Scoring Big in Streaming: The Critical Role of Sports Broadcast Rights

Live sports broadcast rights are not only the most important battleground for the current state of the streaming wars, but arguably, the final arsenal augmentation needed to cement a hierarchy in the larger fight to become the dominant living room operating system. Single service tussles such as Netflix vs Disney+ almost seem quaint these days against the backdrop of Google, Apple, Amazon and others duking it out to become the default streaming ecosystem for all consumers. Sports rights play a key role in both micro and macro confrontations.

ESPN+ has been the exclusive home of the UFC for several years, Amazon Prime Video is the sole destination for the NFL’s Thursday Night Football, Apple has taken control over distribution for Major League Soccer, Google’s YouTube is now the only place to access NFL Sunday Ticket, the NBA is currently negotiating new broadcast rights pacts and Disney executives are openly discussing ESPN’s looming transition to OTT. To paraphrase Ron Burgundy, it’s kind of a big deal.

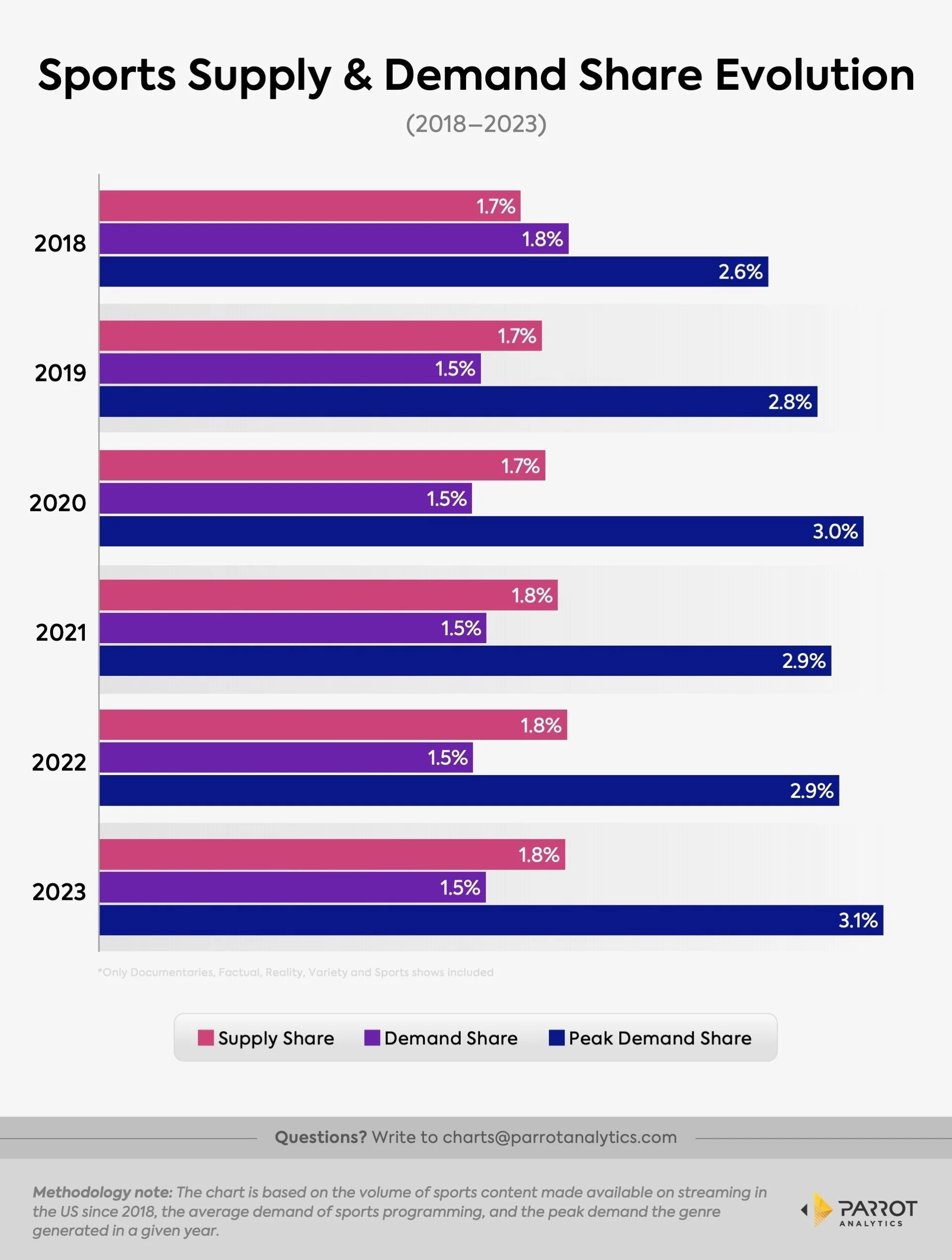

The migration of sports from linear television to streaming has been slow as its supply share has barely ticked up since 2018. In fact, supply share of sports programming on streaming still outstrips demand share, according to Parrot Analytics. Old habits die hard as sports are almost single-handedly keeping the domestic pay-TV bundle from the brink of irrelevance.

Yet we have seen a steady increase in peak demand, or the highest level of demand reached, for sports programming as more and more digital access points are introduced to consumers. In other words, the ceiling for sports streaming programming continues to rise, and Peacock’s exclusive NFL playoff game this season is likely to set another peak demand high. As the supply share increases with the continued migration of sports to streaming, so too should the average audience demand level, particularly among younger consumers in the cord-cutting and cord-never groups. Meaning that we are currently at the center of an industry-wide inflection point.

Streamers that are able to cobble together key sports rights will become more attractive subscriptions for those seeking to transition away from TV. More importantly, exclusive sports packages can be key value drivers to the aggregators who need mass adoption and reliable engagement to become the conduit for at-home consumer entertainment while maximizing advertising revenue.

Yes, sports rights are costly and it is difficult to generate a one-to-one return on investment— Amazon and YouTube are unlikely to turn a profit from their respective football packages on subscription revenue alone. But the longer you can keep viewers within a given environment, the better chance there is of generating engagement across other core businesses, making sports rights a very worthwhile investment.