Is Netflix The New Cable?

In a July 6 Wired article titled “Is Netflix Losing Its Cool?,” Katie Knibbs refers to Netflix as “the Kleenex of streaming.” She goes on to explain that while the streamer is “so dominant it can stand for the whole of the market,” she feels the service “no longer shines,” has “too much filler and not enough appointment television,” and is facing, for the first time, real competition from the likes of HBO Max and Disney+.

No one, not even Knibbs, is arguing that Netflix is at risk of crashing and burning, or even of losing its position as the most strongly penetrated TV streaming service anytime soon. But she does suggest that Netflix is losing whatever reputation it’s had for innovative, cutting edge content: “I’d argue that Netflix may be inching ever closer to occupying the role that CBS did during the heyday of broadcast television—incredibly popular, and yet rarely considered even remotely adjacent to hip.”

We’ve seen evidence that Netflix may be losing some of its mojo in the syndicated work we conduct at Hub, with the most recent evidence in the July 2021 wave of our “Decoding the Default” research. Since 2013, this study has been tracking the platform viewers turn on first when they want to watch TV content—essentially, the TV platform they consider their “home base” for TV. Among other things, the study has consistently shown that viewers who “default” to a particular TV service are anywhere from 20 to 50 percentage points more likely to say they’d keep that service if they could only keep one. The default metric is thus an important predictor of TV service loyalty.

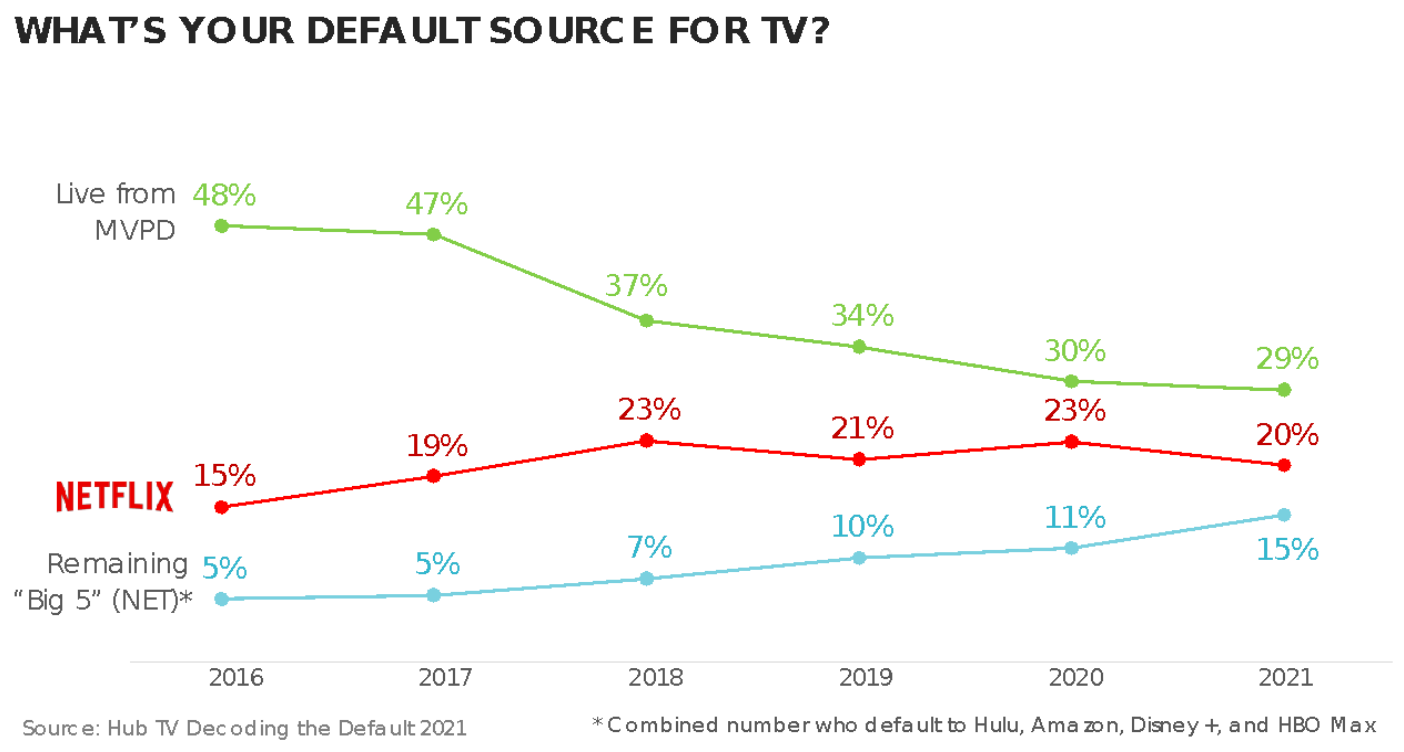

Over time, the percentage of viewers who default to a live broadcast or cable channel has been steadily declining—no surprise there, given what we know about cable TV losses and streaming gains over the past several years. At the same time, Netflix was on a steady upward trajectory as viewers’ default source and seemed on track to overtake live TV as viewers’ top default source.

But starting around 2018, Netflix began to plateau. And between 2020 and 2021, it lost 3 percentage points as viewers’ default TV service. At the same time, the other four top streaming services—Hulu, Amazon Prime Video, HBO Max, and Disney+ -- collectively gained four points as consumers’ TV home base.

What’s especially interesting is that most of Netflix’s default losses—and most of the other streamers’ net gains—come from shifts among young viewers. 31% of 18–34-year-olds say Netflix is the first source they turn to when they want to watch TV, but that’s down 8 points from just last year. On the flip side, 24% of viewers in that age group turn to one of the other four top streamers, and that’s up four points.

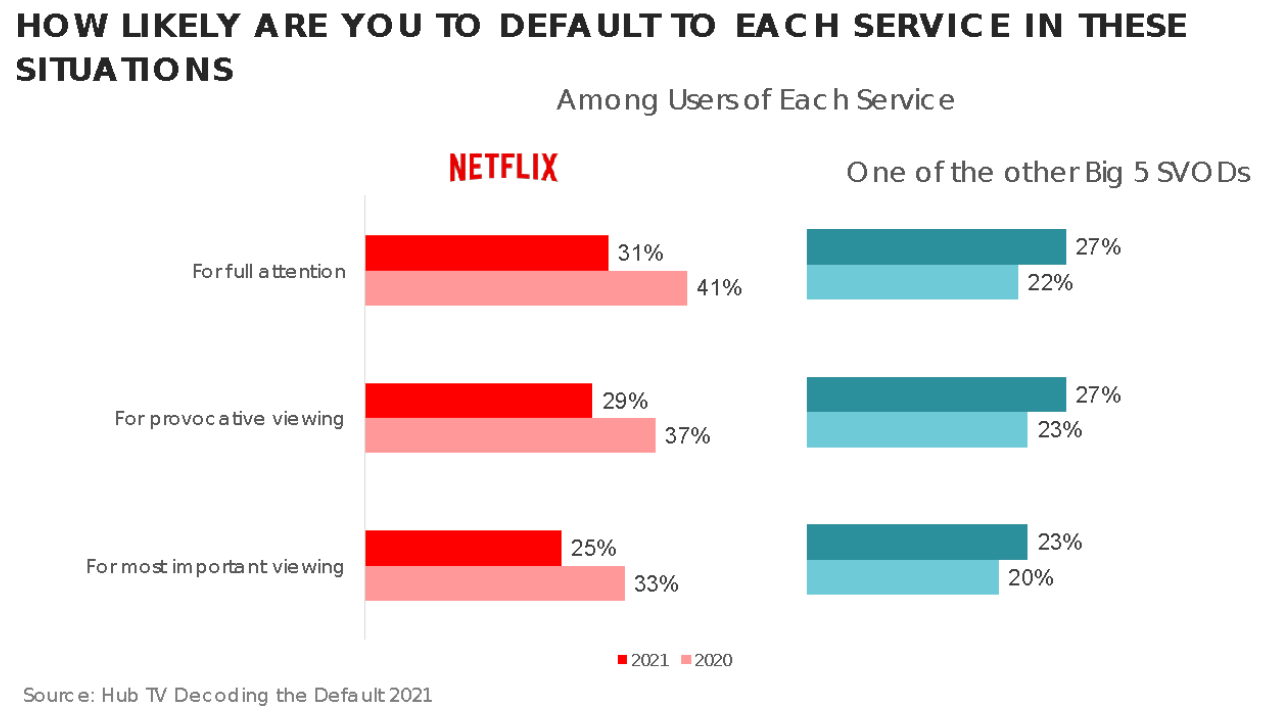

The survey evidence also suggests that consumers are turning to services other than Netflix for edgier, more cutting-edge content. Compared to 2020, Netflix viewers are anywhere from 8 to 10 points less likely to say that Netflix is their first stop for provocative content, for content that requires their full attention, and for their “most important” viewing. The other top four streamers, in combination, have gained in each of those areas.

In spite of these trends, it would be premature to suggest that it’s time for Netflix to press the panic button. Other SVODs may have gained ground on Netflix as a home base for TV viewing, but they’ve gained ground in combination: no single streamer comes close to Netflix on this measure (the top two are Amazon Prime Video and Hulu, but each is used by just 5% of TV consumers as their default TV service). Even among 18-34 year olds, where Netflix has lost the most ground, 31% still make it their TV home base; its closest rivals among that segment are Amazon (9%) and Hulu (6%)—both far behind, with Disney+ and HBO Max (4% each) even farther back.

Still, Netflix has been so dominant for so long that any sign of chinks in its armor are worth noting, especially with Disney and Warner Media both predicted to outspend Netflix on original content in 2021 and with “other-streamer” shows like Loki, Mare of Easttown, White Lotus, and WandaVision garnering the type of buzz that was once Netflix’s bread and butter. It seems unlikely that any single streaming service will overtake Netflix as a default service any time soon, but the “Kleenex of streaming”, turned to by subscribers for “less important viewing”, is probably not where Netflix wants to be, brand image-wise.