Analyst Cuts Ad Spending Forecast, With Streaming Gaining While Broadcast And Cable Decline in 2025

Image via Canva

Amid worries about slower economic growth, influential analyst Michael Nathanson of MoffettNathanson, has joined the chorus calling for slower than expected advertising growth in 2025.

It’s going to be a tough year for traditional broadcast and cable, while ad dollars shift to streaming fueling big increases (on smaller bases) at Netflix and other newer entrants into the ad business.

Nathanson notes that 2024 was a perfect storm for the TV ad business with the election and the Olympics giving the older outlets a boost. He estimates that traditional TV ad revenues were up 4% last year. Excluding those special events, traditional ad spending dropped 4%.

Online ad spending had its best year since the pandemic, increasing 16% powered by the newer entrants into the ad business, including Netflix, Amazon Prime Video and Disney+.

In fact, 2024 was just about the best year the advertising industry has seen since 1983, Nathanson said. His more pessimistic outlook for 2025 is based on not just public consumer companies reporting softer outlooks, but also from advertising channel checks, where clients are becoming more hesitant to deploy media spend amid the growing uncertainty.

Despite those conditions, Nathanson sees streaming ad revenues holding up well in 2025, with some eye-popping numbers at some of the services. He sees Netflix ad revenues increasing 108.5% to $2.982 billion, Disney+ growing 104% to more than 1 billion, Amazon Prime Video increasing 46.5% to almost $3 billion, The Roku Channel up 29.7% to $1.5 billion and Tubi up 13.3% to $1.1 billion. Hulu will remain the leader in streaming ad revenue with $3.2 billion, up 4.1%.

Overall streaming services will increase ad revenues by 25% to $17.3 billion, Nathanson forecasts.

Source: MoffettNathanson

That streaming growth will contribute to contraction in traditional media. Broadcast network revenue is expected to be down 12.5% to $11.4 billion in 2025, or down 5.5% excluding the Olympics. Only Fox is expected to show positive ad revenue growth among the broadcast networks.

Nathanson expects cable network advertising to be $12.9 billion in 2025, down 10.5% (or 9.4% excluding the Olympics.

Total national TV ad revenues will be down 11.4% to $24.3 billion (down 7.4% ex. Olympics).

Here is Nathanson’s new forecast for 2025:

Source: MoffettNathanson

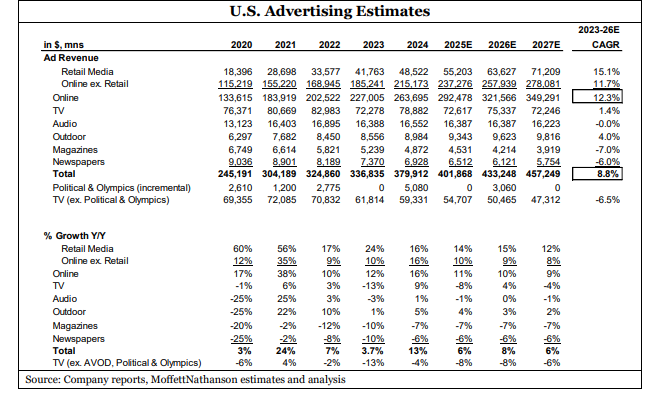

And here is his longer-term forecast:

Source: MoffettNathanson