Super Bowl Brands: Delay of Game or a Return to Strategy of Suspense?

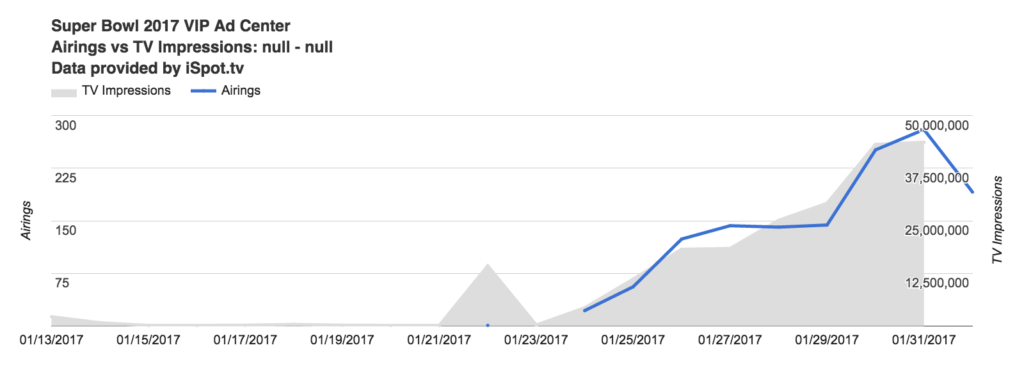

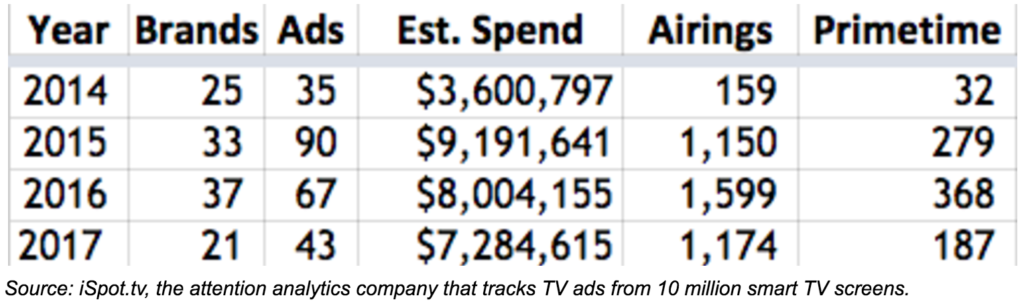

It could be that other news is sucking up the oxygen brands are normally afforded surrounding the Super Bowl every year. It could be that brands are rethinking the strategic value of suspense. Or it could be that brands saw something in the data last year and adjusted course.But one thing is certain so far: Brands advertising in the Super Bowl are later to the pre-release/teaser game compared to previous years.After 2015 and 2016 Super Bowl seasons in which brands released more and more ads earlier and pushed digital spend to support them, the “culmination effect” — where multiple creatives crescendo into 30 seconds of advertising glory in front of 100 million people on the big screen — feels diminished this year. The number of ads and teasers released through Tuesday is more akin to what we saw in 2014.Below is a chart of activity through the Tuesday evening prior to the Super Bowl. In 2015, two notable things happened: The number of brands went up from 25 to 33 and the number of teasers released and the TV spend behind each almost tripled. Brands showed up during conference championships and showed their cards early and often on social and on TV.

Now look at this year: The number of brands that released ads is lower than 2014.

Super Bowl Ad Activity as of the Tuesday Evening Prior to the Big Game

Last year while more brands pre-released ads or trailers, the number of creatives started to come back down, as did the spend. The advertisers are still putting TV spend behind teasers ($7.3 million so far) and instead of a few focused prime time placements, brands are using the big screen to spread the teasers around.And in all of those years, the majority of digital reactions (including social media mentions and search-engine queries) came before the kickoff. So, if I’m a betting man, my money says the creatives should start to flow in big numbers the next few days. But if I’m going off of data from past years, this morning looks a lot like 2014.

Last year while more brands pre-released ads or trailers, the number of creatives started to come back down, as did the spend. The advertisers are still putting TV spend behind teasers ($7.3 million so far) and instead of a few focused prime time placements, brands are using the big screen to spread the teasers around.And in all of those years, the majority of digital reactions (including social media mentions and search-engine queries) came before the kickoff. So, if I’m a betting man, my money says the creatives should start to flow in big numbers the next few days. But if I’m going off of data from past years, this morning looks a lot like 2014.