On the mobile side, ultra-high-speed 5G services are expected to arrive in at least some cities before the end of the year (AT&T has already named Dallas and Waco, Texas, and Atlanta as its first of 12 initial 5G cities). Qualcomm has announced dozens of equipment and handset partners using its chips for wireless modems, phones, and other devices with speeds up to 5 gigabits.Meanwhile, the official voluntary rollout of Next Gen TV, the marketing moniker for the ATSC 3.0 standard, were officially blessed this week by the Federal Communications Commission. Next Gen technologies, already in place in South Korea, promise to give local broadcasters a way to deliver additional over-the-air digital video channels, programmatic advertising, and other interactivity without needing help from a pay-TV box.Elon Musk is also backing an initiative to launch a projected 12,000 small satellites in low-earth orbit to beam high-speed Internet and communications services across the globe. The first two of those satellites were launched recently.The cord cutting declines have implications for several industry sectors beyond the pay-TV providers, beginning with the media companies that own smaller basic-tier video channels.Many of those channels were created in cable's growth heyday of the 1990s, but now don't have the resources to draw significant viewership through stand-alone SVOD channels or to find a place on skinny bundles. Also facing a complicated future are the consumer-focused brands that rely on TV advertising and the media-buying and ad-creation ecosystems that service them.

Projecting that across the entire industry – the big seven represent about 85 percent of the market – works out to about 3.5 million cord cutters last year.The declines were biggest with Dish Network and AT&T's U-Verse service, which both had double-digit drops in their subscriber bases.The U-Verse decline is partly because AT&T is trying to move its subscribers onto either its DirecTV satellite service or its virtual MVPD, DirecTV Now.Dish has a bigger problem. It was always the bargain-basement alternative in the Pay TV world. Now, its own cut-rate vMVPD, Sling TV, leads the pack of online "skinny bundles" in price disruption and its price-sensitive satellite customers are bargain hunting for alternatives.Sling saw its subscriber base rise by 700,000, nScreen said, but that can't be much comfort to even Dish, given that all the vMVPDs are operating at break-even or less pricing to build market share. In fact, it's possible Dish loses more money each time someone switches to Sling.It's no surprise, amid all the cord cutting and bargain hunting, that maverick Chairman Charlie Ergen, who just stepped down as CEO after Dish stock lost 13 percent of its value last year, reportedly is considering other options for the satellite provider's prodigious bandwidth.nScreen predicted cord cutting may be even worse in 2018, as vMVPDs continue their aggressive pricing to grab for vMVPDs. That market pressure could lead to another decline of as much as 5 percent in 2018.Further adding to the challenges, new delivery platforms are rolling out this year that could provide aggressive new competition and further add to the declines.On the mobile side, ultra-high-speed 5G services are expected to arrive in at least some cities before the end of the year (AT&T has already named Dallas and Waco, Texas, and Atlanta as its first of 12 initial 5G cities). Qualcomm has announced dozens of equipment and handset partners using its chips for wireless modems, phones, and other devices with speeds up to 5 gigabits.Meanwhile, the official voluntary rollout of Next Gen TV, the marketing moniker for the ATSC 3.0 standard, were officially blessed this week by the Federal Communications Commission. Next Gen technologies, already in place in South Korea, promise to give local broadcasters a way to deliver additional over-the-air digital video channels, programmatic advertising, and other interactivity without needing help from a pay-TV box.Elon Musk is also backing an initiative to launch a projected 12,000 small satellites in low-earth orbit to beam high-speed Internet and communications services across the globe. The first two of those satellites were launched recently.The cord cutting declines have implications for several industry sectors beyond the pay-TV providers, beginning with the media companies that own smaller basic-tier video channels.Many of those channels were created in cable's growth heyday of the 1990s, but now don't have the resources to draw significant viewership through stand-alone SVOD channels or to find a place on skinny bundles. Also facing a complicated future are the consumer-focused brands that rely on TV advertising and the media-buying and ad-creation ecosystems that service them.