In Global Content Wars, Netflix's Hefty Investment in Overseas Programming Outstrips Amazon

We often forget that the US is the most competitive and saturated entertainment market in the world. Overseas, linear TV generally remains stronger than it is stateside, while internet penetration and SVOD adoption rates are behind America’s. This has created a difficult balancing act for the streaming industry. Emphasize the UCAN market where ARPU is higher but competition is stiffer? Spend enormous sums of money to generate traction in low-yield foreign markets? Figure out a strategy to do both?

While no single service has truly mastered the challenge, there’s no doubt that Netflix and Amazon Prime Video are the most global premium SVOD services on the market. Netflix is estimated to spend $20 billion on content in 2024, while Amazon sits at $22 billion, per Morgan Stanley. Despite the differing overall priorities of these companies, both platforms invest heavily into international programming and non-English fare in order to build up market share in emerging regions of importance. But which one is more global?

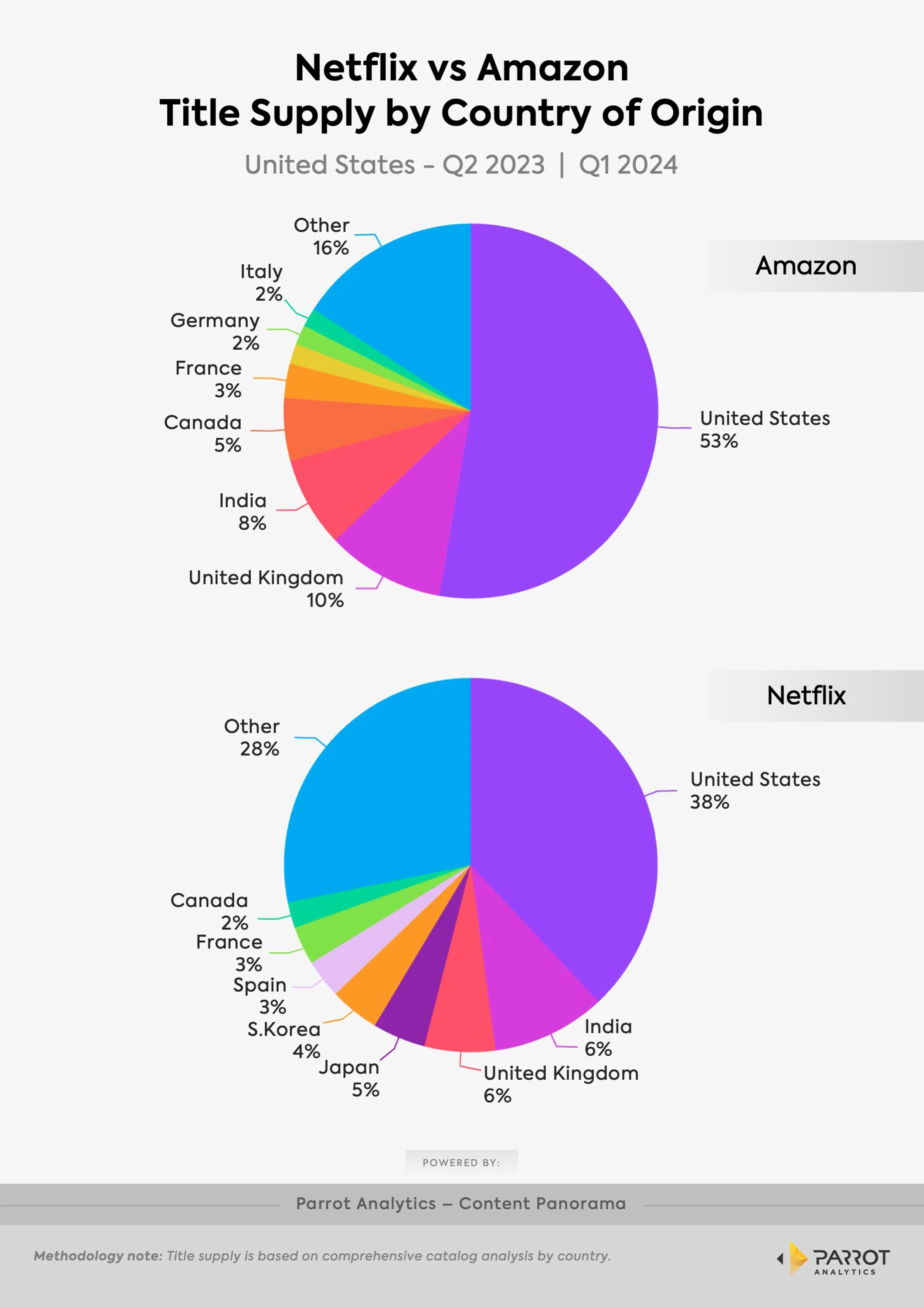

According to Parrot Analytics’ Content Panorama data, 53% of Amazon’s US library over the last four quarters is comprised of titles that originated in the US, compared to 38% for Netflix. The five biggest contributors to Amazon’s library after the US in that span are the UK (10%), India (8%), Canada (5%), France (3%), and Germany (2%). For Netflix, it is India (10%), UK (6%), Japan (5%), South Korea (4%), and Spain (3%).

This tracks with original language shares of each streamer’s US library as well. Since three of Amazon’s biggest content suppliers are English-speaking nations, it’s not surprising that its catalog is 85% English, compared to 62% English for Netflix. The former then counts Hindi (3%), Spanish (3%), and Telugu (1%) as its next biggest languages by title volume, compared to the latter’s Spanish (9%), Hindi (7%), and Korean (5%).

What does this all mean?

Netflix’s unrivaled years-long investments into overseas programming outstrips its closest competitor. While it remains remarkably difficult to deliver a non-English Squid Game-sized hit to the high-ARPU US market, Netflix is responsible for eight of the top 20 most in-demand non-English streaming originals in the US last year, while Amazon boasts just one.

This performance reflects a more efficient use of content resources as overseas production is often less expensive than here in the US. It also intentionally aligns with Netflix’s growth trends. Around 70% of the company’s total subscriber base comes from outside of the UCAN market, while roughly 80% of quarterly subscriber additions are now international.

There are still challenges to overcome — India remains a high-upside question mark — but Netflix has gone global far more effectively than any of its rivals.