Frenemies At The Gate: TV Nets, Facebook, Twitter And Nielsen Social

At long last, Nielsen has finally announced that it is going to be counting Facebook and Instagram activity as part of its "Social TV" rankings, which are currently dubbed their Nielsen Twitter TV Rankings. A bit of a bittersweet moment that couldn't have come at a better time as Twitter activity, and it's validity as a mainstream platform, continues to come under question.

This move is going to shake up the industry in ways we’ve been intimating on here for quite a while now. This is excellent news for Facebook, yet another piece of bad news for Twitter, and a potential mixed bag for the TV networks and their advertisers.

While we've been very vocal about our points of view, a few chess pieces have moved on the board. So, here’s our updated BRaVe prediction on how this situation may play out.

It’s A Numbers Game

At least 50% of TV is now watched on a time-shifted basis, meaning that a real-time platform like Twitter is less relevant than Facebook and Instagram which are generally not very time-sensitive. That means users will be catching up with a show on Facebook days or weeks after it first airs.

It's no longer a game of grabbing attention at one particular time of day ( e.g. Tuesday's at 9pm ET), it's now become a notion of how much total attention you can grab at ANY time of day. Networks will need to rethink the nature of the content they put up.

AKA: Drive Real Attention, Not Just In Real-time.

All That Data

Social TV is valuable to networks because it provides them with a treasure trove of data on who their viewers are and what they love, like, share and have an affinity towards. That’s easier to achieve on Facebook which allows for richer demographic and psychographic profiling. Facebook users also tend to like a wider variety of products, services and media, a Facebook Like being far less of a commitment than a Twitter follow and that gives the platform a much wider pool of data to mine.

Facebook has also started to roll out much deeper topic based insights pulled from private posts in users streams. Companies like ListenFirst Media are providing clients with the ability to dig deeper into these public and private topic based insights, creating powerful anonymized audience segments, while Datasift is arming other analytics provides with the means to performing their own custom analysis.

Dark Posts

Facebook has a more highly developed and well-regarded advertising program than Twitter. Dark posts (ads that look like posts but never get published as posts on the advertiser’s page) have proven to be quite effective and when the networks understand the amount of social TV activity being generated on Facebook and Instagram, they’re going to be spending a lot more ad dollars on those platforms.

The Love-Hate Relationship Between The Networks And Facebook

While networks may indeed start spending a lot more money on Facebook, that doesn’t really alter the love-hate relationship most of them have with Facebook.

On the one hand, Facebook is an excellent source of data and a great way to drive tune-in as they can get ads in front of millions of users. As more MVPDs enable Facebook authentication, users will even be able to tune in directly from the network’s Facebook posts.

On the other hand, the networks don’t own any of that data—Facebook does = Facebook now owns the real Audience insights. That scares them because it gives Facebook an unequal amount of power in the relationship. It also means that Facebook could launch their own original programming and compete with the networks—they certainly have the resources to fund it.

On top of this, Nielsen's final step in the newly announced TAM Ratings SDK process sends viewer data to Facebook and qualifies it further by bumping it up against 150M Facebook profiles to append deeper demographic insights to their ratings. Thus, Facebook becomes the final step and almighty "Qualifier."

Hence love/hate.

Facebook Sports Hub

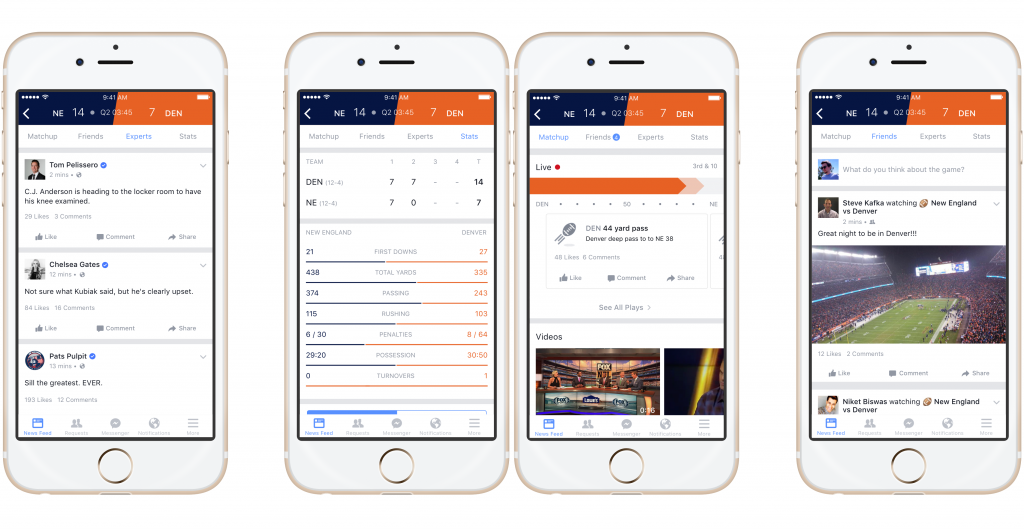

As if to hammer in just how serious they are about Social TV, Facebook also announced the launch of something they are calling their Sports Stadium, a place where fans can come to read posts by friends and pros, see scores and stats, even find out what channel the game is playing on. (And, we assume, eventually tune in using the aforementioned Facebook authentication.) If it’s successful—a lot will depend on the interface—it could become a de facto hub for all social TV activity around sports, another huge win for Facebook. This also puts them squarely in the game for capturing both Real Time activations and activity as well as deeper lead in and post live activity.

All one needs to do is remove "Sports" from this Hub and replace it with ANY Genre of TV, or even the highly coveted Sunday Night Scripted Viewing battleground. The Sunday Night TV Hub would be frothy with activity and engagement.

Why It Matters

Social TV is enjoying a revival, not so much as a user-generated platform but as an ad-supported one. As fewer and fewer viewers watch TV in real-time, on-air promotions lose their value as tune-in drivers. Ads on social media, however, are proving to be very effective.

Facebook, with it’s census-level user base, has been making a real push to become part of the TV ecosystem, starting with its use of native video that autoplays in the user’s News Feed (a great promotion tool for networks.)

It’s inclusion in the Nielsen ratings and the concurrent launch of Sports Stadium are two of its biggest moves ever. As such, it’s role in the TV universe should increase substantially.

What You Need To Do About It

Facebook has effectively Keyser Soze'd the entire TV Industry, but we don't have to sit on the sidelines watching helplessly as they pick us off one by one.

If you’re a TV network or studio, you want to re-examine your Facebook strategy, make sure your promotions team and your social media team are aligned around what they’re doing on Facebook, take another look at which social platforms you’re spending on and why. And make sure you take the BIG out of the data that Facebook provides and convert it into INSIGHT and then ACTION.

If you’re a network ad sales team, you need to prepare your responses to advertisers who are increasingly shifting dollars to Facebook—in other words, make sure you’re clear on your social monetization strategy, becauseFacebook and Twitter certainly are.

If you’re a brand or ad agency, you’ll want to look at the possibility of doing branded co-promotions on Facebook and figuring out how you can tie your on-air ad spend into what the networks are doing on Facebook so you can extend the reach of your commercials, reach an even broader audience and converge all screens to drive ATTENTION, so that people ultimately end up TOUCHING that mobile glass.