Embracing Fragmentation: How to Maximize Reach this Election Cycle

This year, voters will head to the polls to cast their ballots. Political ad spend is surging to reach them, particularly in Connected TV (CTV), where audiences increasingly consume content.

CTV is now a key strategy for political advertisers aiming to reach voters, thanks to its brand safety, targeting, and local advertising capabilities. Ad investment projections reflect this: AdImpact forecasts CTV ad spend to increase by 33% compared to the 2022 midterms.

However, the streaming inventory ecosystem is complex, with layered proprietary technology and rights. Understanding the players in the CTV space is crucial to maximizing investment – as is partnering with the right experts to simplify it. A best practice is to employ strategies like supply path optimization (SPO) or streamlining supply partners to navigate the CTV landscape and maximize campaign impact.

As the largest independent supply partner with access to premium publishers across channels,

Magnite offers a unique perspective on how advertisers can access a wide range of streaming inventory through one access point.

Here are some insider tips for political agencies and advertisers to employ this election cycle to use a fragmented CTV market to their competitive advantage.

1. Get to know all the players in the CTV ecosystem.

While some major streaming platforms, such as Netflix, don’t take political ads, many platforms, like free ad-supported streaming television (FASTs), do. While less obvious, these avenues are highly impactful, all while making ad dollars go further than pouring full budgets into traditional media.

Notably, players in the multichannel video programming distributor (MVPD) space and FAST space may not be as apparent, but they’re just as effective. These platforms offer a linear TV experience, with appointment viewing and access to a plethora of channels – which are largely watched on the big screen.

High engagement in verticals such as live news on FASTs and AVOD services presents a significant opportunity here. As viewers increasingly tune in to town halls, debates, and live polling updates, potential voters will follow the news closely – offering a prime opportunity for advertisers.

As Nick Martorano, director of emerging accounts & political sales at Samsung Ads, shares, “At Samsung, we’re seeing major engagement with news on FAST services heading into election season, especially as the availability of live and local news continues to grow. The advanced targeting capabilities of CTV combined with the unrivaled reach of Samsung households offer advertisers the best of all worlds, with the combined value of addressability, real-time campaign insights, and flexibility. Ultimately, this unlocks the ability to reach voters effectively with the right message at the right time.”

Ad buying across streaming platforms may be less intuitive than traditional ad buying via TV networks but offers the added value of addressability, real-time insights, and flexibility in campaigns – with the ability to optimize campaigns in flight.

As Andrew Tint, general manager of programmatic partnerships at Sling TV, explains, "In the political season, the key to reaching voters effectively lies in engaging them where they're most focused, live TV. Sling TV, as a leading vMVPD, leverages the power of streaming live TV with access to premium, owned inventory adjacent to top-tier networks and content. Through direct partnerships with SSPs like Magnite, Sling TV enables advertisers to not only reach a diverse and engaged audience but to do so with unparalleled transparency and control over ad performance.”

Tint added, “As live TV remains a cornerstone of political campaign strategies, the ability to tap into this engaged viewership through vMVPDs becomes indispensable, ensuring that messages are not just seen, but are also resonating and motivating action among the electorate.”

2. Know that complexity doesn’t necessarily mean waste.

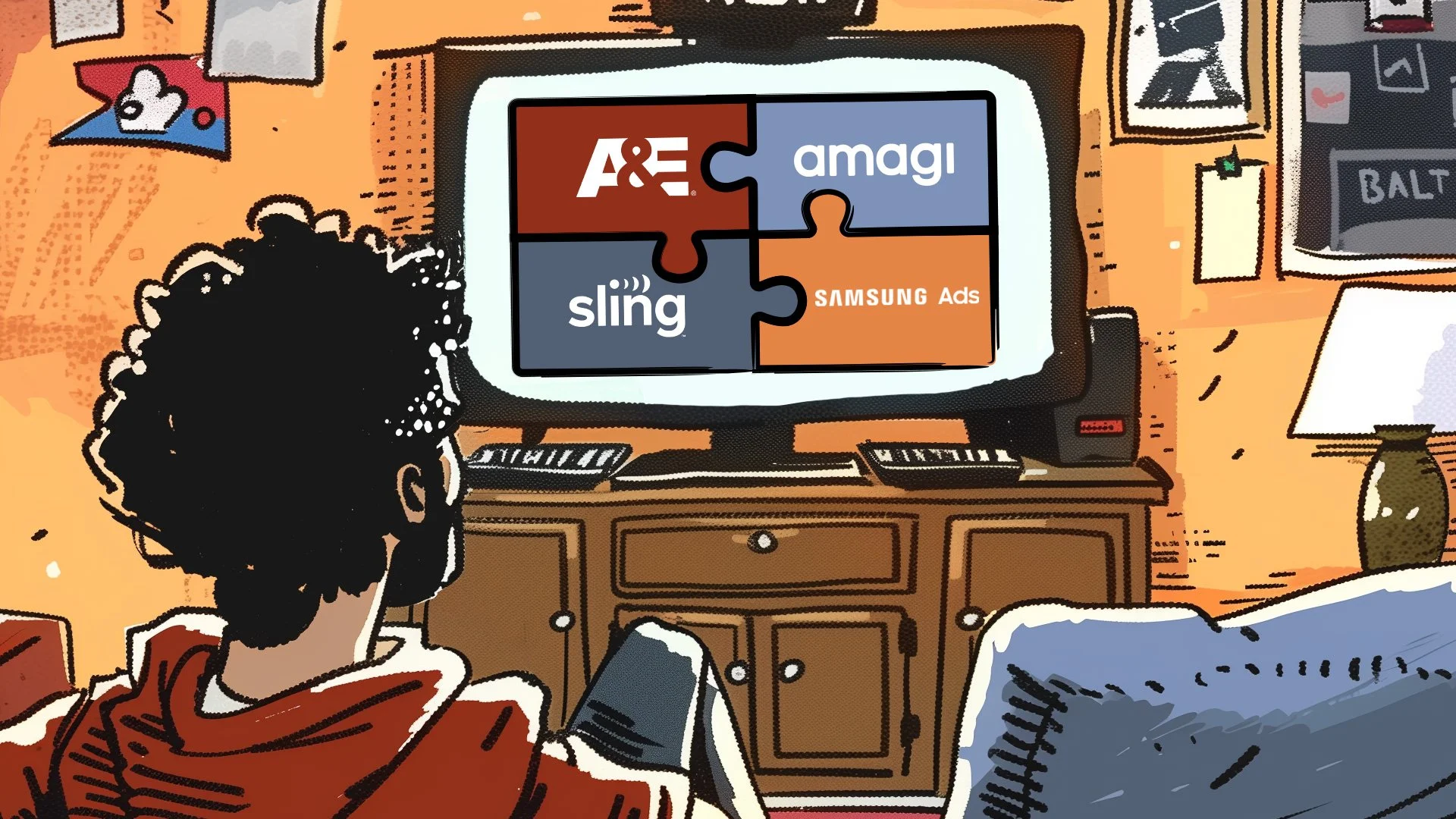

The CTV streaming landscape is more complex than network TV. Put simply, more players in the space are able to monetize the inventory. For example, you could have several parties involved in one ad buy. There’s the content owner (e.g., A+E), the media tech (e.g., Amagi), the distributor (e.g., Sling TV), and the device manufacturer (e.g., Samsung).

Each media player will also bring their own set of tech and measurements to the fray.

Seeing multiple vendors involved in one ad buy can feel like long-tail inventory to ad buyers, but CTV involves several interoperable vendors working together to make the viewing experience seamless and possible. When assessing streaming supply to invest in, this can be disorienting for political marketers. Publishers have different tranches of inventory— but that doesn’t mean the inventory is less valuable or duplicative.

The key is to take a multi-pronged, omnichannel approach but to do so through one point of entry. Wielded intentionally, CTV can pack a major political punch.

As Tyler DeNicola, VP of programmatic revenue and partnerships at A+E, further states, “At A+E, we work with a range of partners to deliver an unparalleled ad experience to engaged audiences, marrying data, best-in-class technology with a premium content ecosystem — all while helping our buyers measure outcomes. In this way, we’re more of a community garden than a walled garden. The end result is a more impactful media buy. The key is to work with partners that give you holistic access to premium supply, which helps brands establish a multi-tentacle presence.”

3. Choose partners that maximize SPO – with measurable results.

Political marketers are keenly aware that they can’t ignore CTV if they want to win at the ballot box. CTV offers the scale and brand safety of television as well as the addressability of digital – all while avoiding the pitfalls of social media, which garners lower levels of trust.

With election day looming large, marketers don’t have the time or resources to buy ads through multiple platforms– it’s a resource drain. Working with one-to-two SSPs on political campaigns helps streamline ad buying while achieving omnichannel reach.

When assessing CTV partners, look for teams that will pick up the phone and offer a white-glove experience in media planning. Ideal partners should also have omnichannel access to premium publishers across CTV supply.

Here, Magnite is a time-tested expert in streamlining the CTV supply path, providing a one-stop-shop for political marketers looking to win votes across platforms and inventory types. Our premium marketplace removes bad inventory or duplicative supply by default, making ad dollars go further. In lay terms, we’re the “easy button,” delivering optimal impact across channels at scale.

Ultimately, while traditional media will remain a mainstay for political advertisers, as viewers (and voters) migrate to content on CTV, marketers are upping the ante on investment. To reach persuadable voters at scale without the burden of added costs, a winning strategy is to embrace fragmentation by streamlining it through a single point of purchase.

Go deeper at Magnite’s Decision 2024 Event in Washington DC

Tuesday March 26, 3-7pm