Netflix Earnings Hikes/Cuts Highlight Uncertainty Over Subscriber Growth

Netflix pulled a clever one late Friday, raising prices in its most lucrative market just as everyone was heading out for a three-day weekend.

With the stock market (and Netflix shares) plummeting just as the company is about to announce Q4 earnings amid uncertainty about its continued growth, the next part could get interesting.

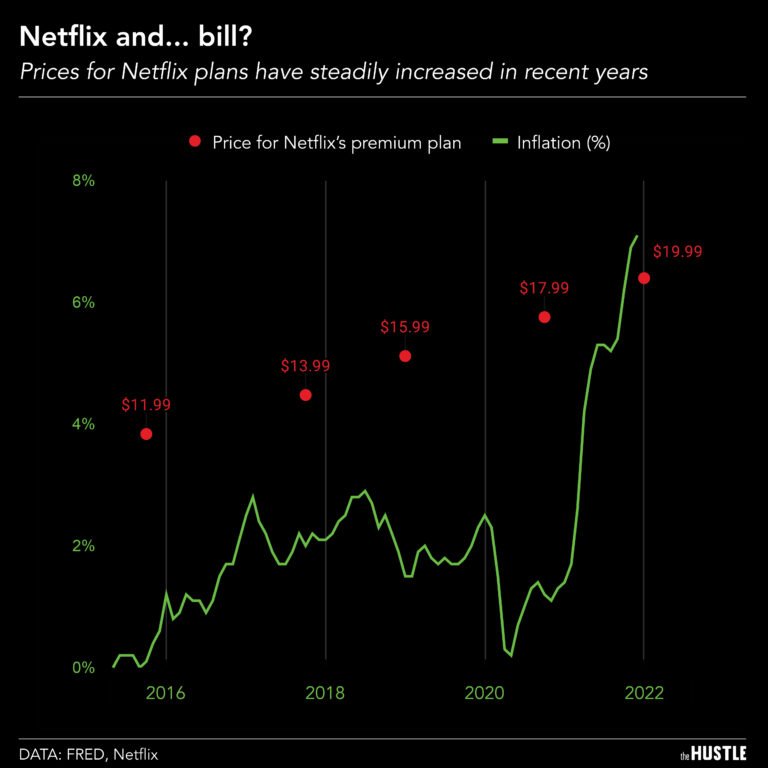

The hikes in the home U.S. and Canada markets were substantial — $1 to $2 a month across most of its plans — increasing to $19.99 a month on the high-end offering that includes 4 streams of 4K-resolution video. That’s well above what the next most-expensive service (the ad-free version of HBO Max at $14.99) is charging. The basic single SD-resolution Netflix stream is now 8.99, also more than just about all competitors at the bottom end.

An analysis by TheHustle.com suggested the rate increases didn’t outstrip inflation by much, after hikes in 2015, 2017, 2019, and 2020 collectively took the most expensive monthly plan’s cost from $11.99 to $17.99. That’s a jump of 50% over a five-year stretch when annual inflation rarely topped 2%.

But then again, inflation now is at 40–year highs (7%) amid supply constraints, a tight labor market, and the continued distortions of the pandemic’s latest surge. Another $2 for many people’s chief entertainment resource probably isn’t going to daunt too many customers.

And that’s what Netflix is betting on.

It raised prices because it can. The latest hike should generate around $1.3 billion, handy additional cash to finance its billions of dollars in content designed to appeal to a wide range of audiences scattered across more than 190 territories.

In 2021, that spending paid off with some of the service’s all-time hits, including series such as Squid Game, Cobra Kai, The Witcher and Emily in Paris, and movies such as Don’t Look Up, Red Notice, The Unforgivable, and The Lost Daughter.

Most of those arrived in or just before Q4, part of a cavalcade of more than 190 series and feature-length projects in the quarter. Beyond those heavily watched shows, Q4 also included some high-quality Oscar bait, such as Jane Campion’s The Power of the Dog, which has already collared a Netflix-record 21 best picture wins from various organizations, as well as tick, tick…Boom!, The Hand of God, Passing, and The Harder They Fall.

Notably, the U.S. price hike comes just a couple of weeks after it strategically cut prices in India, its most promising overseas growth opportunity, but also an increasingly competitive market. The most intriguing move was to cut its basic in-home plan to 199 rupees per month (about US$2.68), barely more than Netflix’s bare-bones mobile-only option.

That could position Netflix to cash in as that country’s vast and emerging middle class (already larger than the entire U.S. population) spends more on in-home entertainment and the hardware to watch them.

“Huge potential markets like India remain in their infancy,” LightShed Partners wrote in its year-ahead tech/media/telecom predictions last week, “with Netflix having recently meaningfully reduced price (albeit a more precise analysis of India reveals that they are really trying to push mobile-only subscribers toward TV-based plans, likely because they know once you start consuming Netflix on the big screen that your engagement surges and churn is greatly reduced).”

Netflix is promising plenty more high-profile shows in 2022, as its pandemic-clogged pipeline continues to unstick.

Accordingly, during Thursday’s earnings call, you can expect CFO Spence Neumann or COO/Chief Product Officer Greg Peters, or perhaps one of the other execs to invoke the company’s standard mantra after a price hike, something along the lines of “from time to time, we go back to our customers and ask them for a small price hike to finance more content, which creates a virtuous cycle that leads to more programming and more customer satisfaction.”

But the execs will make those comments amid a so-far ugly start to the new year for Netflix and other high-flying tech stocks.

Netflix share prices topped $690 several times in November but have drooped 15% since. After a brief bump to $525 Friday afternoon after the hike announcement, Netflix shares joined most of the rest of a miserable market selloff this week, ending at $510.80 Tuesday afternoon.

Contributing to the challenges with Netflix’s share prices is uncertainty among many of the analysts who track the stock about whether it can meet its own guidance on Q4 subscription adds, some 8.5 million. Compounding their uncertainty is an increased disconnect between actual results and many of the third-party indicators such as mobile app downloads.

So in advance of Thursday’s earnings call, here’s a rundown of various analyst comments to help you keep track of the bigger questions, themes, and challenges to watch for…

Barclays analyst Kannan Venkateshwar:

“Historical correlations between commonly used intra-quarter subscriber data for Netflix, such as app downloads and active users to predict Netflix subs, may be becoming less useful” in projecting subscriber growth. Overall, we find that no single model is accurate enough to be useful.”

Credit Suisse analyst Doug Mitchelson:

Titled his preview “Buckling up for fourth-quarter results,” citing weak investor interest amid a broader market downturn. That said, Mitchelson maintained his “outperform” rating and a price target of $740.

Guggenheim’s Michael Morris

“Investor focus remains acutely on member growth fourth-quarter actual (we estimate 8.5 million adds) and first-quarter 2022 guidance (we forecast 6.1 million).” Morris still includes Netflix among his “best idea” stock picks.

J.P. Morgan’s Doug Anmuth

Maintains an “overweight” rating, but cut his price target by $25 to $725, and projects only 5.5 million net adds next month, down 1 million from previous prognostications.

MoffettNathanson’s Michael Nathanson

“While Don’t Look Up is the title of Netflix’s latest blockbuster film release, we think [baseball player] Satchel Paige’s quote ‘Don’t look back, something might be gaining on you’ is probably a more apt phrase to use right now when looking at the U.S. streaming market.”

He cut his subscriber forecast from 9.6 million to 8.6 million, and suggested that Peacock and Paramount Plus are both likely to exceed Netflix net adds in the United States. Nathanson also cut his price target slightly, to $460, and maintained a neutral rating.

LightShed Partners

LightShed pointed to a star-laden Q4, with more hit shows on the way, like the second season of breakout Bridgerton and the first series directly from mega-producer Shonda Rhimes.

“The content cycle was simply too good, starting with the blockbuster performance of Squid Game late in Q3 2021 (heaviest new content slate in Netflix’s history in Q4 2021).”

LightShed also predicted another couple of quarters of “very easy comps” on subscriber adds, thanks to the India price cuts, early 2021’s depressed numbers, and yet more high-profile programming. In the quarters to come, it expects Netflix to return to the substantial heights of its pre-pandemic growth.

“In 2016-2019, Netflix’s annual global subscriber additions were 24 million per year. We expect 2022 to normalize with the content surge and India price cut helping drive subscriber additions back toward the mid-20 million range, implying Netflix could end 2022 approaching a quarter billion subscribers.”

All told, it should be an interesting — and well-covered — call. Stay tuned.