Brands, Video Content and Addressing Influencer Fraud Concern

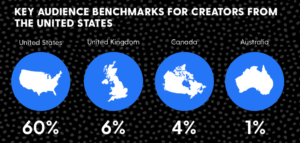

Video could make up as much as 82% of all internet traffic by 2021, which would certainly seem to force brands to embrace that method of engagement or peril.Yet, with ad blocker use continuing to rise worldwide, advertisers have been turning to influencers to tap into engaged audiences and get around those changes in consumer behavior. The influencers -- or would-be influencers -- have also taken notice of this opportunity and rightfully cashed in on their reach and ability to connect, in many cases through video.That’s smart, in many ways, but also comes with demands brands may not necessarily be prepared for. Working with these popular influencers is just like working with any other advertising partner. It’s a media buy, as Viacom-owned WHOSAY regularly points out. So as a media buy, these transactions should be viewed with the same level of scrutiny when it comes to fraud, in particular.Top YouTube network Fullscreen and influencer marketing platform CreatorIQ understand this intrinsically. And to help brands navigate these new waters, they’ve released the results of an in-depth study into how brands can protect themselves from influencer follower fraud -- and make safe, trusted media buys with these sorts of creators. Fullscreen also provides more details in their own blog post.Think of it as a brand placement on a TV show, or an infomercial spot. When buying, you’re buying the audience -- the total number, the composition, the potential to become a future customer. Brands wouldn’t pay for a spot during a show without this information on hand. The same critical lens should be applied to influencers -- a lens that CreatorIQ’s provided with its Creator Integrity Quotient.Analyzing influencers on a variety of platforms, a tool like the Creator Integrity Quotient provides baselines to analyze for follower fraud. Human involvement should be encouraged when performing final vetting personalities, of course. However, for initial flags, CreatorIQ spells out some of the guidelines for what they look for: Follower growthProfiles grow their audience all the time, whether on Facebook, YouTube, Instagram, Twitter or elsewhere. But industry averages can help identity what’s normal and what’s unnatural growth (in many cases, fueled by paid follower farms). Large jumps over the course of a couple days or a week can be a sign of potential fraud in progress.Audience location percentageCreatorIQ sets the benchmark for U.S.-based accounts at a minimum of 60% followers from within the country. Anything above that is fine. If significantly below, that’s another potential flag, as areas of the world like Southeast Asia, South America and Eastern Europe are hubs for fake follower buying and selling.Engagement rateDoes a profile’s engagement rate match up with the expected level for that social platform, or for that individual’s level of followers? Pairing a spike in follower count with a lower engagement rate is an easy way to tip off potential fraud as well.Despite some of the concerns above, influencer marketing remains a growing place for brands to explore new storytelling methods, targeted campaigns and unique ways to engage with audiences. Especially as organic reach dips significantly, there’s more money to be spent (and made) using paid influencer spots. As the Fullscreen and CreatorIQ study points out, it’s still possible to explore these new avenues for advertising. Brands just need to use data to stay diligent about these partnerships -- just like they would any media placement.

Follower growthProfiles grow their audience all the time, whether on Facebook, YouTube, Instagram, Twitter or elsewhere. But industry averages can help identity what’s normal and what’s unnatural growth (in many cases, fueled by paid follower farms). Large jumps over the course of a couple days or a week can be a sign of potential fraud in progress.Audience location percentageCreatorIQ sets the benchmark for U.S.-based accounts at a minimum of 60% followers from within the country. Anything above that is fine. If significantly below, that’s another potential flag, as areas of the world like Southeast Asia, South America and Eastern Europe are hubs for fake follower buying and selling.Engagement rateDoes a profile’s engagement rate match up with the expected level for that social platform, or for that individual’s level of followers? Pairing a spike in follower count with a lower engagement rate is an easy way to tip off potential fraud as well.Despite some of the concerns above, influencer marketing remains a growing place for brands to explore new storytelling methods, targeted campaigns and unique ways to engage with audiences. Especially as organic reach dips significantly, there’s more money to be spent (and made) using paid influencer spots. As the Fullscreen and CreatorIQ study points out, it’s still possible to explore these new avenues for advertising. Brands just need to use data to stay diligent about these partnerships -- just like they would any media placement.