Are Hulu's Linear Leanings A Potential Pitfall To Disney's Streaming Strategy?

It’s official: The Walt Disney Company is in the process of acquiring Comcast’s remaining 33% stake in Hulu for a minimum of $9 billion. At the same time, Disney is reportedly preparing to sell off its India operations for around $10 billion, meaning the company’s cash on hand shouldn’t be totally wiped out. Still, it’s fair to wonder just exactly what Disney is getting with this deal.

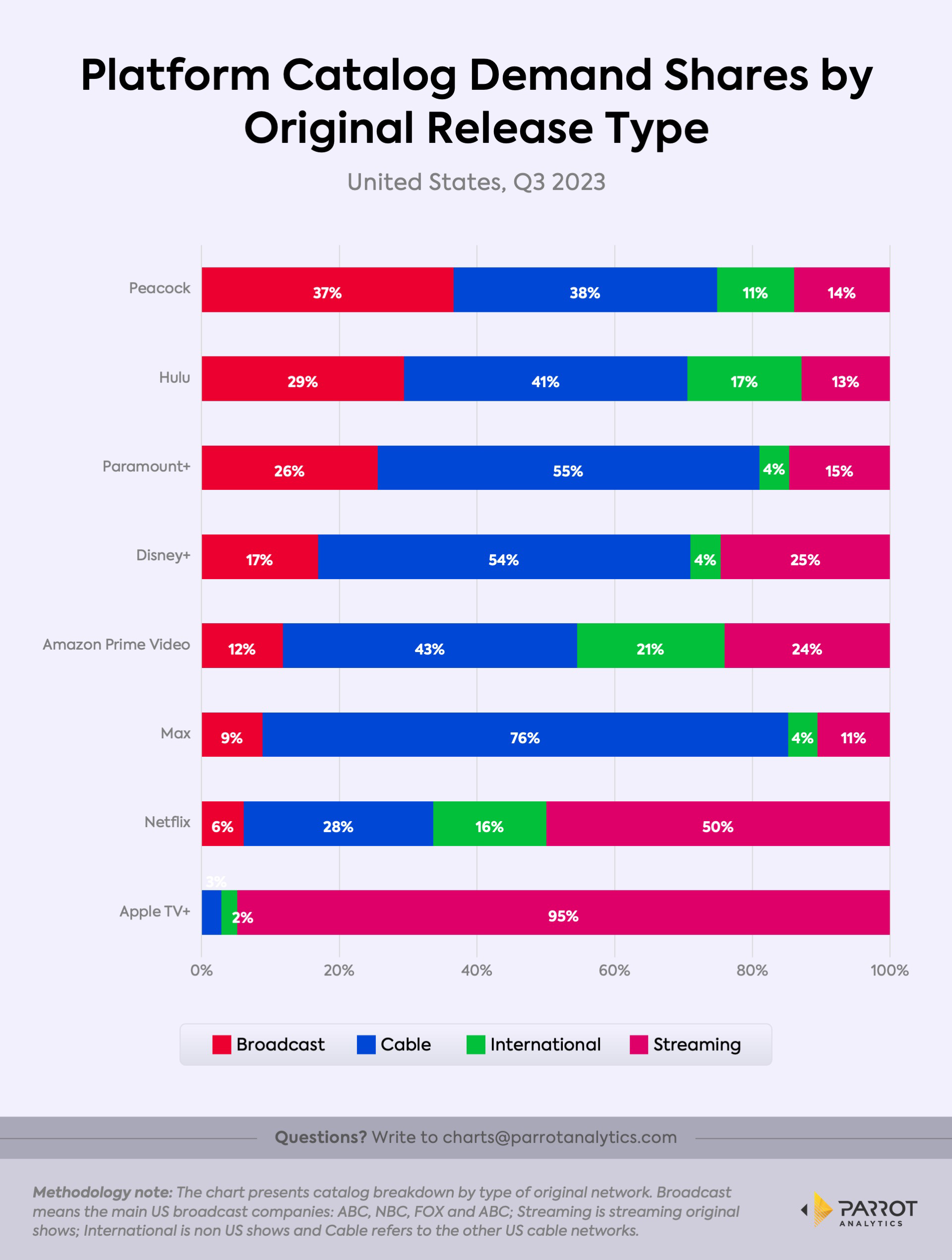

Hulu remains a very linear-reliant streaming service with 70% of its audience demand being driven by programming that originally aired on broadcast and cable, according to Parrot Analytics. NBCU already clawed back next-day air capability from Hulu for Peacock last year. Hulu's remaining NBCU catalog accounts for 4% of the streaming library’s demand, the second largest share behind Disney owned networks. If and when Comcast opts to reclaim all that content, Disney will need to figure out how to replace that lost demand in a cost effective way. At the same time, as linear TV continues to decline, demand for new linear programming may sink with it (Disney is all but giving away ABC at this point). In essence, Disney might be paying top dollar for a US-only streamer that’s about to become noticeably smaller.

Mouse House CEO Bob Iger downplayed the importance of undifferentiated general entertainment earlier this year. But it’s exactly that sort of programming found on Hulu that may be the necessary complement to Disney+’s franchise-centric programming. The latter has proven to be an effective growth driver, though its broad appeal has finally hit its ceiling. The former tends to help with retention and engagement, which Disney+ could use after back-to-back subscriber losses. (Hulu has grown slowly but steadily over the last seven quarters).

Hulu is considered by many to be the gold standard in AVOD, with a whopping 57% of its subscribers paying for the ad-supported tier, per Antenna. (The fact that Hulu was originally 100% ad-supported no doubt plays a significant role in that figure.) Hulu + Live TV is among the six largest Multichannel Video Programming Distributors (MVPDs), giving the company a net with which to catch cord-cutters. And Hulu’s overall average revenue per user (ARPU) of around $12 is among the best in the business.

But is all of that really positioned for growth assuming highly in-demand programming blocks are eventually removed? Will a combined single-app Disney+/Hulu service provide the necessary four-quadrant appeal to reach a level of scale that can turn legacy shows into hits and new streaming originals into revenue drivers a la Netflix?

Everything may need to break exactly right for Hulu in order for Disney to maximize its value moving forward. In this business, how often does any plan go off without a hitch?