Households Are Signing Up For More Streaming Services Than Ever: The Pros & Cons

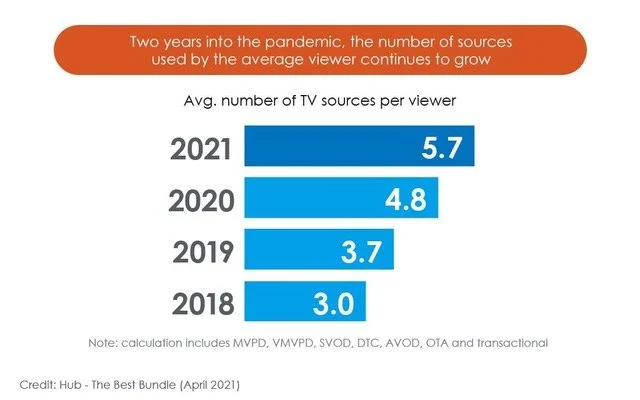

First the good news: the number of TV sources viewers are tuning into hit an all-time high of nearly six per household in 2021, more than double the level of just three years earlier.

That’s according to a viewer survey by analysts Hub Entertainment Research. Respondents said they watched TV from an average of 5.7 sources, including MVPDs, SVOD and AVOD services, broadcast, direct-to-consumer, and transactional sources.

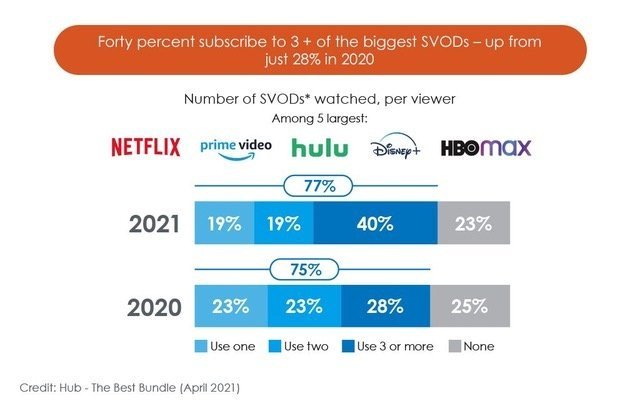

Even better news for the industry’s fastest-growing sector: 40% of those surveyed subscribe to at least three video-on-demand sources, “a huge jump” from 28% just a year before.

Driving that rise is the launch of several big new services, backed by big marketing campaigns and some compelling original series and feature-length projects, according to Hub. Also, of course, the pandemic continues to give everyone reason to stay home and watch.

Now comes the bad news: more sources makes for even more brutal competition for viewers’ time and dollars. That means a need for more compelling programming, better user experiences, and more marketing to entice consumers to sign up, watch, and stick around.

“As the TV experience evolves, SVOD ‘stacking’ has more impact than perhaps anything else,” said Hub Founder and Principal Jon Giegengack. “Viewers are excited about the vast amount of content to choose from. But they need an efficient way to manage all those platforms, which creates an opportunity for aggregators. And for those creating and marketing shows, the competition for each slice of disposable time is tighter than ever.”

Most of the big services saw subscriber additions settle down in the second half of 2021, and saw their stock prices pounded as a result when investors started looking beyond sub adds to metrics such as churn, international expansion, and market share.

Disney share prices, for instance, dropped almost 30 percent in 2021—from a 52-week high in March of nearly $202 a share to as little as $142 a share last month as investors became increasingly dismayed about slow growth for Disney Plus.

On the one hand, most of the services are committing to spending even more on programming. Wells Fargo projects that the nine biggest media and entertainment companies will spend more than $140 billion this year on content, up 10 percent from 2021, the first real year of the streaming battles. Programming spending is expected to top $172 billion for the nine services by 2025.

Disney, for instance, is expected to spend more than $30 billion on programming in 2022, including pricey sports rights and its legacy broadcast and cable TV operations. Netflix is likely to spend $19 billion, though it doesn’t have to feed any legacy or live sports outlets.

But companies also need to spend more on improving the interface and the rest of customer interactions with their services, according to a new Accenture study that found three in five streaming subscribers don’t like their viewing experiences,

Search and surfacing good content remains a headache: nearly half those surveyed said they spend at least 6 minutes looking for something to watch across all their services. And more than half wish their profile could be shared across multiple services.

No wonder Deloitte predicted last month that the SVOD industry will see 150 million subscription cancellations this year.