A Car in Every Driveway, A Chicken in Every Pot, and a Streaming OS in Every TV?

Smart TVs have been sneaking up on us

Technology generates the most attention when it’s new – but the point at which it stops being new and begins being ubiquitous is both less flashy, and more important. Just as almost every cell phone sold now is a smartphone, so it is that almost every TV sold is a smart TV. You can buy one at Walmart for less than $100. From now on, smart TVs will be front-and-center in American homes by default, if not by choice.

This progression became clear this year as Hub Entertainment’s Connected Home 2021 survey revealed that smart TVs are now in 70 percent of US homes, and represent over half of reported TV sets. In fact, based on the results we can estimate that there are about 205 million smart TVs in US homes – approaching one smart TV for each of the roughly 240 million adults in the USA.

Will consumers wait in line to upgrade to the newest TV models?

The blessing of inexpensive smart TV sets running advanced software is accompanied by a curse: rapid obsolescence. TV sets used to last a decade or longer before needing to be replaced. Now the lifecycle of a TV set may more resemble that of a smartphone. After four or five years, it may lack the processing power to handle newer apps, or its operating system may be discontinued.

Do consumers really want to replace TV sets as often as their phones? The replacement cycle of high-end smartphones suggests at least some consumers might. For example, the demand to upgrade to new iPhone models is well known, and at $1,200 an iPhone 12 Pro Max costs about the same as a 65” smart TV. But consumer ambivalence to paying extra to upgrade from HD to 4K sets, until 4K became a standard feature for any larger-size set, indicates people think differently about being on the cutting edge of smartphones versus smart TVs.

There’s a new gatekeeper in town

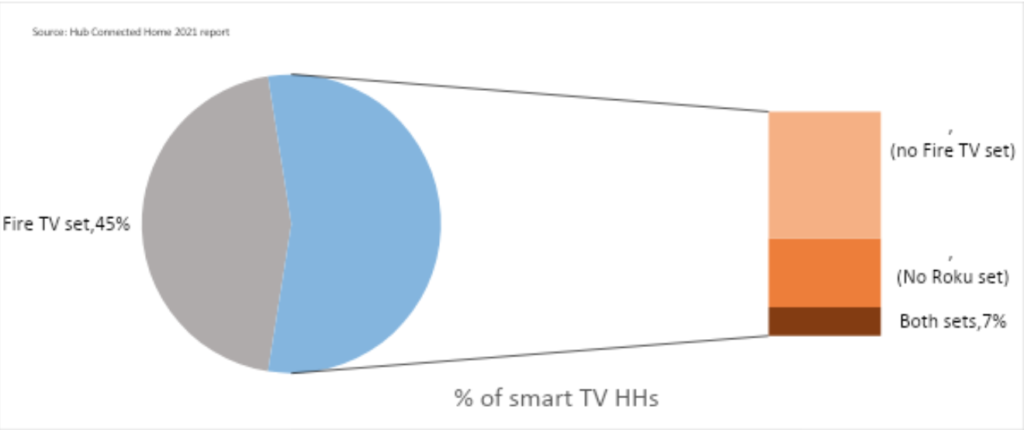

More smart TVs in the home means less reliance on third-party streaming devices to deliver streaming content to the TV – it’s just as easy to do it using a TV’s built-in capabilities. Thus there’s a reason why we’ve seen sets with either Roku or Fire TV operating systems become omnipresent over the past few years – over half (55%) of smart TV homes now report owning a Roku or Fire TV set. Or why Vizio’s recent IPO was seemingly more fueled by its advertising business than its manufacturing business.

In the future, the “television set” business won’t be in low margin, commodity priced hardware. Rather, it lies in building the interface people use to get content on their screen. These companies will the gatekeepers to TV audience – and with it the business of viewer data collection, data analytics, and advertising. It’s the difference between getting a one-time dollop of revenue from hardware and creating a continual revenue stream from audience data, marketing partnerships, and advertising.

At today’s low and declining price points for hardware, one could even project a future where streaming devices and even smart TVs are given away for free, in return for the buyer committing to allow the capture of their viewing data and the delivery of ads. But that’s another column!