YouTube Has The Largest Share, But The Battle To Monetize Streaming Viewers Is Just Getting Started

The entire television business must be thinking about how to compete with YouTube.

Not so long ago, the big strategic question in the TV business was would HBO become Netflix faster than Netflix could become HBO?

Netflix appears to have won that battle, with more subscribers, viewership, revenue and profits than Warner Bros. Discovery’s streaming platform, which will again be known as HBO Max after a short-lived stint as just plain Max.

But as the monthly list of top media distributors released Tuesday morning by Nielsen shows again, YouTube sits astride the industry with the most of television usage, grabbing a 12.4% share, up from 12% in in March.

For YouTube, big viewing numbers are translating into big revenue as well. According to parent company Alphabet’s first-quarter earnings report, YouTube revenues rose 10% to $8.9 billion.

That not as much money as The Walt Disney Co. made between its entertainment (ABC/Hulu/Disney Plus) and sports (ESPN) business, but pretty good considering YouTube isn’t buying expensive Hollywood content (at this time).

Netflix had $10.5 billion in revenue in Q1 and these days, the big battle in streaming may be to determine whether YouTube can become Netflix before Netflix becomes YouTube.

The two companies have a lot in common, starting with the technology to understand what their users want to watch and feed them more of the same.. People want to watch sports, and both Netflix and YouTube are cultivating their relationships with the producer of the most popular TV content, the National Football League.

Netflix has claimed Christmas as the day it will stream NFL games. YouTube bought rights to NFL Sunday Ticket and next season it will stream a game between the Chargers and the Chiefs on Friday night of the season’s opening weekend (September 5) from São Paulo, Brazil.

As YouTube takes the field with football, Netflix is looking to get into YouTube’s kitchen by playing the creator content game, as well as setting up shop in podcasting, which are increasingly becoming video progams.

But beyond content and viewership, the real business battle is monetizing those eyeballs via advertising. Both companies put on a show at the upfronts , talking about how they use technology to connect their viewers with the customers marketes want to reach.

Netflix, which initially grew its streaming business as a non-commercial alternative to traditional, linear TV, talked about the bespoke advertising technology stack it is building as the foundation of its ad business. That ad stack is now in place wherever Netflix sell sads

“By controlling our own ad tech we will be able to deliver newer tools, better measurement and more creative formats,” said Netflix ad chief Amy Reinhard.

Netflix’s ad tech is designed in part to let advertisers use their own data to target and optimize campaigns and makes multiple measurement vendors available.

It will also enable Netflix to roll out more creative formats faster.

“We've created a modular framework that makes it easy to bring in your existing assets and use them to build great ads for Netflix,” Reinhard said.

As part of Google, YouTube has been good at collecting ad revenue from the jump. At its upfront, it talked about new formats and capabilities aimed at large national and multinational advertisers.

In addition to its NFL Kickoff Weekend game, YouTube announced an number of other new sponsorship packages at its upfront event, Brandcast.

Cultural Moments Sponsorships are designed to deliver advertisers’ messages during big moments, such as the PGA Championship or Hollywood awards season with a high share of voice and brand integrations within content/

YouTube also announced Peak Points, new product built with Gemini Ai that identifies the most meaningful moments within YouTube content to place a brand where audiences are their most engaged.

Masthead on CTV puts advertisers on the YouTube home page and Shoppable CGTV lets viewers buy products from the big screen.

When it comes to ad tech don’t sleep on Amazon, which knows not only what its users are watching, but what they’re buying. Amazon also had an upfront–right after NBCUniversal and Fox and talked about more ways it can use that data to produce sales for its advertising clients.

Tech giants YouTube, Netflix and Amazon pose stiff competition for Disney and NBCUniversal, which have poured money into moving from a programming (and personality) based sales process to an audience and technology driven one.

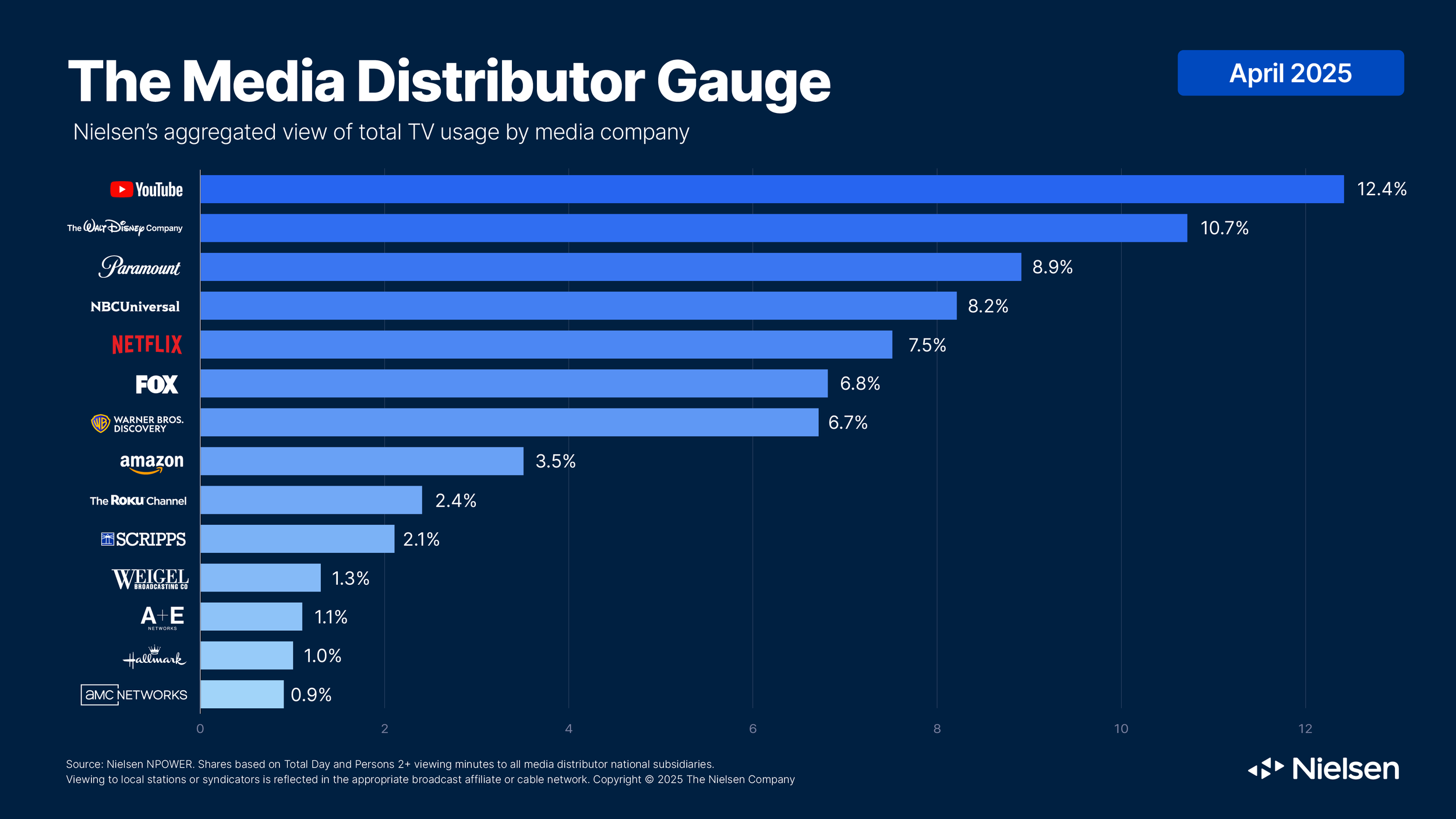

Here’s how the biggest video companies stacked up in April, according to the latest figures from NIelsen.

YouTube was No. 1 for the third=consecutive month and had its largest share of TV usage since NIelsen began making its monthly reports.

Disney was No. 2 with a 10.7% share, boosted by its coverage of the NFL Draft, the women’s college basketball chamapionshipo and the first round of the NBA playoffs.

No. 3 Paramount Global had the biggest monthly share increase, jumping to an 8.9% share from 8.5% in March. Gains at its old-fashioned CBS affiliates accounted for more than half of Paramount’s growth in the month.

NBCUniversal was No. 4, increasing its share to 8.2% from 8%.

Netflix was No. 5, followed by Fox, Warner Bros. Discovery, Amazon and The Roku Channel.

WBD got a boost from The White Lotus (maybe that’s part of the reason Max is being renamed HBO Max) and the NBA playoffs (WBD is losing its NBA rights to NBCU and Amazon starting next season.)

Rounding out he list were E.W. Scripps, Weigel BRoadcasting, A+E, Hallmark and AMC Networks.