Crunchyroll’s Anime Empire: How Niche Streaming Thrives Amidst Consolidation

In today’s mass market media ecosystem in which major companies fear failure if they aren’t servicing the entire world, there is real value in being a big fish in a smaller pond. Such a dynamic is usually accompanied by greater flexibility, lower costs and a strong grasp of the target audience. It can work…as long as you have an idea of how to monetize the fanbase beyond just streaming. Direct-to-consumer models, especially in the entertainment industry, can’t just be one-dimensional.

Anime streaming service Crunchyroll is arguably one of the few niche services that has not only managed to stay afloat in an era of consolidation, but actually thrive. The service has done so by creatively actualizing on president Rahul Purini’s ambitions of “providing amazing experiences for our fans across their fandom, all of those touch points.” This includes streaming, events, theatrical, games, consumer products, collectibles and manga publishing. (My Film Twitter circle is already abuzz with anticipation for Crunchyroll’s panels and exclusive merchandise at next month’s New York Comic Con).

The anime audience may be smaller than, say, the worldwide appetite for procedurals and sitcoms. But that audience is loyal and passionate, which leads to low churn rates and the potential for high consumer spend.

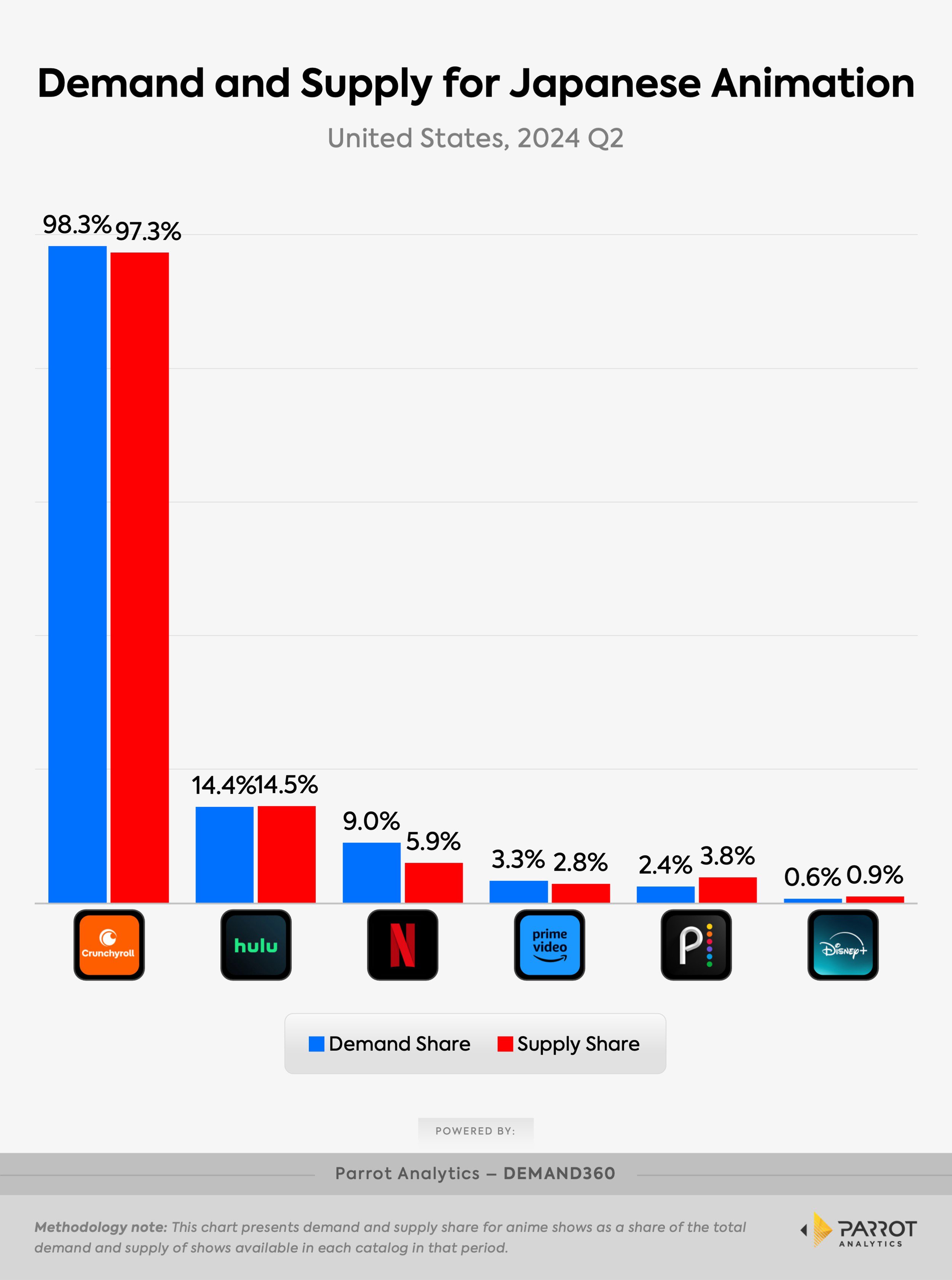

The results speak for themselves; Crunchyroll has grown from 5 million global subscribers in 2021 to 15 million as of June 2024. The company captures more than $1 billion in global customer spending. According to Parrot Analytics, the specialty service boasts significantly greater supply and demand for Japanese Animation — routinely one of the most in-demand sub-genres globally — than better-resourced rivals such as Hulu, Netflix, Amazon Prime Video, Peacock and Disney+. At a time when these services are attempting to be one-stop-shops for all manner of entertainment fans, Crunchyroll’s focus on a small but passionate sub-genre provides greater opportunity for select growth and the ability to engage with audiences in multiple ways. It’s easier to attract new customers when you’re not directly competing in the same general entertainment space.

Sony’s combination of Crunchyroll and Funimation provides the parent company with the strongest collection of anime of any major service. This has greatly helped the platform evolve its model from FAST to AVOD and SVOD and expand its money-making ambitions. Already adept at packaging unique theatrical anime events, Crunchyroll stands to benefit from Sony’s acquisition of Alamo Drafthouse, which provides the opportunity for further bundled experiences built around anime and adjacent passions. There’s a reason even Netflix began embracing live-experiences as it opens up new revenue streams and deepens consumer affinity for the brand.

Sony Electronics also boasts 900 million devices worldwide, representing further marketing and bundling opportunities to keep the service growing. Given the overlapping audience of anime and gaming, a package that includes Crunchyroll and PlayStation Plus (or even Sony Music perks) might be enticing. Now fully integrated into the parent company following its acquisition from AT&T earlier in the pandemic, Crunchyroll can leverage the full weight of Sony’s product suite to continue dominating its niche. After voluntarily opting out of the traditional Streaming Wars, Sony has now found impressive success with its own specialized flywheel at a fraction of the cost.

Similar to A24 in many ways, Crunchyroll has managed to develop a strong brand association in a specific content lane. In doing so, it has figured out how to leverage that steady passion in multiple monetizble ways that stretch beyond just a streaming app. No, it will never be as big as Netflix or Amazon, but it never needs to be. Niche with a rising commercial tide and clever product offerings can work just fine on its own.