Primetime Ad Minutes Keep Climbing For Top TV Networks

Even as TV viewership continually shifts to disparate streaming services and alternative dayparts, there’s still a premium on primetime programming — as you’ll likely hear repeatedly during Upfronts.

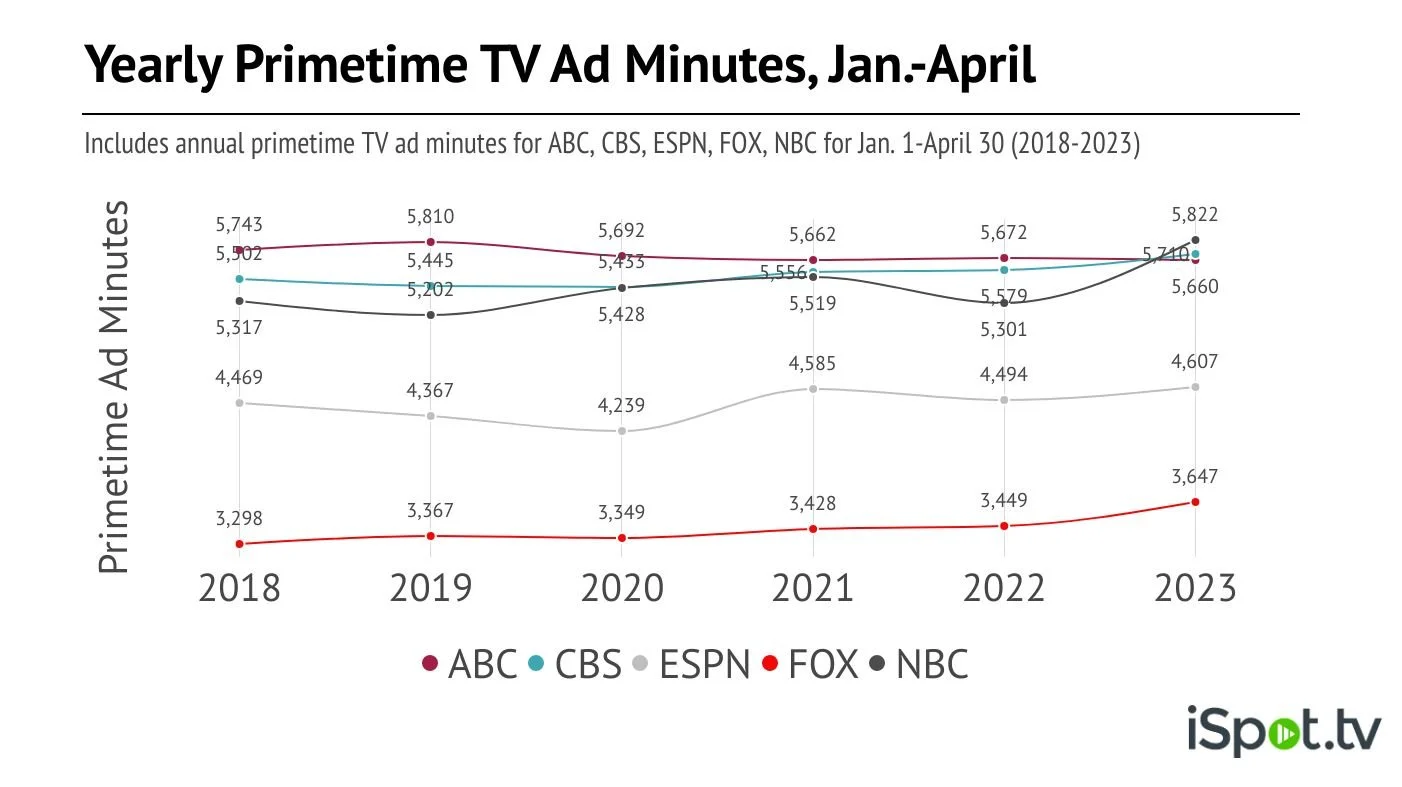

Perhaps as a result, ad time has kept climbing in primetime in the January through April timeframe. TVREV analyzed data from iSpot looking at primetime TV ad minutes in January through April over the last six years, and ad minutes are up significantly for the Big Four networks and ESPN, both year-over-year and compared to 2018.

The chart below looks at those five networks (ABC, CBS, FOX, ESPN, NBC) by yearly primetime TV ad minutes.

At first glance, it’s obvious that Fox has fewer ad minutes in primetime, but the network also has less primetime sports and scripted programming than its peers (though also had the Super Bowl this year). Still, we’re seeing ad minutes grow on Fox too, as these networks make scheduling changes year-over-year, while also continuing to try and right-size following the pandemic and in light of shrinking audiences in primetime. Those adjustments are not the same across the board, however.

ABC: 1.4% fewer ad minutes in 2023 vs. 2018, 0.2% fewer YoY

CBS: 3.8% more ad minutes in 2023 vs. 2018, 2.3% more YoY

ESPN: 3.1% more ad minutes in 2023 vs. 2018, 2.5% more YoY

FOX: 10.6% more ad minutes in 2023 vs. 2018, 5.7% more YoY

NBC: 9.5% more ad minutes in 2023 vs. 2018, 9.8% more YoY

NBC actually reduced ad loads considerably in primetime (from January through April) last year to coincide with the Olympics. But then landed in a similar spot to CBS and ABC this year. ABC’s been the most consistent over time in terms of ad minutes, avoiding any noticeable increases throughout this six-year stretch. Compared to both 2022 and 2018, ABC is still the only one of these networks to reduce ad minutes, despite industry-wide calls for lesser ad loads and streaming services making fewer ad loads a priority (for as long as they can, anyway).

The increase in primetime ad minutes have not helped attention figures either. According to iSpot, ads in primetime across these five networks received an average of 2% more attention than expected from January through April 2023, but that figure was 23% (!!!) more than expected back in 2018. So more ads are not equaling more attention from audiences. And again, when battling against streaming environments with fewer and more creative ads, having lower attention makes the primetime premiums harder to stomach.

All of these dynamics will take center stage during the Upfronts, when spending seems poised to stay the same — if not grow — but the narrative we’ve been hearing for months now says that everyone’s cautious about ad costs. TV is still delivering superior messaging reach to any other medium. But attention is also dropping, even for the most premium ad placements like primetime.

For many brands, it’s the cost of doing business. And until a network finds a way to change the attention conversation on linear, or just opts to go all-in on streaming from a programming perspective, it seems that will remain the case. You’re already seeing networks aiming for more flexibility with cross-platform buying, however, which at suggests there’s an acknowledgement of linear’s current limitations (along with these companies’ larger streaming aspirations and they need to pay for them).