The eSports Economy

Today is a big day for esports. Blizzard is launching Overwatch, the first major PC esports title since Valve launched Dota 2 three years ago. ELEAGUE, the first eSports league to be broadcast nationally on television, is debuting its inaugural season.

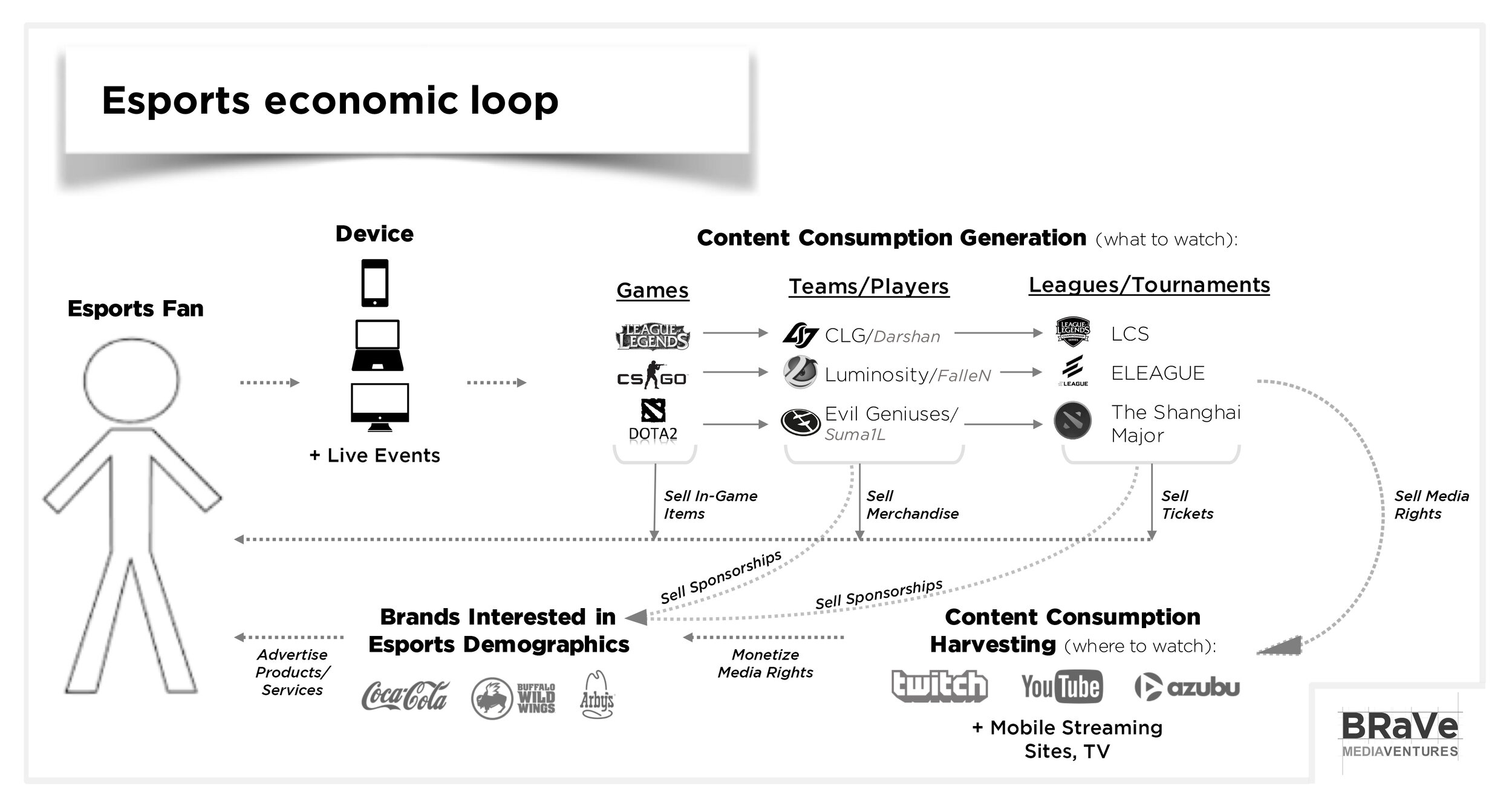

It’s a good time to understand the economics of a nascent industry with great potential. eSports is currently a $500 million dollar industry and I believe it will someday rival traditional sports, a $145 billion dollar industry. Chris provided a great framework for understanding the economic loop as a model train track:“Positions in front of you can redirect traffic around you. Positions after you can build new tracks that bypass you. New technologies come along (which often look toy-like and unthreatening at first) that create entirely new tracks that render the previous tracks obsolete.”Just like the internet economic loop, there are interesting developments and flash points happening throughout the esports loop. The most prominent battle being fought this year is in the leagues and tournaments portion of the loop. This battle is important because increasing the value of media rights depends on the consolidation of the hundreds of esports tournaments happening every year. Possible future flash points include:

The maturation of esports infrastructure. Governing bodies. Collective bargaining agreements. Franchises. Players’ unions. Revenue sharing and competitive balance. The question isn’t if, but when and led by whom? Last week, ESL announced the formation of the World eSports Association (WESA). WESA aims to be the “global benchmark for industry-wide standards” for esports, starting with the game CS:GO. This controversial initiative has been pilloried by the gaming press and skewered by esports insiders and fans.While few and far between, there are thoughtful pieces of support for this initiative as well. What’s interesting about this move isn’t whether WESA will ultimately succeed or fail, but that this is truly uncharted territory. The NBA and NFL dealt with these issues 70–90 years ago. Who can guide the formation of esports infrastructure in a time when fans, players, teams, and leagues all have influence in the court of public opinion?

The ownership of esports viewers. There’s a shittonofpeoplewatchingeSports. And brands are starting to payforthat. Who is going to own and monetize those eyeballs? For now, Twitch is still the king. ELEAGUE, Vainglory, and Rocket League all chose to partner with Twitch in the past few months. Twitch’s main competitor in the future will be owned & operated channels and Facebook, not YouTube.We are entering the age of Red Bull TVs, Mountain Dew Green Labels (MCN), and Lexus L/Studios. Brands want more control over their content and data especially as platforms tailor algorithmic feeds to be more user-friendly than brand-friendly.Facebook has proven that relationships — not content or distribution —is “king.” This is especially relevant for esports viewers, most of whom demand authenticity and value community opinion.The future of Overwatch. 9.7 million open beta players. Over 81 million hours played across more than 37 million matches. The first new IP in 17 years for Blizzard Entertainment, arguably the most iconic game developer of all time. All of this happening on the heels of the creation of an esports division, Activision-Blizzard Media Networks, last October and the acquisition of Major League Gaming (MLG) this January. MLG recently reported record esports viewership figures for a CS:GO tournament — 45 million hours of live broadcast viewed and 1.6 million concurrent viewers across OTT, web, mobile and in-game streaming.

Blizzard has witnessed and evaluated the pros and cons of the two major esports models: Riot’s iOS (closed) model and Valve’s Android (open) model. If Blizzard aims for any degree of the open model, this move will likely spur the next level-up of the esports economic loop as the old guard (sports leagues, teams and their billionaire owners, stadiums, broadcast television networks), the big four (Apple, Amazon, Facebook, Google), and the wild cards (Snapchat, Netflix, Twitter) clamor to get a piece of the action.