Connected TV Inventory Explodes, Video Advertisers Enjoy Results

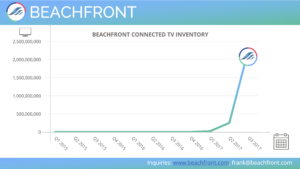

As Connected TV use grows rapidly (including a 30% increase in the US alone this year), it stands to reason that advertising would keep up with that rate. In Q3 of 2017, Beachfront's own SSP experienced Connected TV ad requests increased to over 2 billion -- or over 600 million views per month. This rapid growth shows that midtail to longtail video inventory is alive and well, and video publishers are finding more and more places to go. Apple TV, Fire TV, Android TV and Roku devices are bursting with new and engaging midtail content providers. And it’s not just the big ones everyone’s used to hearing about.Netflix and Hulu may have earned the initial jump on the market -- and still control a significant amount of market share. However, you’re seeing substantial growth from streaming options like Chromecast, PlayStation Vue, and many others as well. That sort of movement and variety of options in the marketplace means more inventory and opportunity. That’s a win for brands and publishers alike as they look to further explore what Connected TV can do for them.And they’re starting to do so, in part because the video advertising ecosystem on Connected TVs continues to rise. Great apps like WatchMojo, TED TV and Crunchyroll are a handful of many names adding to the exploding inventory. The payoff for publishers is an ample number of options to invest in. There are currently few limitations to how a publisher can invest, and that’s allowed more players to jump right into the pool.According to our recent study at Beachfront, Connected TV video ads aren’t just growing, though. They’re also providing results for those willing to invest. Connected TV video ads are delivering 97%+ completion rates, and viewability is a non-issue. Recent trends have shown a three-times increase in fill rates in the past quarter along -- which is poised to rise into 2018.Most impressive: CPMs were also three to four times higher on Connected TV than mobile advertising.Mobile is important, clearly. But consumers still appear to be even more willing to tune into TV and TV’s video ads, even if it all looks a little different from its traditional format.People like watching TV? Go figure…There’s also a strong correlation between mobile video advertising and Connected TV ads, as both are based on a lot of the same platforms. Apple’s tvOS for Apple TV and iOS are close derivatives of one another, Fire TV and Android TV are both respectively based on the Android operating system, and Roku’s mobile and Connected TV platforms are interwoven pretty well too.Platforms created with mobile or Connected TV in mind is well situated for the other. With publishers pivoting to video-centric content models, a healthy pipeline of video ad inventory is only going to help the entire ecosystem. It’s an impressive upward trajectory right now, and one that should continue to increase in 2018 and beyond.

This rapid growth shows that midtail to longtail video inventory is alive and well, and video publishers are finding more and more places to go. Apple TV, Fire TV, Android TV and Roku devices are bursting with new and engaging midtail content providers. And it’s not just the big ones everyone’s used to hearing about.Netflix and Hulu may have earned the initial jump on the market -- and still control a significant amount of market share. However, you’re seeing substantial growth from streaming options like Chromecast, PlayStation Vue, and many others as well. That sort of movement and variety of options in the marketplace means more inventory and opportunity. That’s a win for brands and publishers alike as they look to further explore what Connected TV can do for them.And they’re starting to do so, in part because the video advertising ecosystem on Connected TVs continues to rise. Great apps like WatchMojo, TED TV and Crunchyroll are a handful of many names adding to the exploding inventory. The payoff for publishers is an ample number of options to invest in. There are currently few limitations to how a publisher can invest, and that’s allowed more players to jump right into the pool.According to our recent study at Beachfront, Connected TV video ads aren’t just growing, though. They’re also providing results for those willing to invest. Connected TV video ads are delivering 97%+ completion rates, and viewability is a non-issue. Recent trends have shown a three-times increase in fill rates in the past quarter along -- which is poised to rise into 2018.Most impressive: CPMs were also three to four times higher on Connected TV than mobile advertising.Mobile is important, clearly. But consumers still appear to be even more willing to tune into TV and TV’s video ads, even if it all looks a little different from its traditional format.People like watching TV? Go figure…There’s also a strong correlation between mobile video advertising and Connected TV ads, as both are based on a lot of the same platforms. Apple’s tvOS for Apple TV and iOS are close derivatives of one another, Fire TV and Android TV are both respectively based on the Android operating system, and Roku’s mobile and Connected TV platforms are interwoven pretty well too.Platforms created with mobile or Connected TV in mind is well situated for the other. With publishers pivoting to video-centric content models, a healthy pipeline of video ad inventory is only going to help the entire ecosystem. It’s an impressive upward trajectory right now, and one that should continue to increase in 2018 and beyond.